Household Products in 2021: a Record Year

The main sectors of the Home System did record a double-digit growth

Published by Marcello Antonioni. .

Check performance Conjuncture Home items Global economic trendsRecord year for worldwide sales of Household Products

2021 was a year of record performance as worldwide sales of Household Products1.

Indeed there was a very significant increase in exports worldwide, not only in terms of values (+ 18.5% in euros), but also in quantities (estimated growth of 14.6 percentage points).

In 2021 the growth phase that had characterized the sector in the second half of 2020 continued (and which had ensured the sector a closing of the year of the "Great Lockdown" with a slight increase compared to pre-pandemic levels: + 0.8% at constant prices). It should also be emphasized that 2020, though not particularly dynamic, did not show the downturns that instead characterized a large part of the industrial sectors.

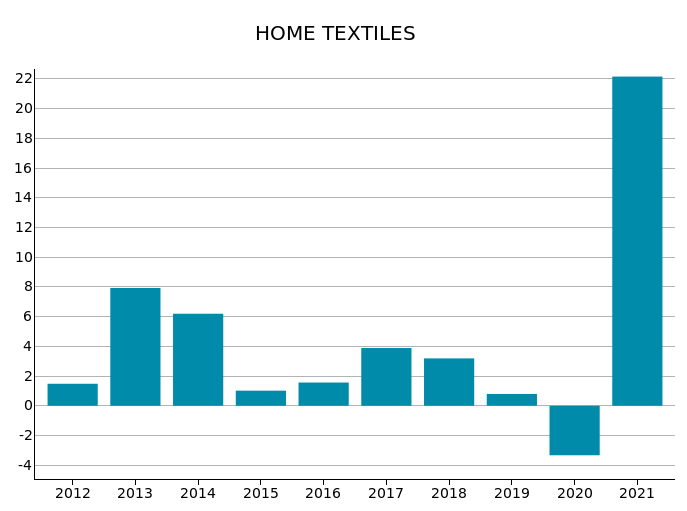

The graph below, which shows the evolution of world exports of Household products over the last ten years, testifies to the record year of household goods: there had never been such an intense increase, in a context of constant growth over the last decade.

Double-digit growth rates for world exports in quantity

all main sectors of the Home System

The generalized increases at sectoral level are also confirmation of the high liveliness in the consumption of Household Products. Indeed, all the main sectors of the Home System showed double-digit growth in world exports in quantities (except for the case of Glasses and tableware, whose growth stopped at +9.3%).

The most dynamic of all were the Pots and pans (with an increase in world exports of +24% in quantity compared to 2020) and Home textile (+22.2%).

Excellent performances also for the Lighting sector, with an increase close to 17 percentage points compared to 2020, and for the Cutlery sector (+14.9%).

There was also strong growth in the Consumer electronics (+12.8%) and Home appliances (+12.6%) sectors, only slightly more dynamic in the Furniture sector (+11.5%).

|

|

|

|

|

|

|

|

|

|

Source: ExportPlanning - Market Research - Analytics, "World Trade" Datamart

In 2021 double-digit growth rates

for almost all the main world exporters in the industry

As regards the competitors of Household Products at a global level, the picture shows generalized growth performances (two-digit rates of change for 2021/2020) for all the main exporters in the industry, with the exception of Germany and the United States (which, moreover, grew by just under + 10%).

Household Products: performance of the main world exporters

(% changes at constant prices)

| 2021/2020 | 2021/2019 | |

| China | +18.2 | +19.5 |

|---|---|---|

| Germany | +8.5 | +5.3 |

| Mexico | +12.4 | +10.1 |

| Vietnam | +11.9 | +39.7 |

| Poland | +10.4 | +16.7 |

| Italy | +15.8 | +8.4 |

| Netherlands | +15.7 | +12.1 |

| Turkey | +17.3 | +15.3 |

| United States | +8.6 | -9.1 |

| India | +37.5 | +23.7 |

Source: ExportPlanning processing on double declarations

India2 (+37.5% in quantities in the 2021/2020 variation) and, subsequently, China (+18.2%), Turkey (+17.3%), Italy (+15.8%) and the Netherlands (+15.7%) recorded the largest increases compared to 2020.

Analyzing the variations over the last two years, Vietnam 3 (+39.7% compared to 2019) and, subsequently, India (+23.7%), China (+19.5%), Poland (+16.7%) and Turkey (+15.3%) are the competitors with the best performances since the beginning of the pandemic.

On the other hand, United States4 (whose exports of Household Products remain significantly in negative territory compared to pre-pandemic levels) and, subsequently, Germany and Italy (penalized by the 2020 results) are the competitors with the relatively less favorable performances since the beginning of the pandemic.

Conclusions

The international demand outlook for Home System producers appears particularly favorable: the results of 2021 confirm a high dynamism of the sales of household products, widespread both at the sectoral level and at the level of the main competing countries (with the only notable exception of US firms).

The pandemic has certainly influenced the purchasing decisions of international consumers5, shifting the "search for beauty" from goods typically linked to the social space towards products whose use takes place within the domestic space, thus enhancing the Home System.

In this context, the ability to distinguish short-term changes from those that will have a permanent nature and that will accompany post-Covid life, and which will therefore be fundamental in the definition of an optimal strategy. For these reasons, the activity of monitoring up-to-date information on the markets, capable of capturing the structural changes that have occurred in demand, represents a activity with a high strategic value.

1) For a list of the sectors considered in this analysis, please refer to the following description.

2) In a context of generalized growth in all sectors, the greatest contributions to the growth of Indian exports came from the Home Textiles sector, followed by the Carpets, tapestries and wallpaper and Furniture.

3) In the case of Vietnam, Consumer electronics and Furniture are the sectors that have driven the growth of Vietnamese exports of Household Products over the last two years. In particular, note the strong growth performance recorded by Vietnamese exports in 2020 (with double-digit percentage increases), with gains in share on international markets.

4) US exports of Household Products were penalized above all by the drops recorded in 2020 in the Consumer electronics sector. The greatest positive contributions, although insufficient to rebalance the overall budget, came from the Home appliances sector.

5) See the article "Shifting Consumer Habits: from Fashion to Home&Furniture".