EU Investment Goods Exports in 2020: Widespread Falls, but less Pronounced than in 2009

Average declines aroung 10 to 15 percentage points, compared to 20 to 25 points during the Great Recession

Published by Marcello Antonioni. .

Great Lockdown Conjuncture Internationalisation Metal industry Global economic trendsThe analysis of EU firms' foreign trade, updated to the fourth quarter of 2020 (see the EU International Trada Datamart by ExportPlanning), allows to document the impacts of the COVID-19 crisis on the performance of the European capital goods sector (electrical engineering, industrial machinery and equipment, ICT and services tools and equipment, industrial plants, transport and agricultural machinery).

Last year the downturn in European sales of the sector (-13.5% in EUR) was decidedly more contained compared to the Great Recession (-21.7% in 2009 alone)

Despite what was feared last spring, European sales of capital goods have shown a significantly smaller downturn in the average of 2020, compared to the one experienced during the Great Recession.

Comparing 2020 results to 2009 performance, they appear significantly less penalizing for all major capital goods industries. The result confirms the thesis that the current crisis is having a greater impact on the services sector, with relatively less dramatic effects on trade in goods, unlike the effects of the financial crisis. In particular, the analysis of the different segments of the capital goods industry highlights the export performance of the different sectors as follows:

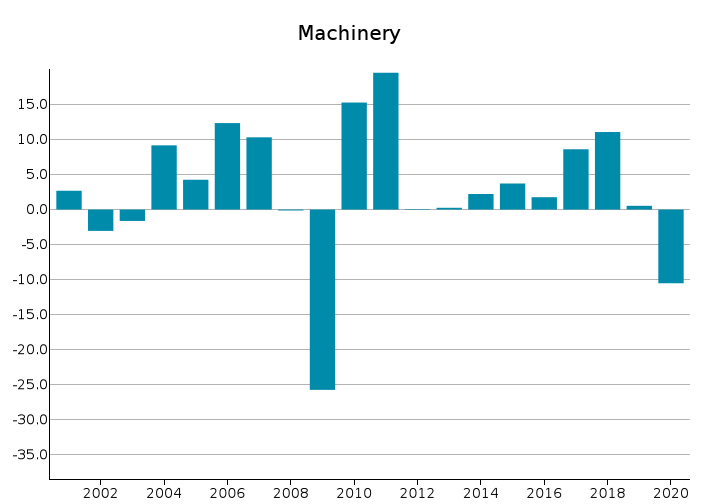

- Industrial Machinery and Equipment1:

- in 2020 this industry recorded a YoY drop of 10.5% in EUR;

- in 2009 the fall had been far more intense, amounting to nearly 26% in EUR.

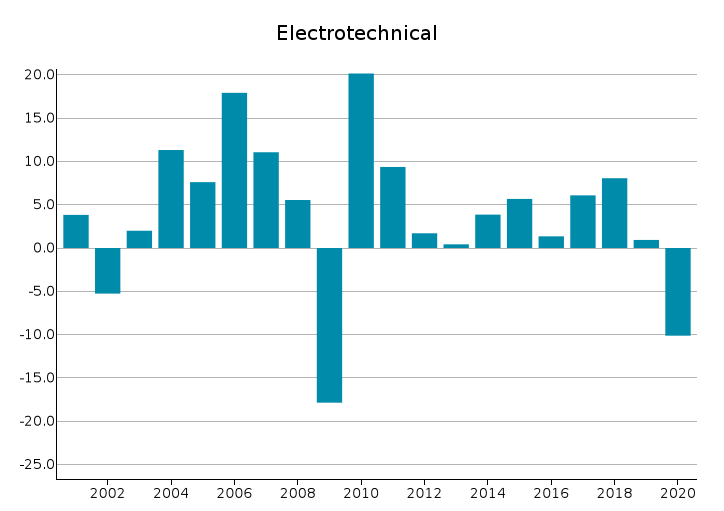

- Electrical engineering2:

- in the average 2020, EU exports of this industry marked a drop of 10 percentage points in EUR compared to 2019;

- in 2009, the average annual drop had been close to 18% in EUR.

