Price Dispersion: Natural or Symptomatic?

Analysis of the determinants of market price dispersion

Published by Lucrezia Fenudi. .

Premium price Foreign markets Trade balance Prezzi CommodityProduct differentiation is a strategy that allows a company to offer a product that is actually or apparently different from that of its competitors. If this strategy is successful, it generates a competitive advantage for the company operating it.

When entering foreign markets, it is therefore of considerable importance to investigate the nature of a product. In a market where differentiated goods are available, the uniqueness of the product means that, in addition to the set of characteristics, even the price can be evaluated differently and can therefore be a premium price: the buyer is willing to pay a higher price because the good better meets his needs (i.e., it seems more like his ideal variety). Differentiation is therefore strategically important in the approach to foreign markets because, through this price differential, the company can achieve a situation defined as above-average performance.

In contrast, homogeneous goods (or commodities) are highly standardized products. The alternatives are all perceived as qualitatively identical, so no consumer is willing to pay a higher price. According to the law of the single price in fact, in conditions of competition identical goods must have the same price in any market. This is certainly true for those commodities that are the underlying of some derivative instruments, such as futures: their price, quoted on the stock exchange, is determined by the market and coincides with the equilibrium price. Examples are energy commodities, natural metals or consumer goods such as sugar or coffee. The dispersion should, therefore, be very small in the case of these goods.

