World Export of Capital Goods for Industry Holding in Q4 2022

Is the world industry betting on a mild and short recession?

Published by Marcello Antonioni. .

Industrial equipment High-tech Uncertainty Conjuncture Slowdown Global economic trendsAfter the significant deceleration of the pace of development of worldwide exports of capital goods for industry1 which occurred in the first part of 2022, the last quarter of last year showed a substantial stability at constant prices2.

As shown in the graph below, according to the most recent data available in the ExportPlanning Information System , in the period October-December 2022 world exports - measured at constant prices - of capital goods for industry (instruments and equipment, machinery and plants, plant engineering) achieved - after two negative quarters - a result of moderate trend growth ( +1.4% compared to the corresponding quarter of 2021).

Overall, in the pre-final balance of 2022 world exports of capital goods for industry measured at constant prices recorded a - albeit timid - growth (+0.3%), however in a clear deceleration compared to +13.3% of the 2021 average.

World exports of capital goods for industry

Year-over-Year changes at constant prices

Source: Export Planning Processing

The 4th quarter of 2022 showed

widespread signs of stability for world exports

of tools and equipment,

machinery and plant engineering

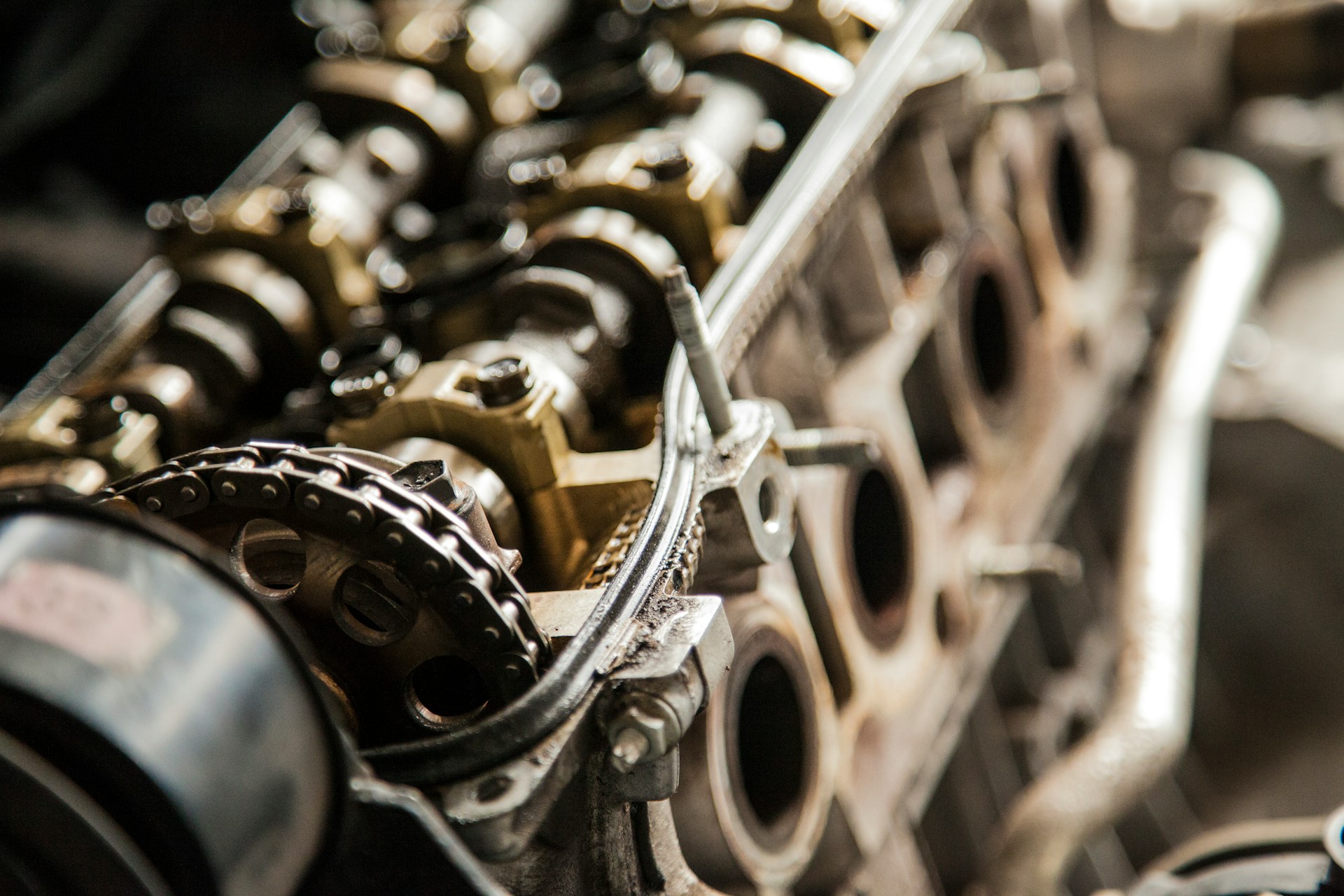

Industrial Tools and Equipment

After achieving double-digit growth on average in 2021 (+10.9% at constant prices), world exports of tools and equipment for industry showed a sharp deceleration in the first part of 2022 (with a sign negative in the second quarter of the year), but also signaling an unexpected resilience in the fourth quarter of the year (+1.3% at constant prices).

In particular, in the most recent period, world exports of measuring instruments and, above all, pumps and filters and lifting and handling equipment. Conversely, worldwide sales of tools and moulds and, above all, electromechanical instruments.

Machinery

After a record-breaking 2021, with an increase of +18.2% at constant prices, world exports of machinery and plants for industry recorded trend declines in the second and third quarters of 2022, only to regain the "plus" sign " in the last quarter of the year (albeit with minimal growth).

In particular, in the fourth quarter of 2022 the growth trend of world sales of paper mill machinery, food machinery, metalworking machinery, extrusion machines and other special purpose machines.

Of on the other hand, the "minus" signs are seen for the world exports of machine tools for metalworking, machine tools for hard materials, textile machinery, printing and publishing machinery and, to a lesser extent, packaging machinery.

Industrial Plants

After 2021 with an average annual growth of +10.2% at constant prices, world exports of industrial plant engineering marked a sharp slowdown during 2022 (although remaining constantly in negative territory), closing the year with a performance of moderate growth (+2.3% at constant prices on average in 2022) and timidly accelerating in the most recent period (+3.2%).

