Indian rupee: an Update

Historical current account surplus and investors' comeback might be guiding the currency into a phase of recovery

Published by Alba Di Rosa. .

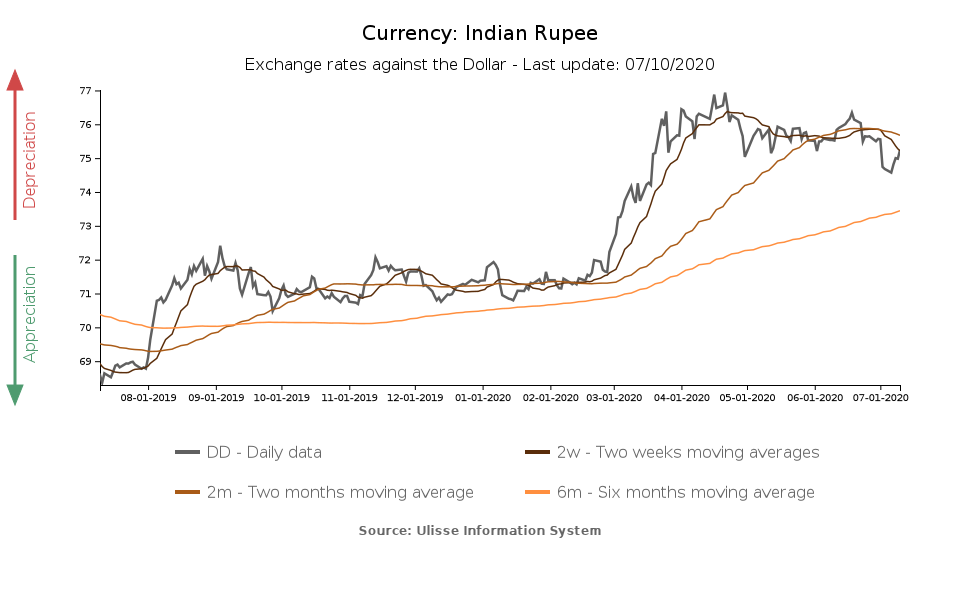

Exchange rate Asia IMF Central banks Exchange rate risk Covid-19 Emerging markets Exchange ratesSince early 2020, the Indian rupee has lost 5.4% of its value against the dollar, resulting in one of the worst performances among Asian floating currencies. The graph below shows a significant depreciation in March, related to the pandemic shock, which brought the currency from the level of 71.5 rupees per dollar to the threshold of 77.

After this peak, the rupee has entered a phase of relative stability, while from the end of June a recovery seems to have begun (1.4%): this would lead the rupee to join the trend observed for other emerging countries.

Reasons for a recovery

Risk sentiment. There are several factors that can support a scenario of recovery for the currency: first, the return of risk sentiment, which the rupee shares with other EM currencies. However, investors' appetite for risk is not, by itself, sufficient to justify the rupee's dynamics: as the dollar exchange rate, now a thermometer of risk aversion, suggests, the return of appetite for risk has been in the field since the second half of May.

It is therefore necessary to broaden our gaze to consider some specific factors for India.

Balance of Payments. A key element to consider for the analysis of the Indian currency is the balance of payments. India tends to post current account deficits due to a deficit on the side of goods, not fully offset by a surplus on the side of services.

However, it seems that in 2020, with the start of the Covid-19 epidemic, something has changed. According to the information released by the Reserve Bank of India for Q1-2020, India recorded a marginal surplus in terms of current account ($0.6bn), a figure in any case significant if compared to usual deficits. A significant contribution in this reversal of the trend comes from a lower trade deficit, which improved by 2.5% YoY.

The shock generated by the epidemic on Indian foreign trade exacerbated this turnaround in April and May: the latest data issued by the Indian Government's Ministry of Commerce and Industry show that exports fell by 33.66% and imports by 48.31% in the period April-May compared to the same period of the previous year, for a total trade surplus of $4.37 billion.

Therefore, if the presence of a trade surplus may seem good news, at least for the currency as it puts less pressure on it, it actually provides an alarming signal for the Indian economy as a whole, suggesting a strong contraction in domestic demand, as showed by the imports' collapse.

Foreign portfolio flows. Another element that is supporting the currency is the return of foreign capital, after the fall linked to the Covid shock, as can be seen from the graph below.

India: Net foreign portfolio flows

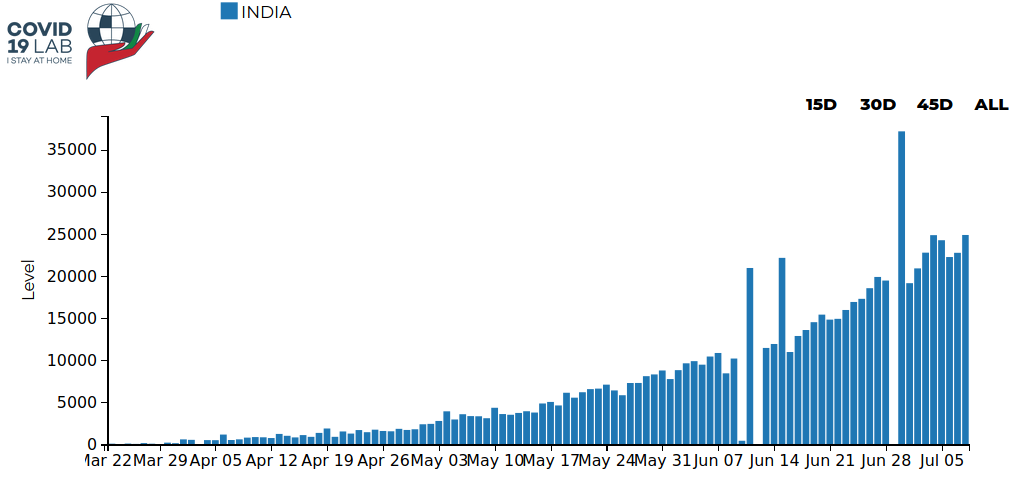

It should be noted, however, that the optimism that is driving the recovery in capital flows is not solidly supported by comforting economic news, given the deadlock in the real economy. The International Monetary Fund has recently reviewed forecasts for the Indian GDP in 2020 at -4.5%, in a scenario where Covid risk firmly remains on the scene. In India, in fact, confirmed cases are still following an upward trend and the country is, at present, the third most affected in the world, after the United States and Brazil.

India: Covid-19 new confirmed cases

Source: Covid19Lab.

Action of the Reserve Bank of India. A final element to be reported in the analysis of the dynamics of the rupee is the action of the Reserve Bank of India (RBI). According to analysts, if the RBI had not bought dollars in recent months, the rupee would have showed a stronger recovery. In fact, data about FX reserves show a trend of growth since May; in early July, they reached the threshold of $513.25bn, an all-time high.

Indeed, the RBI seems intent on increasing its stock of reserves, given the numerous upcoming challenges. If, therefore, its current action puts a brake on the strengthening of the currency, keeping it competitive in a critical phase, at the same time the RBI's work seems to aim at building a buffer that can be used against possible future depreciations, in order to safeguard financial stability.