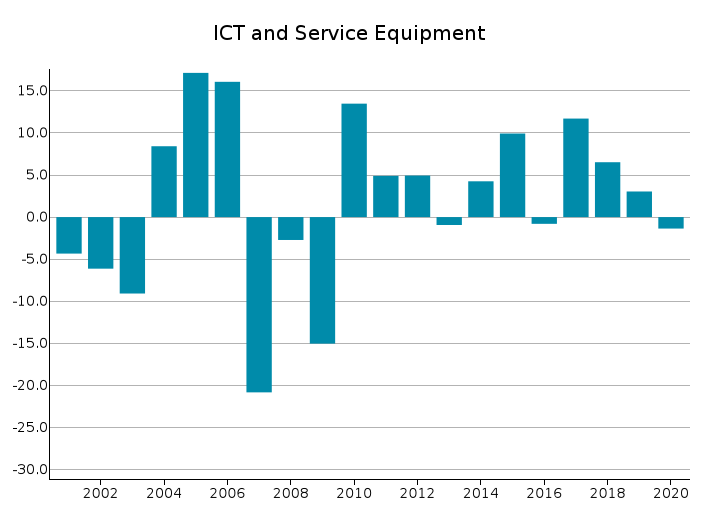

- Instruments and equipment for ICT and services3:

- on average, 2020 European sales of this industry were able to maintain a certain resilience (-1.4% in EUR compared to 2019);

- we can see a strong difference compared with what happened in 2009, when the average annual drop reached 15% in EUR.

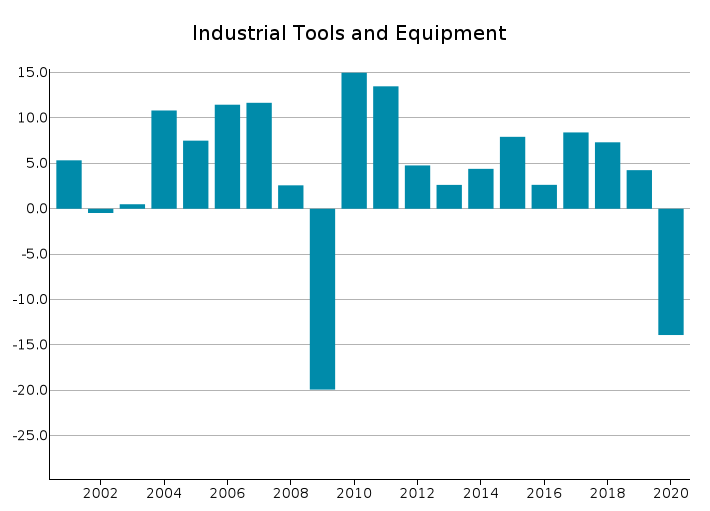

- Instruments and equipment for industry4:

- pre-consensus 2020 data mark a delcine of almost 14% in EUR for EU exports of this industry;

- also in this case, the comparison with the 2009 performance shows a more encouraging scenario in the current context, with a fall of 6 percentage points lower

- Industrial Equipment5:

- EU exports of this industry marked a decline of 13.7 percentage points in EUR on average in 2020;

- this is again a better performance compared to 2009, when European sales of this industry fell by more than 19% YoY.

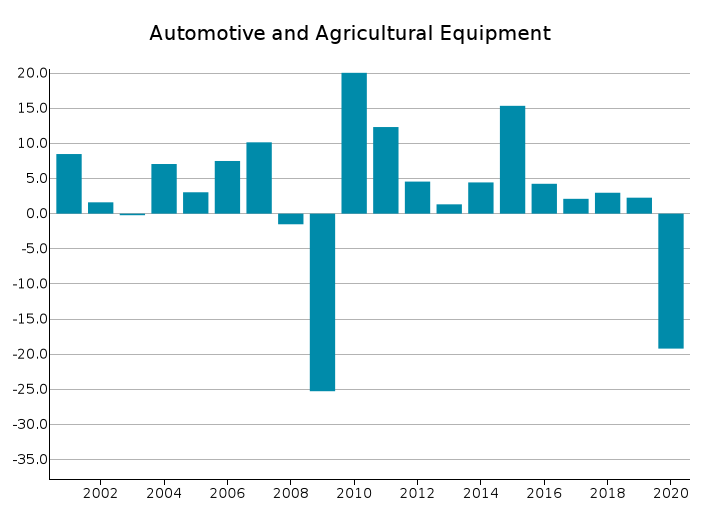

- Automotive and Agricultural Equipment6:

- in the average of 2020, this industry showed a particularly intense fall of more than 19% in EUR compared to 2019;

- it is, however, a less penalizing performance than the 2009 average, when the fall exceeded 25% on an annual basis.

- the automotive segment, which lost about 20% in terms of lower exports by EU companies compared to 2019;

- the agricultural machinery7 sector, which instead showed high resilience, with only a weak decline (-2.8%) in European sales compared to 2019.

|

|

|

|

|

|

Source: ExportPlanning - Market Research - Analytics, EU Trade Datamart

1) See the list of the sectors included in this industry in the related

industry description.

2) See the list of the sectors included in this industry in the related

industry description.

3) See the list of the sectors included in this industry in the related

industry description.

4) See the list of the sectors included in this industry in the related

industry description.

5) See the list of the sectors included in this industry in the related

industry description.

6) See the list of the sectors included in this industry in the related

industry description.

7) See the list of the products included in this sector in the related

sector description.