The future of EVs: challenges and opportunities for the European Union

Published by Alba Di Rosa. .

Export Asia Competitor analysis Europe Automotive High-tech Uncertainty United States of America Foreign markets AutomotiveWith the February 2023 decision by the EU parliament to ban the registration of new cars and light vehicles with combustion engines (gasoline and diesel) from 2035, the EU took an important step along the energy transition path. The agreement was subsequently adopted by the European Council in March 2023 and entered into force the following month.

This decision has come into the crosshairs of several industry analysts, as it is considered dangerous in terms of the competitiveness of the European automotive industry. Consider, for example, the words of Luca De Meo, president of ACEA (European Automobile Manufacturers' Association) as well as CEO of the Renault Group, who pointed out that the farewell to heat engines could present multiple risks for Europe, including on the employment front. For heat-engine vehicles, the European automotive industry holds in fact an undoubted competitive advantage over the Chinese industry; conversely, in the Electric Vehicles (EV) sector, the European industry is considered much weaker than the Chinese industry, both because of the lesser expertise accumulated on the product volume side and because of the weakness of the supply chain of components specialized in EVs.

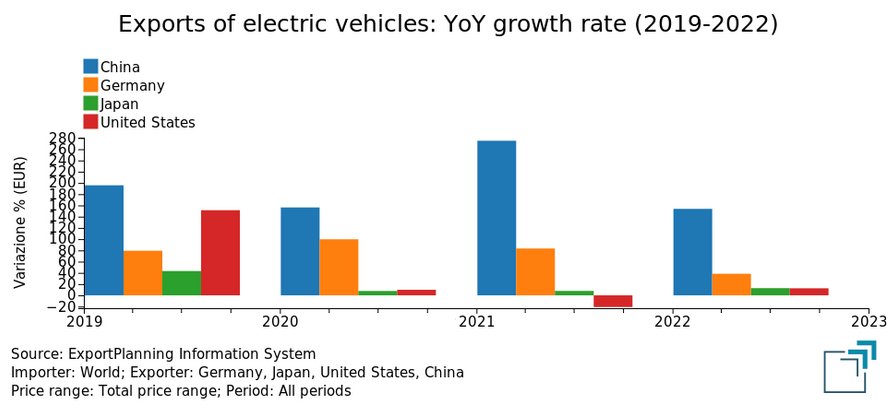

The export growth rate of the major players clearly shows the presence of different trends: in fact, as can be seen from the graph below, China's electric car exports have shown a consistently higher growth trend in recent years compared to the other industry leaders.

The world of electric cars: the new role of China

One of the most established theories in industrial economics concerns the learning curve of an industry in a given country. This curve suggests that, as the cumulative output of a product increases, the unit costs of production tend to decrease. The logic behind this phenomenon is that firms become more efficient in producing a product as they accumulate more experience in its manufacture, due to:

- operational efficiencies: with experience, companies can improve their processes, reducing waste and optimizing resources;

- labor specialization: as production increases, workers become more specialized in their specific tasks;

- technological innovations: companies can invest in research and development to find better and more efficient ways to produce the product;

- economies of scale: as the scale of production widens, firms can produce at progressively lower costs.

A measure of China's accumulated competitive advantage over Europe on the electric front can be obtained from the amount of vehicles produced. According to EV Volumes data, global production of electric vehicles between 2021 and 2022 grew by more than 60 percent, from 6.3 million to 10.3 million; China, for its part, went from covering 19 percent of production in 2021, to 32 percent in 2022.

The Asian country also dominates the sales front, as shown by data from the International Energy Agency (IEA): sales of electric cars in China in 2022 were close to 6 million (up 82 percent from the previous year), compared with nearly 2 million in the EU (up 15 percent) and nearly 1 million in the US (up 55 percent).

China, Europe and the US represent the three largest markets for electric cars, collectively covering about 95 percent of global sales in 2022. The three areas differ, however, in the market share currently held by EVs in total domestic car sales, which is 29 percent in China, more than 20 percent in Europe, and 8 percent in the United States (2022).

Let's not forget that the success of EVs in the Chinese market is also linked to a significant policy of incentives, which have been in place for more than a decade and carried on longer than initially planned; these have been complemented by non-financial support, such as the rapid introduction of charging infrastructure and strict registration policies for non-electric cars (source: IEA).

In this context, the European automotive industry is thus faced with an increasingly competitive EV market, in the face of the entry, starting in 2020, of new competitors mainly from China, which offer cheaper alternatives and risk penalizing the performance of European manufacturers, both in the domestic and international markets.

An element that undoubtedly plays in the Chinese industry's favor is the high level of vertical integration of battery and electric vehicle supply chains - from mineral processing to battery and vehicle production - as well as the presence of lower labor, production and financing costs. Outside of China, the need is thus emerging for the EU as well as the US to build in turn an adequate and competitive supply chain that can optimize costs and reduce dependence on the Asian giant, which plays a leading role in the trade of batteries and components for electric vehicles.

The EU industry: a weak production chain

The production of an electric vehicle requires specific components compared to those assembled for an internal combustion vehicle. A non-exhaustive list of the main specific components of an EV is reported as follows:

- electric motor;

- storage battery;

- electric charging system;

- speed controller instead of mechanical transmission system;

- regenerative braking system, to recover energy during braking.

An electric vehicle also does not have the need for exhaust systems and cooling systems1, for which the European industry has a significant competitive advantage.

Specifically, let us analyze the supply system of storage batteries.

