Coronavirus fears weigh on Asian currencies

It’s not just the yuan: knock-on effect for ASEAN countries facing the brunt of the contagion risk

Published by Alba Di Rosa. .

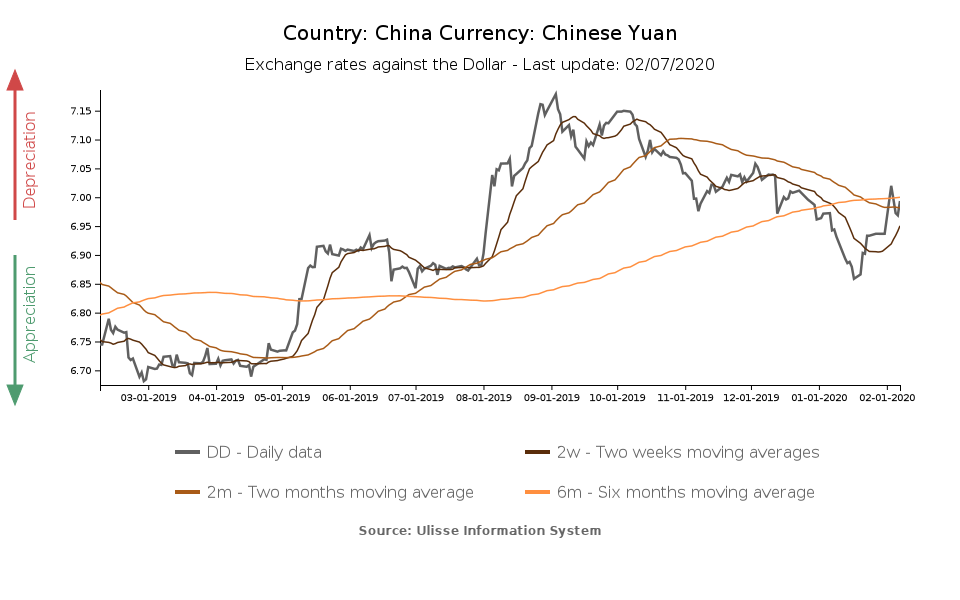

Exchange rate Asia Central banks Uncertainty Exchange rate risk Emerging markets Exchange ratesIn recent days, fears related to the spread of the new coronavirus are the master, even in financial markets talks. The Chinese currency stands on the front line of the emergency, as it showed a depreciation against the dollar in the second half of January (-2.3%), i.e. since China raised the alarm about the spread of the epidemic.

In the last days, the yuan showed a slight recovery (+0.4%).

It is worth noticing that China does not adopt a free floating exchange rate regime; the yuan is linked to a basket of currencies, a factor that cushions its fluctuations in the face of a shock; in a context of free floating exchange rate regime, the impact of the shock could therefore have been heavier.

However, it is not just the yuan: Chinese stock exchanges are feeling the effects of the current climate of fear, as well. The main Chinese stock exchanges, Shanghai and Shenzen, after closing on January 24 for the Chinese New Year's holidays, reopened on February 3 and registered significant losses: the Shanghai Stock Exchange Composite Index lost 7.7%, while the Shenzhen Stock Exchange Composite Index lost 8.4%. The losses have been partially absorbed in the follwng days.

Given the strong fears of a negative impact of the epidemic on the economy, the Popular Bank of China took the field using monetary policy tools. The recoveries recorded in the last few days by Chinese stock exchanges and currency reflect this action.

In particular, the Popular Bank of China:

- Injected liquidity through open market operations (reverse repo operations): 1.2 trillion yuan (about 156 billion euro) on February 3, and 500 billion yuan (about 65 billion euro) the following day

- Cut the 7-days and 14-days reverse repo rates by 10 basis points (respectively to 2.4% and 2.55%)

The reason for this action is the will to preserve a “reasonable and adequate liquidity in the banking system and sound operation of the money market during the period of epidemic prevention and control”.

Monetary policy action, together with slower growth in the number of new coronavirus cases in recent days, has partially calmed market fears, leading to a slight recovery of Chinese stock exchanges and currency. However, many analysts point out that monetary policy actions will not be enough to revive the economy, which will most likely suffer the repercussions of the epidemic in terms of GDP growth, retail sales and industrial production.

The rest of Asia

As mentioned last week about the Thai baht, market fears related to the coronavirus are also having an impact on other Asian currencies and, consequently, on the decisions of their central banks.

On 5 February, the Bank of Thailand cut rates to 1%, against the backdrop of a slowdown in economic growth and fears of reduced tourism linked to the spread of the epidemic - as well as an explicit strategy aimed at weakening a very strong currency (see the article for more details).

Philippine peso has not recently showed signs of weakening; nonetheless, the country's central bank has acted towards monetary accommodation, reducing its benchmark interest rate on February 6. Among the reasons is also the spread of the coronavirus, which could exert a negative impact on the country's economic activity and market sentiment in the months to come.

As regards Malaysian ringgit and Singapore dollar, they have indeed weakened in the last weeks, proving the sensitivity of ASEAN currencies to the epidemic and risk aversion, as well as the possibility of a slowdown in Chinese demand.