Coronavirus Effect on Markets and Economies

A brief recap of a stormy month

Published by Alba Di Rosa. .

Exchange rate Central banks Europe Uncertainty United States of America Dollar Emerging markets Global economic trendsIn March, the effects of the Coronavirus began to be felt worldwide. While in January the epidemic was still confined to China, with isolated cases in the rest of the world, at the end of February the Italian outbreak was discovered, acting as a forerunner in Europe. Since the second half of March, confirmed cases have been showing a significant growth in the rest of Europe and the United States; last week, the US overtook Italy and China in terms of number of infections, rising to the first place in the world.

This health emergency situation, labelled by the World Health Organization as a pandemic, is having and will have inevitable economic repercussions, due to the increasingly restrictive measures that governments have been forced to take to stop the contagion, up to a complete lockdown in many cases. The power of this shock lies in its symmetrical nature and in the fact that it involves both supply and demand, a factor that strengthens its magnitude. It also adds to a pre-existing phase of weakness in global economic growth, constituting one of the current major sources of weakness threatening the development of world economy.

In the words of the World Trade Organization, "The COVID-19 pandemic represents an unprecedented disruption to the global economy and world trade, as production and consumption are scaled back across the globe".

Purchasing Manager Index

How to measure the Covid effect on the economy? A first element that allows to evaluate, almost in real time, the effect of the pandemic on the economic system, is the Purchasing Manager Index (PMI). The PMI takes into account new orders, production, employment, deliveries and stocks in the manufacturing sector, constituting a good index of the sentiment of the business community. A PMI value lower than 50 indicates a contraction in economic activity compared to the previous month, a value greater than 50 an expansion and a value equal to 50 an unchanged situation.

The rapid spread of the virus has led to a rapid deterioration in business expectations, as can be seen from the PMI index which fell in March both in Europe and the United States.

Purchasing Manager Index: Europe, United States and China

Source: PricePedia.

In March, US and Europe PMI showed values lower than 50, i.e. expectations of a contraction in economic activity; for China, on the other hand, a value of 50 suggests that the situation is unchanged - therefore equally negative - compared to the previous month. As a matter of fact, for Europe and China expectations were already negative in February; on the contrary, for the United States the index entered negative territory only in the last month, in relation to the different timing of the epidemic.

Financial Markets

Another real time gauge of the effect of the epidemic are the reactions of financial markets. Generalized fear over the impact of Covid19 on the global economy has affected investor sentiment, with inevitable repercussions on stock exchanges and currency markets.

- As regards exchange rates, an appreciation trend for the dollar and a depreciation dynamics for emerging markets currencies have been observed during March.

The spread of the coronavirus has in fact generated a general risk-off sentiment. The first currencies to suffer the repercussions of risk aversion were EM Asian currencies, due to the strong exposure of these countries to the risk of contagion from China; these currencies began to depreciate in early February.

As the epidemic spread outside of China (roughly from the end of February, with the Italian outbreak), most EM currencies began to suffer, while the dollar began its run. In this period of general sell-off, the demand for dollars (intended as a safe-haven asset and liquidity par excellence) has driven the dynamics of FX markets. - Stock exchanges dynamics in March has been marked by strong volatility, as shown by the Vix index, which exceeded the levels reached during the 2008 crisis. Large losses were recorded in relation to investors' fear of the Covid epidemic and its effects on the economy. However, stock exchanges were reactive to the central banks' announcements of expansionary actions to support national economies (see the point below), which contributed to a partial recovery.

- Major protagonists of the month just ended were, in fact, central banks: in the front line, the American Federal Reserve and the European Central Bank, which have undertaken massive expansionary monetary policy actions to shield the economies from the most dramatic effects of the current health emergency.

The FED, in addition to a double cut in its reference rates – which brought them close to zero – has launched the so called "unlimited QE", i.e. it has committed to buy securities in the amount needed to ensure smooth market functioning.

The ECB for its part has launched the Pandemic Emergency Purchase Programme, pledging to buy securities in the amount of €750 billion.

Like the institutions just mentioned, many other central banks around the world have adopted the same approach, taking strong expansionary actions to alleviate the impact of the crisis on economies by providing liquidity at a very low cost.

