Machinery: the Fall in World Demand mainly Affects Italian and German Exports

In H1-2020 the two main European exporting countries show the worst performances among international competitors

Published by Marcello Antonioni. .

Check performance Global demand Industrial equipment Uncertainty Competitor analysis Great Lockdown Global economic trendsIn the second quarter of the year, the downfall of global demand for the Machinery industry1 intensified: -15.9% in euro (YoY), according to ExportPlanning elaborations available in the MarketBarometer tool.

This drop follows the smaller 5% YoY reduction that marked the first three months of the year.

(cumulative year-over-year % changes)

|

Source: ExportPlanning - Market Monitor, MarketBarometer

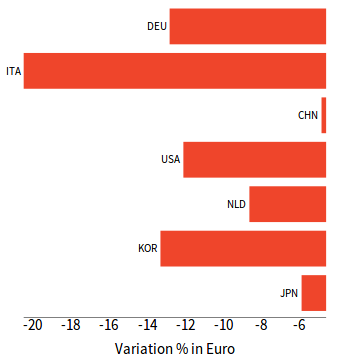

Overall, the first six months of 2020 marked a 10.6% fall in global demand for Machinery in euro values, with generalized reductions for almost all major competing countries, but with different intensities:

- Italy (-23.5% in euro) and Germany (-18.1%) showed the greatest repercussions in terms of cumulative variations in their exports of machinery and industrial plants;

- double-digit decreases in the cumulative values in euro also for the exports of Japan (-12.3%) and South Korea (-12.9%);

- slightly better performances for Taiwan, China and United States, whose exports respectively fell by 5.7%, 3.4% and 2.1%. As regards China, after a robust growth in 2019 (+13.7%), the slowdown started with a strong economic downturn in Q1-2020 (without, however, entering into negative territory on an annual basis) and a subsequent quarter which recorded a YoY drop in exports; as for the US, after a favorable Q1-2020 (+13.7% in euro values), in the April-June period US export dropped by 16.3% YoY in euro values;

- performance in positive countertendency for Dutch exports (+16.2%), which however appear to be favourably influenced - in a context of widespread restrictions on air transport - by a greater operation of its ports.

For Italy and Germany, falls between 25% and 35% for

exports of machine tools and metal processing machinery

The major losses for Italian and German exports can be seen in the Metal processing machinery3 sectors (with cumulative YoY variations respectively amounting to -26.7% and -30.8%) and Metalworking machine tools4 (-33.1% and -28.3% respectively).

While in the first sector the cumulative downturn appears generalized also to the other main competitors, in the second case the export performance of the United States, the Netherlands and Singapore appear to be in positive countertendency.

Metal processing machinery

|

Metalworking machine tools

|

Source: ExportPlanning - Market Monitor, MarketBarometer

Reduction in foreign trade shares in the textile machinery and food machinery sectors

In the Textile Machinery5 sector, in the face of a global demand dynamics down by 16% in euro values, in the first six months of the year Italian exports showed a drop greater than 30%, while German exports fell by about 20%.

In the Food Machinery6 sector, in the face of a global demand dynamics dropping by 11% in euro values, in H1-2020 Italian exports fell by more than 20%, while German exports by about 13%.

Textile Machinery

|

Food Machinery

|

Source: ExportPlanning - Market Monitor, MarketBarometer

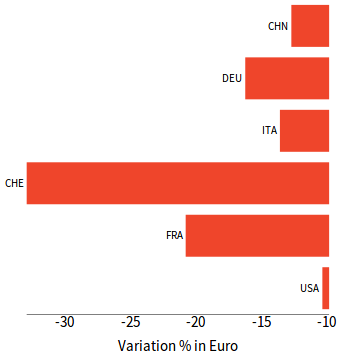

Altough negative, in the converting sectors performances appear less penalizing

Export trends of major competitors in H1-2020 (year-over-year % changes in €)

Paper-making machinery

|

Packaging machines

|

Source: ExportPlanning - Market Monitor, MarketBarometer

Italian and German exports, although decreasing, appear to be relatively less penalized in the Paper-making machinery7 and Packaging machines8 sectors. As for the former sector, Italian and German exports respectively showed a cumulative YoY performance of -13.6% and -16.2% in H1-2020, less worse than e.g. Switzerland and France; as for the latter, percentage changes amounted to -13.7% and -10.1% respectively.

In the packaging machines sector, the performance of other relevant competitors, such as Japan and, to a lesser extent, United States and China.

are in positive contrast.

It should therefore be noted that, even in sectors relatively less impacted by the recessionary effects triggered by the Covid-19 emergency, the export performance of Italy and - albeit to a lesser extent - Germany generally appears to be more penalizing compared to the average of their competitors.

The international trade data that will become available in the coming weeks, with reference to July 2020 and pre-estimates for Q3-2020, will allow a verification of the possibility of a competitive recovery of the main European exporting countries in the machinery industry.

(1) In the graph in question and in the following ones, the competitors' performances are descendingly ordered according to relevance of their 2019 export values.

(2) For a list of the sectors considered in this analysis, please refer to the following description.

(3) For a list of the products considered in this analysis, please refer to the following description.

(4) For a list of the products considered in this analysis, please refer to the following description.

(5) For a list of the products considered in this analysis, please refer to the following description.

(6) For a list of the products considered in this analysis, please refer to the following description.

(7) For a list of the products considered in this analysis, please refer to the following description.

(8) For a list of the products considered in this analysis, please refer to the following description.