Optimism on Financial Markets supports the Swedish Currency

Published by Alba Di Rosa. .

Exchange rate Central banks Europe Uncertainty Exchange rate risk Covid-19 Exchange ratesAt the beginning of the Covid crisis, Sweden ended up in the spotlight for its unconventional management of the health emergency: Sweden, in fact, avoided a rigid lockdown - unlike most of the countries affected by the epidemic - by imposing lighter restrictions that exerted a minor impact on personal freedoms and economic activities. How did the currency react during this period?

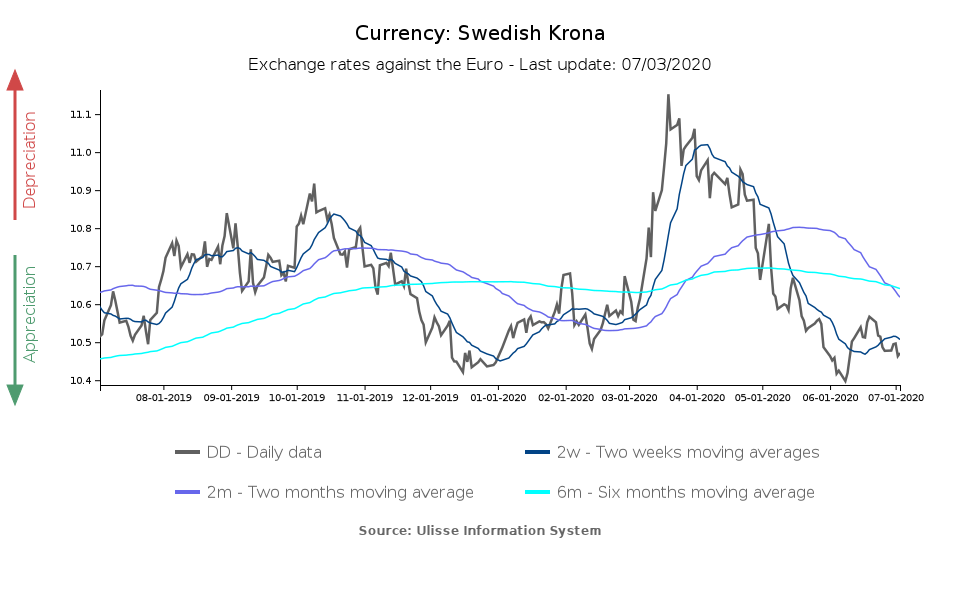

Looking at the exchange rate against the euro, we can see that the Swedish krona weakened in the initial phase of shock on financial markets (-5.6%), related to the spread of the epidemic on a global scale, and then recovered from the second half of March: after reaching a peak of SEK11.15 per EUR, the krona fully recovered against the euro over two months. To date, the Swedish currency has returned to its early 2020 levels (SEK/EUR 10.47).

What is the reason for this recovery? According to the country's central bank (Riksbank), the main reason lies in the improvement in risk sentiment on financial markets: the July 2020 monetary policy report states that “a large part of this appreciation can be explained by the more positive risk sentiment that is reflected in rising global equity prices".

