Turkish Lira: a Fragile Balance

Negative real interest rates try to boost the country's competitiveness; exchange rate stability is at stake.

Published by Alba Di Rosa. .

Exchange rate Exchange rate risk Central banks Turkish lira Emerging markets Exchange ratesThe Turkish government is planning to boost the country's competitiveness, and it looks like it might want take the currency route.

For several months now, the Central Bank of the Republic of Turkey (CBRT) has been working to this end through its monetary policy action; on January 16, the central bank made the fifth consecutive cut in its reference interest rate.

The new expansionary cycle began in July, with central bank president Uysal replacing the former Cetinkaya. According to Reuters, the latter had failed to carry out the government's policy recommendations.

Last July, Turkish monetary policy-related interest rate amounted 24%; after the last cut, it is now slightly above 11%. What alarmed Moody's is that the last cut brought Turkish real interest rate into negative territory: this could be dangerous for financial stability, since a real interest rate lower than the emerging markets average could drive investors away from Turkey, putting further pressure on the lira.

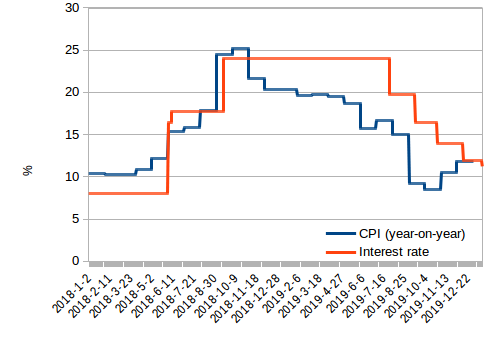

Turkey: Monetary policy-related interest rate

and Consumer Price Index (2018-2020)

Source: ExportPlanning and Central Bank of the Republic of Turkey.

As stated by the CBRT, reasons for this choice lie in the general improvement in the country's economic situation, compared to the trough experienced in 2018. After recording continuous contractions since Q4-2018, for the first time in Q3-2019 GDP growth (y-o-y) returned to positive territory (+0.5%). The dynamics of the industrial production index looks similar: after recording contractions from Q4-2018 to Q2-2019, it showed a weak recovery in Q3-2019; the recovery became more sustained in the last quarter (+3.84%).

Turkish central bank's statements also point to an ongoing gradual disinflation process; nonetheless, looking at the latest data, the price outlook does not actually look so rosy. As can be seen from the graph above, after a slowdown in early autumn, the consumer price index showed a renewed acceleration in recent months, reaching almost 12% year-on-year in December.

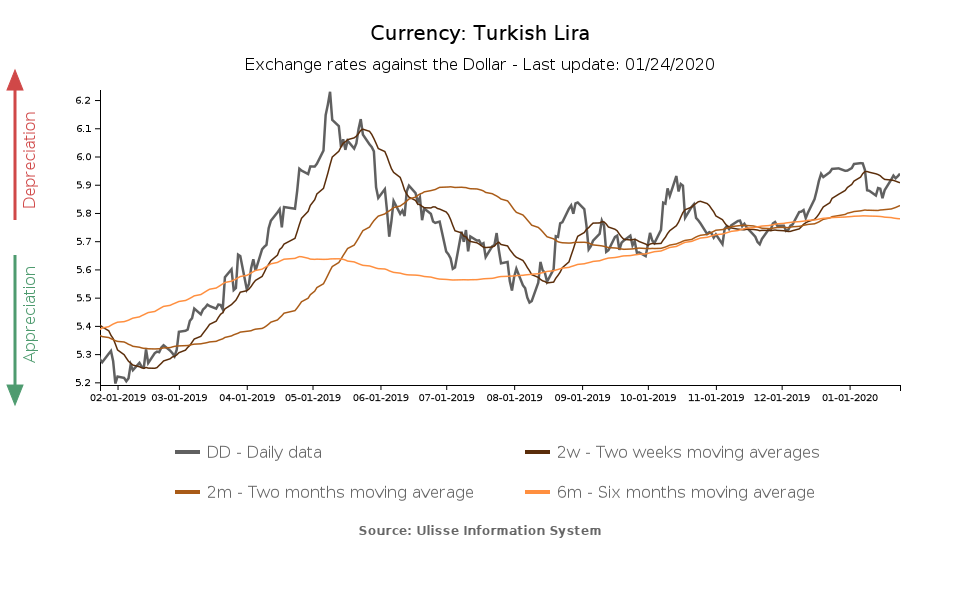

With a nominal interest rate of just over 11%, this move risks to put further pressure on the currency. In a context of relative exchange rate stability in H2-2019, an underlying weakening trend has nonetheless been present.

Looking at the last period, we can sport a weakening against the dollar (-3.5%) between the second half of December and the first week of January, which has been only partially recovered in the following weeks.

An additional element that makes the position of the lira quite unstable is its need for support. In fact, according to media and analysts, the action of the central bank and state banks is helping to support the lira, through more or less orthodox means.

Since the 2018 currency shock, the stability of the lira has been a top priority for the country: according to Finance Minister Albayrak, “it is a matter of national security”. Minister Albayrak also stated that, since 2018, the role of all banks, private and public, is becoming much more active in the market, for the ultimate goal of financial stability.

The exchange risk relative to the Turkish lira therefore remains high: the currency moves in a precarious equilibrium, driven by market dynamics, persistent inflation and expansionary monetary policy choices, on the one hand, and the alleged support of Turkish financial institutions on the other. The dependence on such support, combined with the risk of a decline in investments in Turkish lira, puts its fragile stability at risk.