Turkish Lira on a Slippery Slope

The Covid epidemic could bring Turkey on the brink of a new currency crisis

Published by Alba Di Rosa. .

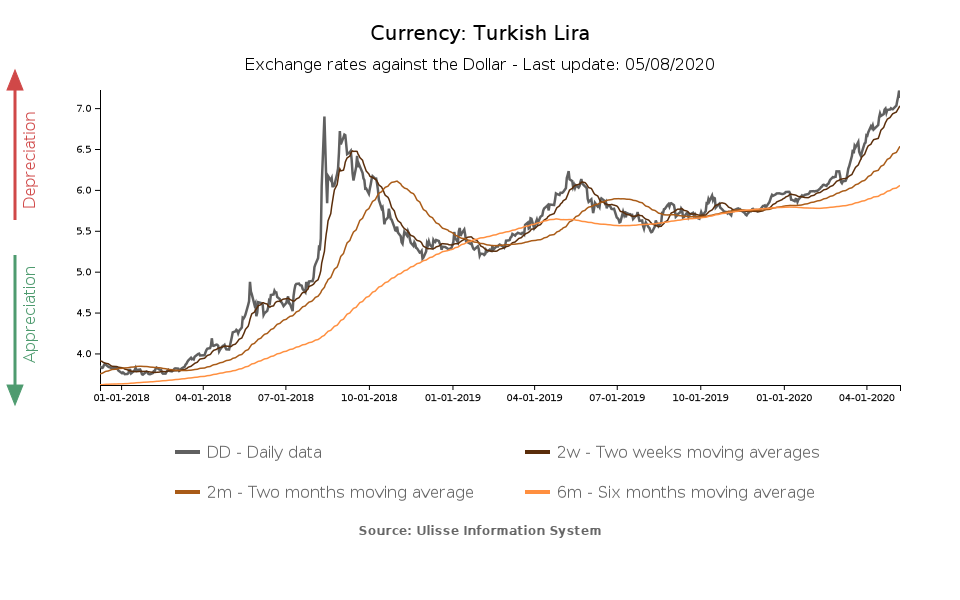

Exchange rate Uncertainty Central banks Turkish lira Emerging markets Exchange ratesIn the last few days the Turkish lira set new records, unfortunately negative ones. Yesterday the currency closed at 7.21 lira per dollar, in an almost uninterrupted depreciation trend since the beginning of the year, which led it to lose almost 20% of its value against the greenback.

As you can see from the chart below, the currency has just reached a new high, exceeding the levels reached during the 2018 currency crisis, when it took 6.9 lira to buy a dollar.

Risk factors

As well as Brazil, Mexico

and South Africa, analyzed in recent weeks, Turkey also belongs to that group of emerging countries characterized by structural economic imbalances, and whose economic system is therefore poorly equipped to deal with the effects of a strong shock like a pandemic. The dynamics of the Turkish currency reflects this unfortunate combination of factors.

The Covid crisis, which in Turkey is having quite a strong impact with more than 130,000 confirmed cases to date, fits into an economic context that was just experiencing a recovery in the last two quarters, after three consecutive quarters of GDP contraction.

In spite of this apparent improvement, structural risk factors for the currency have never disappeared. Although since late 2018 the Turkish authorities have managed to bring the exchange rate under control, the currency has always remained at risk due to the lack of markets’ confidence in the Central Bank of the Republic of Turkey (CBRT), and its ability to stabilize the currency: the bank is seen as over-politicised, and the markets do not share the strategy favoured by President Erdogan, who is known to be against high interest rates. At present, with a currency weaker than in summer 2018, the reference interest rate amounts to 8.75%, compared to 24% in September 2018. With inflation currently at 10.94%, the real interest rate is actually negative, which is clearly not an incentive for investors. This add up to the general capital flight from emerging markets' assets, triggered by the pandemic, bringing the lira to a particularly precarious position.

A further risk element for the lira is the erosion of the country's FX reserves, which limits the central bank's ability to intervene. As a matter of fact, while the recent depreciation of the lira is high in itself, it is common opinion that, without the support of the central bank, an even more tragic scenario would have occurred. Looking at recent FX reserves dynamics, you can infer that a quite substantial intervention might have taken place: Turkish FX reserves fell from $77.3 million in February to $59.2 million in March, a drop greater than 20%. Figures for April are not yet available, but everything suggests that, in a context of depreciation, the sale of foreign currency reserves might have continued in the attempt to contain the weakening.

Turkey: foreign exchange reserves excluding gold

The strong limit of this strategy, however, is the risk of eroding the reserves, especially in a context of foreign exchange shortages such as the current one. This year alone Turkey will have to repay a foreign currency debt amounting to $168.5 billion: the country is therefore facing serious financing problems these days, exacerbated by the pandemic that has not only caused a capital flight but has also wiped out tourism, one of the major sources of foreign currency for the country.

All in all, the Turkish currency stands in a very dangerous position, poised between the shock of the pandemic, lack of market confidence and lack of liquidity. The effect of the lack of confidence has been felt in the last few days, when the statements of a FED official about FX swap lines, already granted to several EM countries to alleviate the demand for liquidity, suggested that these concessions are reserved to countries with which the US cultivate a relationship of mutual trust - a group to which Turkey does not seem to belong.

Today the lira showed a slight recovery, to 7.12 lira per dollar, but it seems unlikely that this could mark the beginning of a turnaround. This could rather be the effect of new regulations preventing three international banks from trading Turkish lira, in order to limit investors' bets against the currency. Since these measures are not addressing structural problems affecting the lira, most analysts expect the Turkish currency to remain under pressure in the short term.