Highest potential markets: a look towards 2021

In the 2020-2021 period ASEAN countries - Vietnam first - will offer the major opportunities

Published by Giulio Grisanti. .

South-east Asia Asia Conjuncture Forecast Emerging markets Global economic trends

The Forecast datamart has recently been updated, offering the possibility to analyze the trend in international trade from 2000 to 2023 for 152 countries and over 3000 product codes.

By integrating this information with the GDP growth rates at constant prices present in the World Economic Outlook database, it is possible to identify the areas and, more specifically, the markets, which offer the best opportunities for european exporting companies.

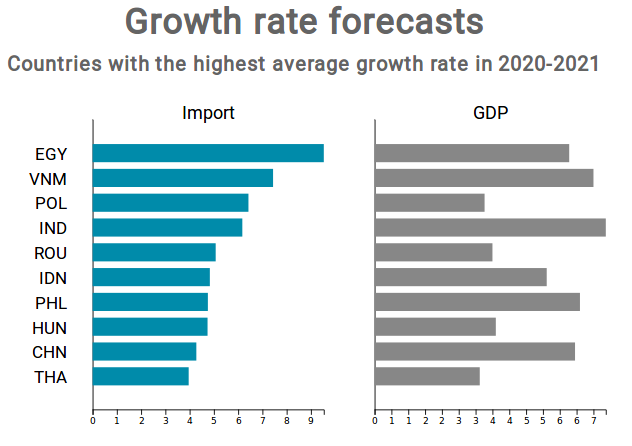

The following graph shows the compound annual growth rate (CAGR) of imports and GDP for the 2020-2021 period for the countries that meet the following requirements:

- Total Import Value greater than $80 billion in 2021;

- GDP average growth rate higher than 3% per year.

As can be seen from the graph, almost all countries are in Asia and 4 ( Vietnam , Indonesia , Philippines and Thailand ) belong to the ASEAN (Association of South-East Asian Nations).

As an example we analyze the case of Vietnam, which is the most virtuous among ASEAN countries and can represent a strategical economic ally for the European Union.

Vietnam - Import from EU by industry

The following chart analyzes Vietnam import data and shows on the abscissa the average annual growth rate of the imports in the 2010-2019 decade, on the ordinate the one expected in 2020-2021 and the import of each sector in 2018 is represented by the size of the sphere. The yellow line represents the bisector, usable as a discriminating factor between the sectors that are expected to accelerate in the 2020-2021 period compared to the decade 2010-2019 (located above the bisector) and the sectors that are in deceleration (located below the bisector).

The growth trend of most of the cluster containing the Intermediate products will accelerate, confirming the strong industrialization of the country. Among these, Electronic parts (D1) and Fabrics and leathers (B2) are to be mentioned for their strong acceleration. The forecasted growth rate will exceed the already substantial growth rates of the last decade.

As can be seen from the graph, the sector with the greatest acceleration is that of Industrial raw materials (A2), whose import is expected to grow by 29% on an annual basis between 2019 and 2021, against the average annual 2% of the last decade.

Conclusions

The strong growth of Vietnam represents for European companies an opportunity to be seized to expand their basin of foreign markets to all ASEAN countries. In fact, a free trade agreement (FTA) between Europe and Vietnam has been recently completed and, once in force, will lead to an increase in trade between the two areas. Moreover, the FTA will make Vietnam the second entry port to the 10 countries of the Association after the city-state of Singapore, with which Europe currently holds a free trade agreement.