Uncertainty Weighs on Investments

The current economic slowdown will lead to a decline in investments and international trade of capital goods.

Published by Marzia Moccia. .

Industrial equipment IMF Uncertainty Conjuncture Global economic trendsOne of the most significant elements to understanding the current slowdown of the international economy is revealed in the analysis of international investments in machinery, equipment and construction industry. As an economic variable, investments are particularly exposed to macroeconomic shocks and the uncertainty of investor expectations.

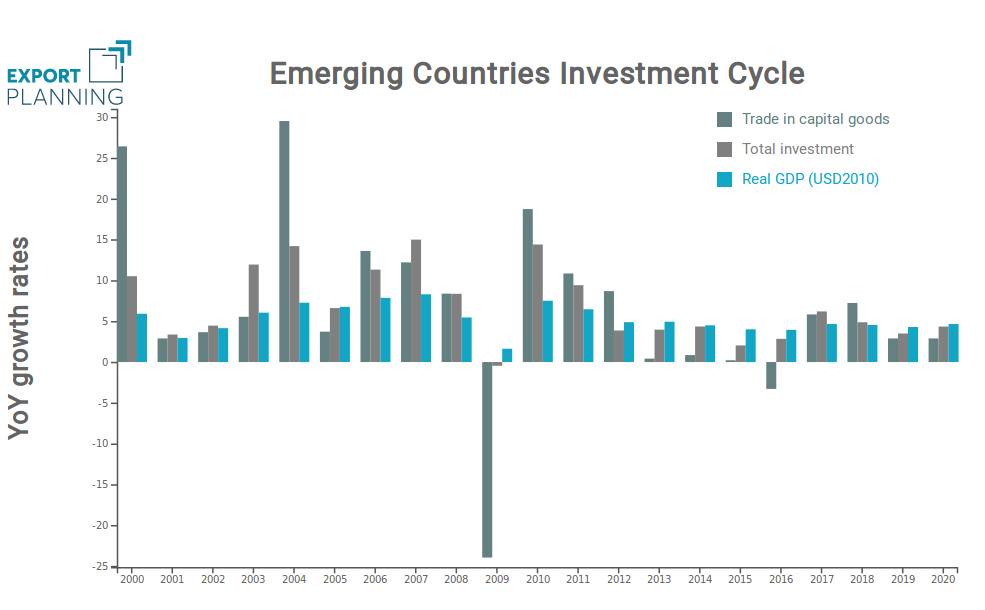

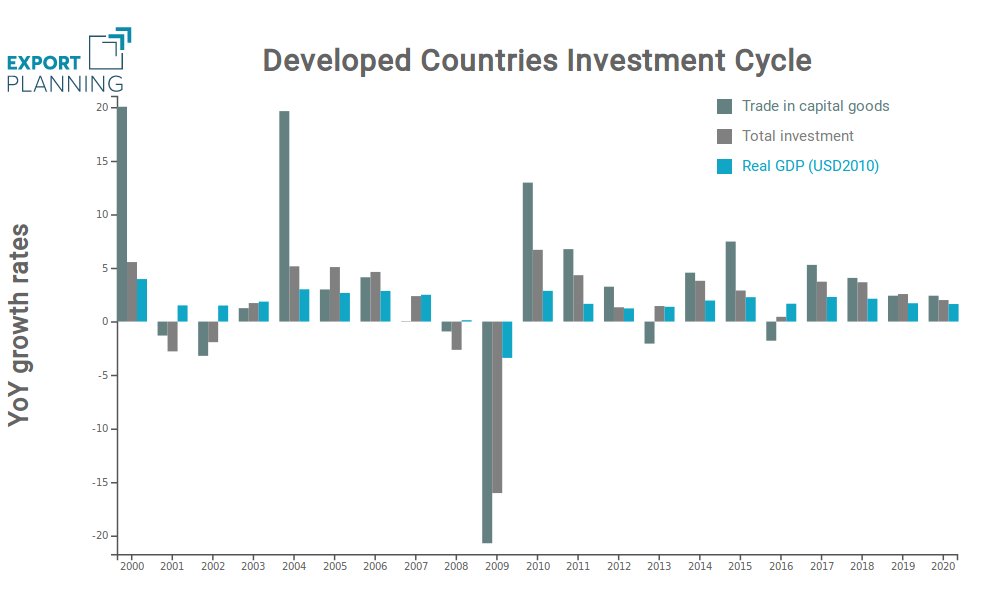

The following graphs show the dynamics of GDP and investments in a historical perspective, in terms of growth at constant prices, based on estimates made by the International Monetary Fund which are available at the following link. The figures are associated with changes recorded by global trade flows of capital goods.

|

Source: ExportPlanning.

In general, the rate of growth in international investments has remained in line with real growth rate in the economy since the beginning of the century.

From a historical perspective, the cycles that characterise trends in global investments during recent years are evident. The first phase of expansion was interrupted with the bursting of the internet bubble between 2000 and 2001, which was followed