The weakness of the single currency

Data released for Q4-2019 show that Eurozone economic pain is getting worse.

Published by Alba Di Rosa. .

Exchange rate Central banks Macroeconomic analysis Uncertainty Economic policy Slowdown Dollar Euro Exchange ratesOne of the most interesting trends in currency markets this week is the significant weakening of the euro, compared to the opposite trend showed by the world’s major currencies.

Effective exchange rate - % change against moving average

Source: ExportPlanning, Exchange Rates Tool.

Multiple factors concur to to this weakness: first of all, the weakness of the Eurozone's economy, combined with worries over the new Coronavirus, which are exerting a negative impact on the euro. The single currency reflects concerns about the slowdown in Chinese demand and the possibility of a disruption of global value chains. Among non-European markets, China represents the EU's second largest destination market and its first supply market (ExportPlanning data, 2019).

Last but not least, the weakening of the euro reflects a strengthening dollar, as exchange rates are by definition relative: in recent weeks, the US currency is confirming its role as the main safe-haven, in a context of growing risk aversion. Nonetheless, its strength also reflects the state of the US economy, which is looking healthier compared to the Eurozone.

Eurozone: GDP slowdown and industrial production contraction

The main long-term factor weighing on the euro is the weakness of its economy, while the ECB is increasingly losing room for manoeuvre in terms of expansionary monetary policy.

The latest data released today by Eurostat did not show a rosy picture for the Eurozone economy. In terms of gross domestic product, growth rates have been slowing down during 2019, as can be seen from the graph below.

GDP growth rates, Eurozone (2019)

In Q4-2019, the Eurozone economy showed almost no growth compared to Q3 (+0.1%), while it showed a 0.9% increase compared to Q4-2018. Germany and Italy recorded the worst performance: 0.5% and 0%, respectively (y-o-y).

On the other side of the ocean, the US economy grew by 2.3% in Q4-2019 (y-o-y) and by 0.5% compared to the previous quarter.

Industrial production data does not suggest a better performance. In December, the Euro area seasonally adjusted industrial production index contracted by more than 2% compared to the previous month, the highest contraction recorded in 2019. Italy, Germany and France exceeded the -2% threshold, while in Spain industrial production contracted by “just” 1.5%. Analysts are worried about Germany, above all: the Euro area major economy appears to be at a standstill.

Effects on the currency

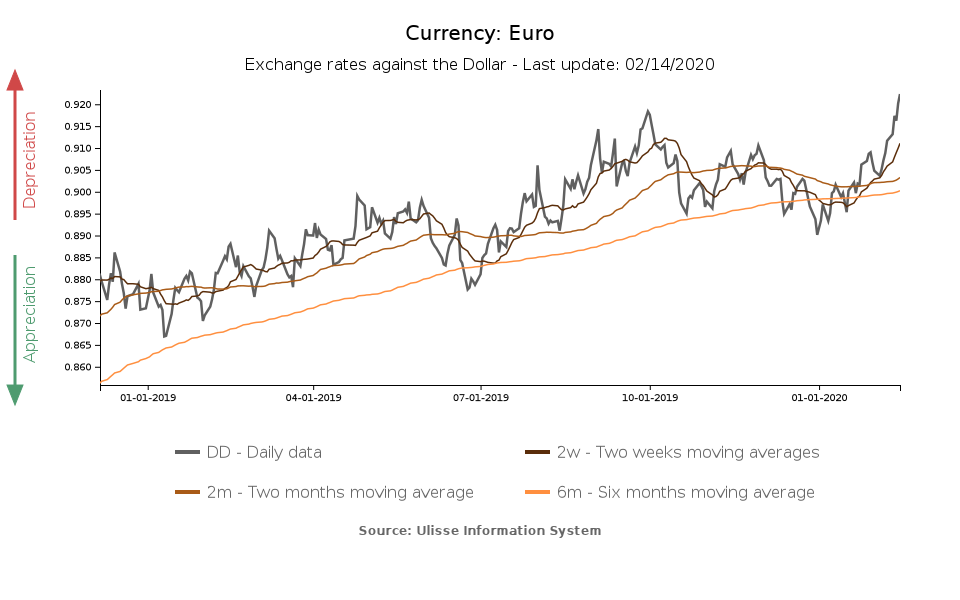

The euro has followed a path of gradual weakening, as well, losing 2% of its value against the dollar during 2019. This trend is evident from the 6-month moving average, as can be seen from the graph below.

The weakening trend has accelerated since early 2020, in particular in recent weeks: from the beginning of January to date, the euro has lost 3.2% of its value against the dollar. This can be explained in relation to the Coronavirus effect, but also to short-term market movements, linked for example to the political turmoil in Germany and the outcome of recent Irish elections.

2020 forecasts

According to the European Commission's Winter 2020 Economic Forecasts, risks for the Eurozone economy remain tilted to the downside, and its growth rates will remain below potential in the period 2020-2021.

Despite a partial easing of tensions on the trade war front, thanks to the US-China Phase One Deal, uncertainty about US trade policy remains high, as does the future of trade relations with the UK. The effects of the new Coronavirus on public health and economies also emerge as a new and predominant element of risk.

2020 is therefore not going to be easy for the single currency. The silver lining of a possible weakening could be a marginal effect in terms of increased competitiveness, in the face of the scarce monetary policy tools now left to stimulate a suffering economy.