In particular, in the last quarter of 2022 we note the significant growth trend at constant prices of world sales of heat exchangers, boilers, turbines and engines and, to a lesser extent, of automatic regulating devices, against - instead - signs "minus" for the world export of valves and pressure reducers.

Conclusions

Although there has been a significant slowdown in world trade (as documented in the recent article "Pre-consensus 2022: cyclical point on global demand for goods", From this data it would seem that a industrial investment cycle holding up.

A first hypothesis is that the sign of stability found in the last quarter of last year actually reflects more of a time lag between orders and deliveries, i.e. that these the last ones (detected by customs flows) are deliveries of "old" orders, decided some time ago.

However, there is a second hypothesis, decidedly more encouraging, which contemplates the fact that the global manufacturing system believes that the recession forecast for the coming months in some of the main western economies may be small and above all transitory, such as not to lead to a downward revision of the demand for capital goods for industry.

In this sense, the upward trend of financial prices of metals6, which have been underway for three months now, would seem to corroborate this last hypothesis, at least with reference to the financial community.

To evaluate which of the two hypotheses is the most correct in interpreting the expected development dynamics of the world demand for capital goods for industry, the data relating to the first months of the year will be fundamental, which the ExportPlanning Information System will be able to make it available in the coming weeks.

1) A Quantity at constant prices (Q) measure has been constructed in the World Trade Datamart of the ExportPlanning Information System. This measure includes a deflation operation, in which the historical series of monetary values (V) has been transformed into a similar series of values expressed at constant prices, with a reference to a specific year, known as the base year. For a description of the applied methodology, please refer to Conjuncture of International Trade: Methodological note.

2) The aggregate considered includes the following industries: equipment and tools for industry, machinery and systems for industrial processes, industrial plant engineering.

3) For a description of the products included therein, see the relative sector profile.

4) For a description of the products included therein, see the relative sector profile.

5) For a description of the products included therein, see the relative sector profile.

6) In this regard, see the information on the PricePedia platform and in particular the recent article "In three months, dollar metal prices have risen nearly 25 percent".