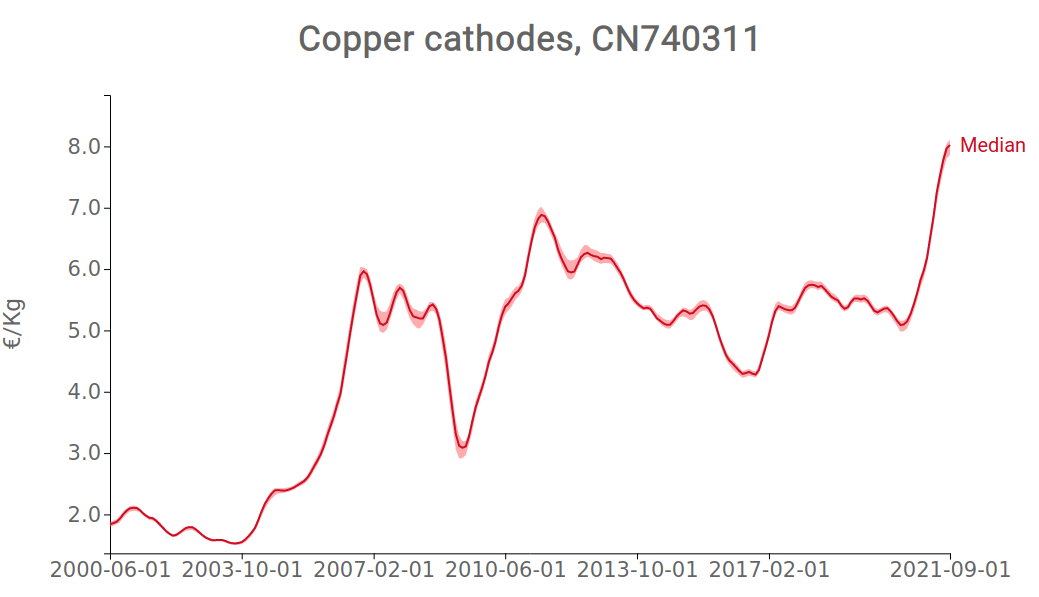

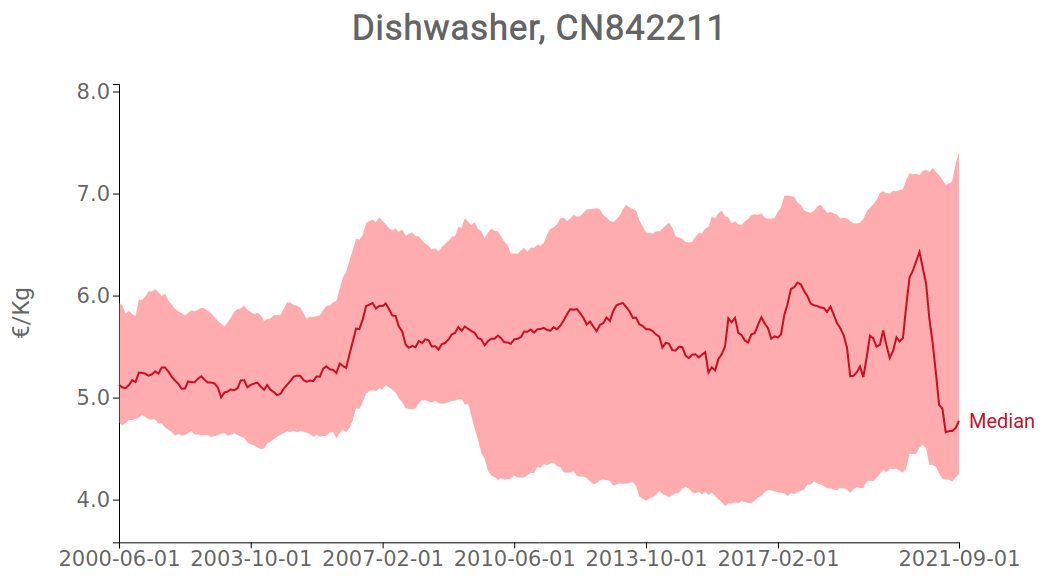

Given these assumptions, it is natural to wonder how it is possible to distinguish a differentiated product from a commodity. In the market of differentiated goods, for example, it is natural that products belonging to the same category can be sold at very different prices, thus presenting price dispersion. If, in the same period and on the same market, are imported goods that are homogeneous in terms of merchandise (i.e., belonging to a single customs code), but with different prices, then this can be considered an indication of differentiability of the good. For example, if one compares the dispersion of import prices of copper cathodes and dishwashers, cathodes are clearly non-differentiable: there will never be a buyer willing to pay one euro more than the price of copper listed on the LME, while dishwashers are clearly differentiable.

|

|

|---|

Source: ExportPlanning elaborations.

As shown in the graphs, dispersion (represented by the red area) is higher for differentiable goods, such as dishwashers.

One could then think of considering dispersion as the sole indicator of differentiability; this could be misleading, as within such a complex market system inefficiencies are detected, which alter the law of single price. When certain circumstances occur, dispersion is no longer a discriminator between the two product categories, as it can be a symptom of market failures. So, it is necessary to know and try to identify such circumstances:

- Information asymmetries, i.e., a situation in which the parties have different information. In fact, it is possible that different buyers have different information about the price of a good and are therefore inclined to pay different prices. If consumers focus on a few bidders, or websites, they acquire different levels of information.

- Research costs, which can be very significant in the process of finding the lowest price. A buyer's desire to know all the prices charged in the market before implementing his or her purchase strategy is utopian and would require a significant expenditure of resources and time.

- Market concentration, as it increases, price dispersion also increases: increasing the number of sellers and increased competition reduces the ability of sellers to monopolize the market price, causing sellers to offer prices more similar to marginal cost. The size of price dispersion is thus negatively related to the number of sellers.

In addition to dispersion, further analysis may therefore be necessary, such as measuring the intensity of the correlation between high and low prices for a given product: even if a homogeneous good has price dispersion, it is possible that the fluctuations of low and high prices over time have the same pattern. Their link, measured precisely by the correlation, should therefore be stronger than in the case of a differentiable good, whose price differences are linked to the qualitative nature of the good rather than to a market inefficiency. Looking again at the two graphs seen above, it can be seen that while the fluctuations in the different price ranges are concordant in the case of the commodity, in the graph on the right it happens that in some periods an increase in the high end of prices corresponds to a decrease in the low end.

Conclusion

Before developing a strategy of differentiation on foreign markets, it is therefore fundamental to verify if the latter are able to appreciate this variety, recognizing a premium-price to the highest quality variety or to the ideal one. Price dispersion is certainly the first sign of this appreciation, but it must also be confirmed by the absence of a high correlation between the prices of the different quality ranges. This evaluation requires an accurate analysis of available information. If, in fact, differentiability evaluation may seems obvious in many consumer products, it is not so obvious in intermediate goods and components.

Lucrezia Fenudi, student of Economics and Economic Policy at the University of Bologna, is writing her master thesis in collaboration with StudiaBo srl, joining to her studies the analysis of ExportPlanning foreign trade data.