Paper converting and converting machines: the opportunities of international markets in a phase of "structural" acceleration

A couple of cases of high potential markets for sector exporters

Published by Marcello Antonioni. .

Asia Planning Industrial equipment International marketing Uncertainty Marketselection Slowdown United States of America Foreign markets Export markets Foreign market analysisThe paper and converting industry

The packaging and other paper and graphic-related products industry continues to show a high level of dynamism at international level in the values denominated in euros: the most recent ExportPlanning data, relating to world trade in the first 9 months of 2022, attest to a cumulative trend growth in world exports of this upcoming industry 27 per cent in euro values.

However, given the strong cost increases along the paper supply chain in the last year and a half1, the world export dynamics of the paper and converting industry reduces to a cumulative year-over-year growth of "just" 3.3 percentage points when measured at constant prices. This is therefore a performance which, although positive, appears to have slowed down in the most recent period: from +6.3% in the last quarter of 2021, the pace of growth in world exports of this industry has gradually slowed down over the last 9 months, up to +1.7% in the third quarter of 2022.

In a context of slowdown in the downstream industry, the upstream sector of paper- and converting-machines is likely to suffer particularly from the effects of uncertainty

Paper- and converting-machines

In the first 9 months of 2022 the world export of paper- and converting-machines showed a cumulative Y-o-Y change in the values denominated in euros of almost 10 percentage points, which however becomes negative sign if measured at constant prices: -1.4 per cent. In particular, after two substantially "flat" quarters, in the most recent quarter world exports of paper- and converting-machines marked a Y-o-Y contraction of about 4 percentage points in measurement at constant prices.

Accelerating Markets

For manufacturers of machinery for the graphics-paper and converting industry, it appears essential, in this phase of increased uncertainty in the demand framework, to be able to grasp the acceleration phase of imports of a given market , as recently documented, for example, in the article "Textile Machinery: Foreign market Opportunities undergoing 'structural' Acceleration", with reference to another sector (textile machinery) of the machinery industry in a slowdown phase.

Paper-machines: the case of the Indian market

A first case of sure interest for the exporters of the sector, with particular reference to the segment of paper-machines, is the Indian market.

This is a market that is characterized by an undoubted phase of acceleration: after a rather long phase of "latency", in just 6 years (from 2015 to 2021) Indian imports of paper converting machines have more than doubled their values, from less than € 28 million in 2015 to around 60 million in 2021.

The development of the demand for imports of paper converting machines on the Indian market can be traced back to the simultaneous development of a local production of downstream industry products: as the two graphs below document, Indian production of paper-related products2 went from values below 150 million euros at the end of the first decade of the century to over 900 million euros in 2019, only to be affected - at least partially - by the pandemic crisis. Similarly, the Indian production of tissue products3, although smaller in size, went from values well below 50 million euros at the end of the first decade of the century to over last year the 200 million euros.

India: production of paper-related industry

Source: ExportPlanning-Country Data Datamart

Converting-machines: the case of the US market

Another case of great interest for exporters in the sector, with particular reference to the converting-machines segment, is the US market.

This is a market that is characterized by an undoubted phase of acceleration: after a rather long phase of "latency", in just 7 years (from 2014 to 2021) US imports of converting machines have grown by 170 percent, exceeding the threshold of 1.2 billion euros last year.

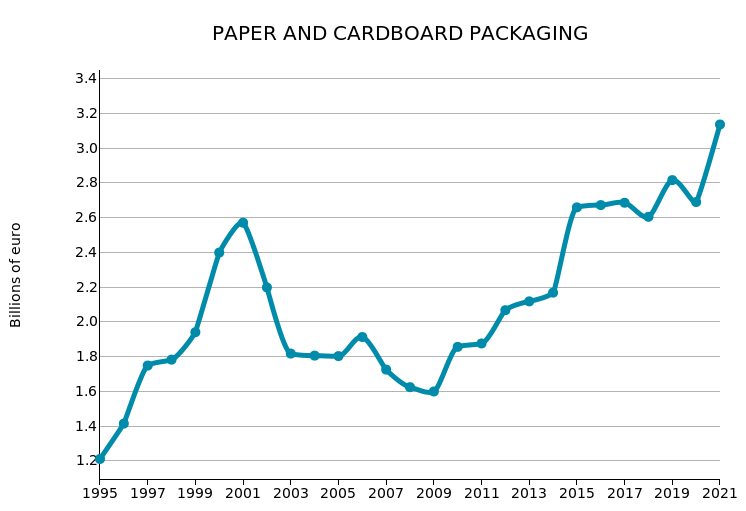

The development of the demand for imports of converting machines in the US market is attributable to the simultaneous development of a local production of downstream industry products: as documented by the two graphs below, the US production of paper and cardboard packaging4 went from values of less than 1.6 billion euros at the end of the first decade of the century to over 3.1 billion euros last year. Similarly, US production of flexible packaging5 went from below € 10 billion at the end of the first decade of the century to over € 17 billion last year. euro.

United States: production of packaging industry

Source: ExportPlanning-Country Data Datamart

Conclusions

In a context of slowing international demand for paper converting and converting machines, it appears essential for the sector's exporters to be able to identify those markets that are going through a "structurally" accelerating phase in the dynamics of imports of products in the sector.

Through the ExportPlanning's Market Selection tool, it is possible for a company to identify the accelerating international markets in its business area (marked by the customs code or by specific aggregates of codes).

1) According to the data available on the PricePedia platform, the average prices in the values in euro of the Wood-Paper supply chain reached an absolute maximum point in September 2022, corresponding to a record increase of over 20 percentage points compared to twelve months earlier and of 76 percent if measured compared to the 2020 average.

2) The following items are included in the definition of paper-related products:

- Wallpapers

- Envelopes of paper or paperboard

- Envelopes of paper and cardboard for offices and shops

- Registers, account books

- Notebooks

- Binders

- Blocks and booklets for multiple copies

- Drums, Bobbins

- Filter paper and paperboard filter, in strips or rolls

- Paper with diagrams to chart recorders in rolls of a width <= 36 cm

- Articles of paper obtained by pressing

- Other paper and paperboard for writing.

- Toilet paper in rolls of a width <= 36 cm

- Handkerchiefs

- Tablecloths and serviettes

- Sanitary towels and tampons

- Trays, dishes, bamboo

- Trays, dishes, paper cups

- Wadding, other articles of wadding.

- Boxes of paper or corrugated cardboard

- Cartons, boxes and folding, non-corrugated paper or paperboard

- Paper Sacks.

- Plates, sheets, film, foil and strip, of non-cellular polymers of ethylene

- Plates, sheets, film, foil and strip, of polymers of propylene, non-cellular

- Plates, sheets, film, foil and strip, of non-cellular polyethylene terephthalate

- Plates, sheets, film resins, non-cellular

- Plates, sheets, film of polyurethanes

- Plates, sheets, films of polyesters, non-cellular

- Plastic bags (other than ethylene)

- Paper and cardboard, colored, surface-decorated or printed, coated

- Paper, paperboard, cellulose wadding and webs of cellulose fibers

- Foil of aluminum, of a thickness not exceeding 0.2 mm.