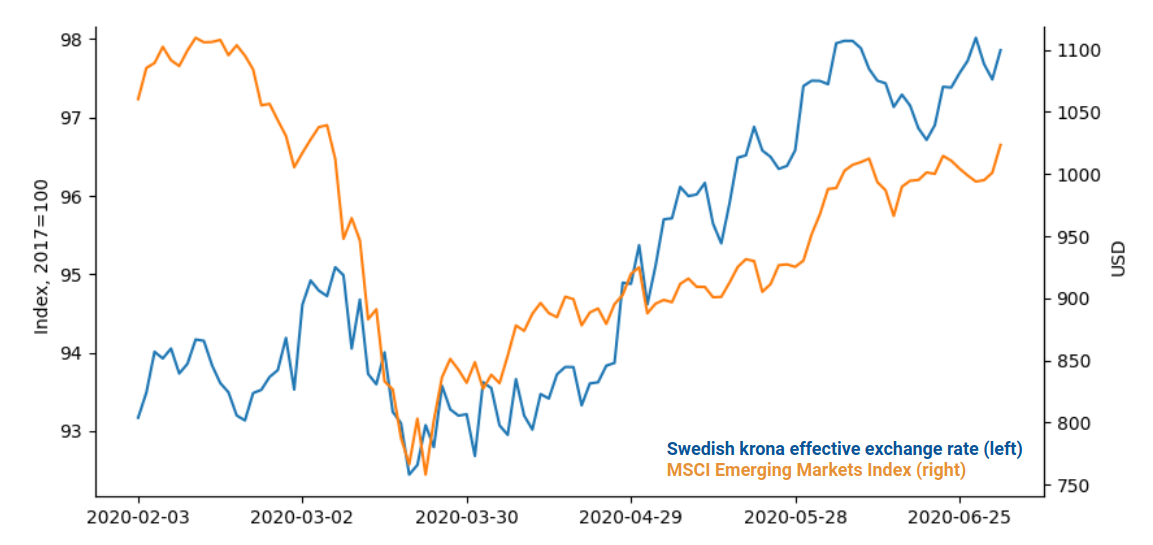

This statement is confirmed by the joint graphical analysis of the time series of the effective exchange rate of the krona and the MSCI Emerging Markets Index. As can be seen from the graph below, the dynamics of the two series are similar, although the stock market index has shown a stronger decline and a less intense recovery compared to the SEK exchange rate.

Swedish krona effective exchange rate and MSCI Emerging Markets Index

Source: StudiaBo elaborations.

According to some analysts, the clear recovery of the krona could also reflect some market optimism about the outlook for the economy, which is suffering less economic damage from the "Corona crisis" compared to many other countries by avoiding an actual lockdown.

Nonetheless, the Swedish economic situation is thorny, as well: the country is not exempt from the common challenges of the post-Covid era. While in Q1-2020 Sweden's GDP looks substantially unchanged, the central bank expects a 7% contraction in Q2 which, for the whole of 2020, will result in a -4.5% change, the deepest annual contraction since 1940. The contraction expected for Sweden is far lower compared to countries that have implemented the most stringent lockdowns, or whose economy is heavily dependent on tourism; nevertheless, this value signals a significant reduction in economic activity. Unemployment is also rising and inflation remains below expectations.

In this context, in order to avoid an “an unnecessarily prolonged and deep decline in the economy and inflation”, and to support, on the contrary, the recovery of the economy and of price dynamics, the central bank in the July 1 monetary policy meeting decided to:

- extend the Quantitative Easing program from SEK300 to 500 bn and extend it until the end of June 2021;

- start buying corporate bonds from September;

- further cut interest rates for loans to banks;

- keep the monetary policy reference rate (repo rate) unchanged at 0%.

The central institution therefore aims to maintain cheap liquidity in the economic system and, although it has not for the moment brought the repo rate below zero, it does not exclude the possibility of a return to this policy, whether necessary.

Prospects for the currency. According to analysts, the decisions taken in the last monetary policy committee did not exert a significant impact on the currency, but certainly highlighted the Riksbank’s stance: QE does not support the strengthening of the krona. As a matter of fact, while from an historical perspective [1] the currency is currently not so strong, the rally in recent months has been remarkable; a very strong currency might not be the central bank's target, for an export-oriented country like Sweden [2], and at a time when the economy is trying to emerge from a severe crisis.

Experts' views on the outlook for the krona in the coming months are mixed. What is certain is that the change in risk sentiment linked to the possibility of a "second wave" represent a risk factor for the currency, since it could diminish investors' appetite for risk, bringing them back to the traditional safe havens.

[1] See the “Monetary and Financial Indicators” database for exchange rates monthly time series since 2000.

[2] According to World Bank data, Swedish exports of goods and services as a share of GDP amounted to 47% in 2019.