Industrial production

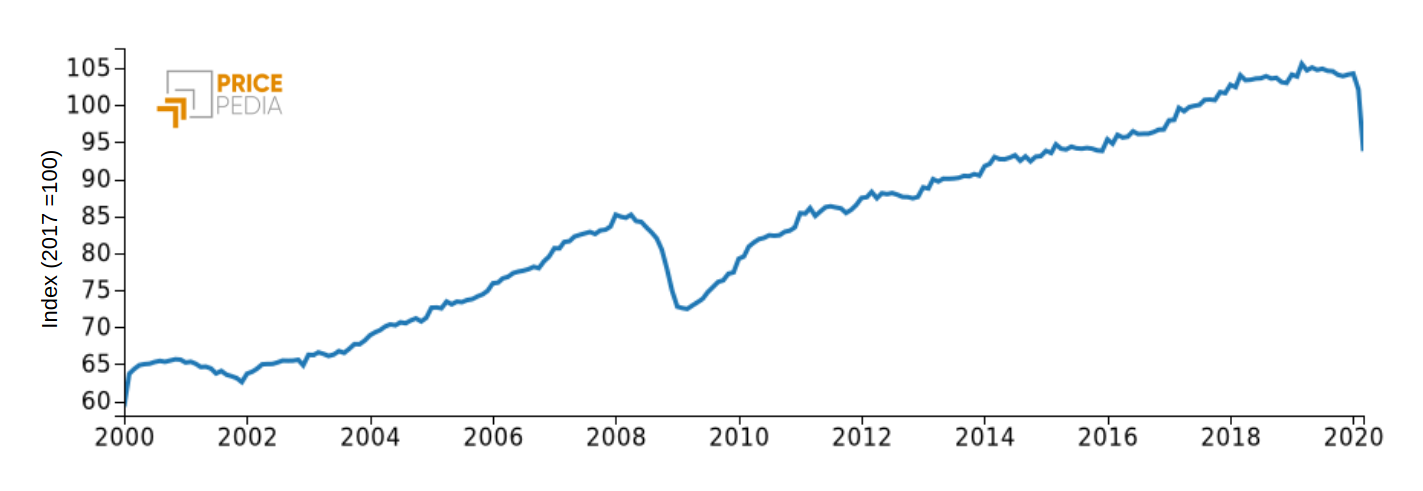

Further key indicator to measure the effect of the coronavirus in terms of reduced economic activity is the industrial production index. According to PricePedia estimates, gloabal industrial production suffered a severe blow in March, with a contraction of more than 8% compared to the previous month and 11% YoY.

Global industrial production index

Source: PricePedia.

World trade

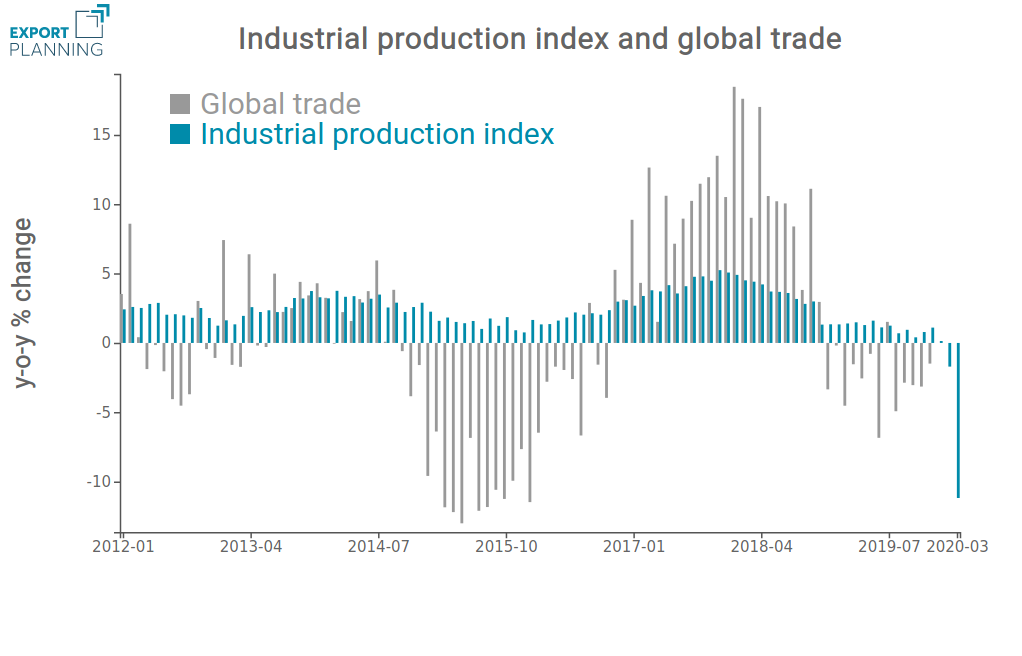

To conclude, a look at the effects of the epidemic on world trade is a must. The sharp deterioration of the global macroeconomic context will in fact have an almost inevitable impact on the supply and demand for goods, and consequently on international trade trends.

According to the Director-General of the World Trade Organization, Roberto Azevêdo, "a very sharp decline in trade" is expected. The effects of the pandemic on trade also add to an international context of pre-existing weakness in world demand, mainly caused by the US-China trade war.

Waiting for official statistics on international trade data, it is possible to make an initial assessment of the effects of the epidemic on trade from trends in global industrial production. The dynamics of the two economic variables is in fact very correlated, although YoY variations in world trade are usually more pronounced.

Exploring the trend of international trade since the beginning of 2020 on the basis of industrial production data, it is possible to assume that the weight of the Covid-19 epidemic on world trade began to show in January and February, given China’s strong integration in global value chains: China alone holds about 13% of world exports.

From the sharp contraction in industrial production evident in March, we can therefore infer that a drastic reduction in international trade flows has taken place. Considering the Chinese economy as a benchmark to get an idea of the potential intensity of this contraction, data from the National Bureau of Statistics of China suggest that the spread of the epidemic has led to a cumulative 17.2% loss in terms of domestic exports in January and February. On the basis of the evolution of the pandemic, the next few months will reveal the extent of the collapse in trade for the rest of the world.