Further worsening of the US trade balance

Sulla base dei dati più recenti, nel periodo gennaio-marzo 2022 si è registrato un aumento del deficit commerciale USA

Published by Giulio Corazza. .

Conjuncture Trade balance United States of America Global economic trendsThe availability of ExportPlanning pre-estimates of U.S. foreign trade flows, accessible through the U.S. Conjuncture datamart, allows us to tell the story of the U.S. balance of trade in goods in light of the latest available information for the first quarter of 2022.

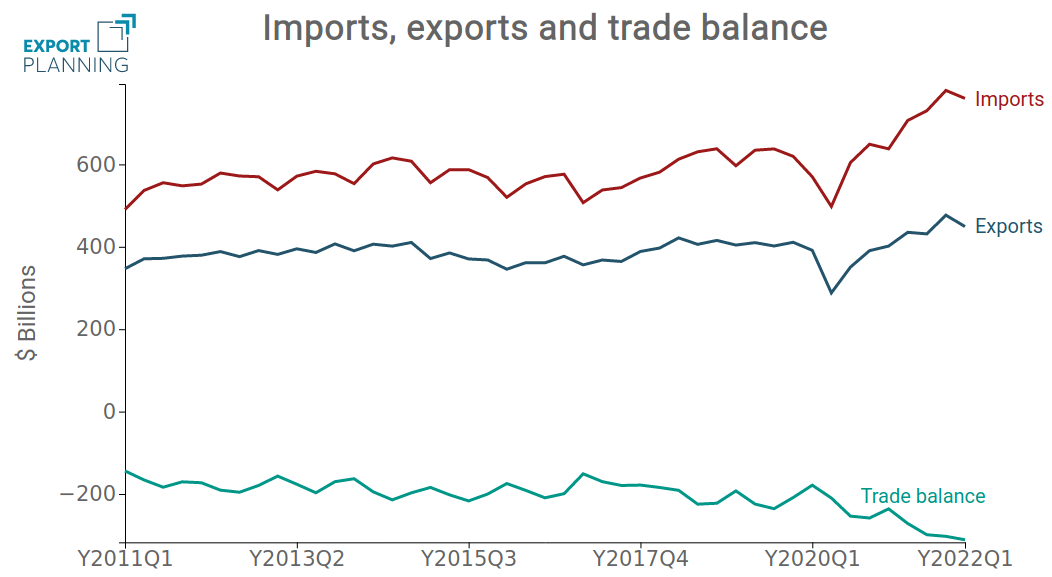

In the January-March 2022 period, there was a 19% increase in U.S. imports on a trend basis, which was accompanied by a more timid growth in exports, which increased 11.8% compared to the same quarter in 2021. This increase caused a further worsening of the US balance of trade in goods, which reached a negative value of 311 billion dollars in the last quarter. The following chart shows the quarterly time series of U.S. imports and exports, along with the associated trade balance.

Import, export e saldo bilancia commerciale (MLD $)

Fonte: Elaborazioni ExportPlanning

From the proposed graph, it is evident how the worsening of the US trade balance has reached one of the historically lowest values.

But towards which countries has the US trade balance worsened?

The following graph shows the US trade balance (expressed in Bn $), divided by the main partner countries. On the x-axis is the US trade balance as of the first quarter of 2021, while on the y-axis is the balance in the first quarter of 2022. In this way, it is possible to identify on the right of the bisector those countries towards which the US deficit has worsened during the last quarter; on the left we find those countries towards which the US trade position has improved during the last period.

Fonte: Elaborazioni ExportPlanning

In general, the proposed graph makes it possible to highlight how the worsening of the US balance has mainly affected the main Asian and NAFTA partners and has, on the other hand, remained relatively constant towards the countries of the European continent.

Naturally, the country towards which the United States presents the greatest deficit is China, towards which the American deficit has experienced a significant worsening in the last quarter: the trade balance has gone from -82 billion $ in the first quarter of 2021 to -108.6 billion $ in the same period of 2022.

It may be interesting to observe which sectors have led to this worsening of the deficit towards China. In fact, with the gradual loosening of tariffs on Chinese products, there has been a widening of the trade deficit in sectors that were already in deficit: these are, above all, the personal items segment, which rose from -3.8 billion $ to -5.66 billion $, and the communications equipment segment, which went from -12.92 billion $ to -14.53 billion $.

Particularly significant is also the case of the pharmaceutical sector, for which the US position has gone from being a net exporter to being a net importer: the pharmaceutical sector has in fact gone from a surplus of +1.39 billion $ to having a trade deficit of -1.94 billion dollars. Specifically driving the result were U.S. imports of diagnostic reagents and sera for testing activities related to pandemic management.

Large increases in the deficit are also registered towards other Asian countries such as Japan and South Korea. In the case of Japan, of particular interest is the fact that among the sectors that have caused a worsening of the American trade position is that of machinery for the manufacture of semiconductors, which goes from a deficit of -0.1 billion $ to a deficit of -0.7 billion dollars.

A second group of countries toward which the United States has widened its trade deficit are the North American Free Trade Agreement (NAFTA) economies, especially Canada, with its deficit rising from -9.9 Bn $ in the first quarter of 2021 to -24.5 Bn $ in the first quarter of 2022, even as nominal increases in commodity prices are reported.

Indeed, among the sectors responsible for this deterioration is energy commodities, with the deficit rising from -$15.9 billion to -$28.4 billion.

Equally important, but to a lesser extent, is the precious metals sector, which went from having a surplus of 1.1 billion $ to having a deficit of -0.8 billion $, and aluminum, which went from a deficit of -1.3 billion $ to a deficit of -1.9 billion $.

In general, for European countries such as Germany and Italy, the US deficit has remained almost unchanged.

A special case, however, is the deficit to France, which improved from -5.5 billion $ to -3.1 billion $ between the first quarter of 2021 and the same period in 2022.

At the sector level, there is an increase in the surplus of energy commodities from $0.8 billion to $2.4 billion.

The aircraft sector sees its deficit decrease from -$1.7 billion to -$0.7 billion while the jewelry sector moves from a deficit of -$0.2 billion to a surplus of $0.1 billion.