by a new growth phase that ended with the subprime crisis of 2008-2009. The recovery of investments in the post-crisis period shows two major slowdown periods: the first in conjunction with the sovereign debt crisis (2011-2012), and the second in 2016, in relation to the slowdown in growth of the Chinese economy.

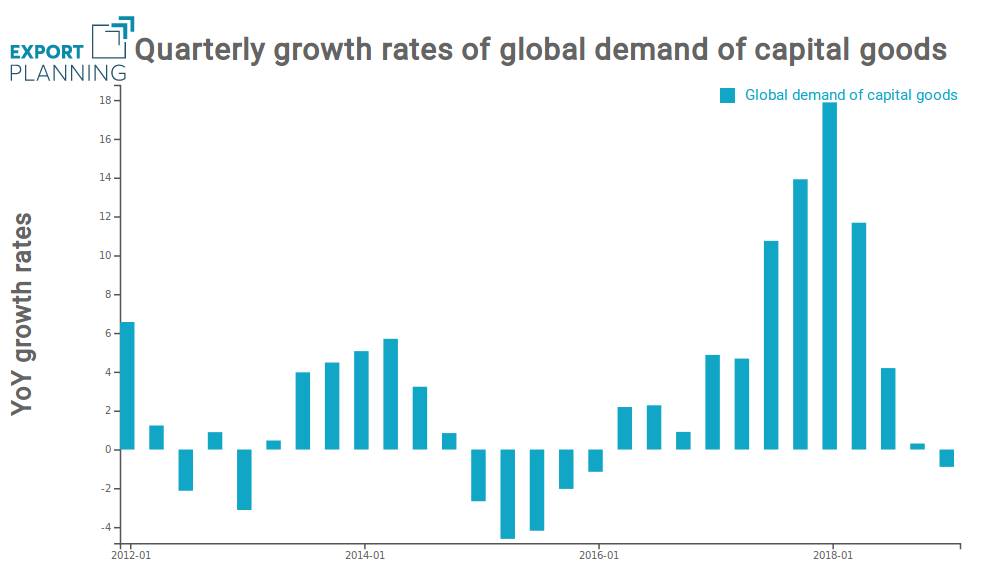

Refocusing the analysis on more recent years, two important elements emerge:

- Years 2017 and 2018 were largely positive for international investments, both for developed and emerging countries. In both cases, growth in investments shown was largely supported by world trade flows of capital goods;

- On the other hand, years 2019 and 2020, reveal a sharp slowdown in international investments, both for developed and emerging countries, with a negative impact on global demand for investment goods. In fact, in the first quarter of 2019, global demand for durable goods decelerated, signaling the end of the expansion phase of the investment cycle recorded over the past two years.

Source: ExportPlanning.

One of the most significant factors behind the current slowdown is the increase in uncertainty on a global scale, that is strongly linked to the protectionist stance of US trade policies. A second important factor to consider is the weakness of the manufacturing sector, especially the automotive industry, which has amplified the end of the global cycle.