At present, the most common batteries in electric cars, but also widely used for electronic devices and industrial applications, are lithium-ion batteries due to their high energy density relative to their weight. In 2022, lithium production was almost completely concentrated in four countries: Australia (61000 tons), Chile (38921 tons), China (19000 tons), and Argentina (6378 tons); on the other hand, lithium battery production is mainly concentrated in Asia.

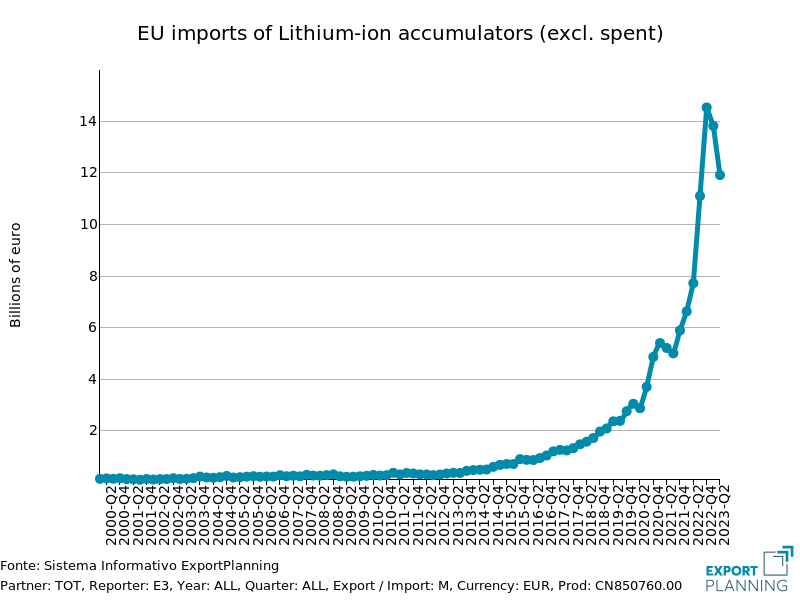

As you can see from the chart, European imports of accumulators have shown marked growth in recent years, approaching €40 billion in 2022; of this, 17.6 billion came from China.

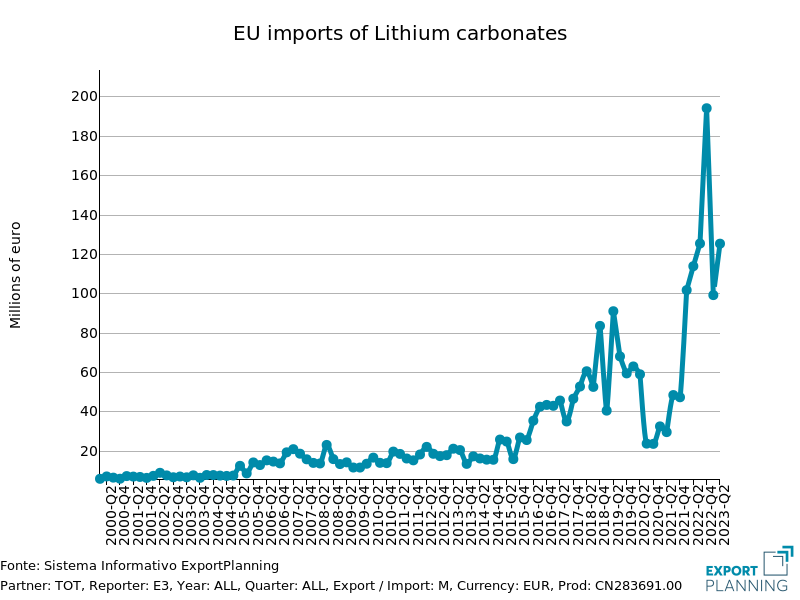

Lithium oxide and lithium carbonate, in particular, are used for battery production. Still looking at EU imports, in 2022 oxide and hydroxide came mainly from the US (€73 million), followed by China (€43 million), while nearly €270 million of lithium carbonate was imported from Chile.

|

|

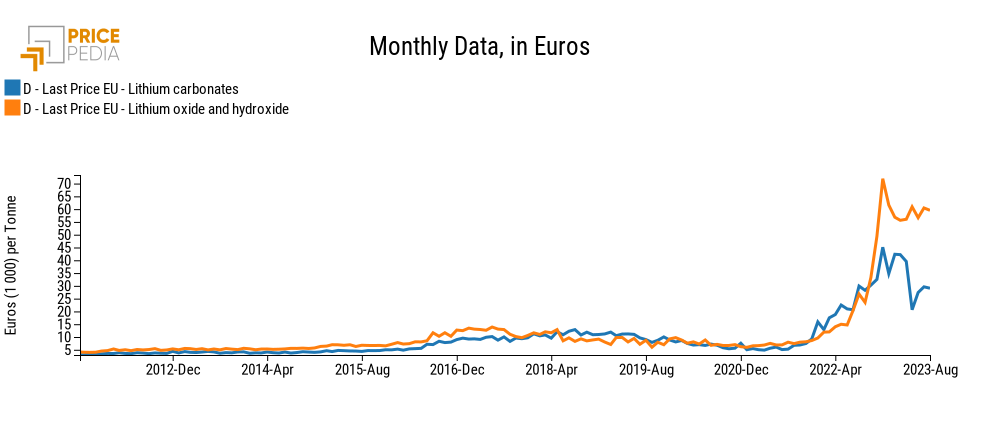

In tandem with the increase in demand, the prices of these goods have also clearly risen in recent years: as the chart below shows, EU customs prices peaked in December 2022 and then only partially retraced in 2023.

The policy response

The battery value chain in Europe thus retains a strong dependence on supplies from outside the EU. In the face of the significant changes taking place in the transportation industry, not only the EU but also, for example, the United States, are gradually perceiving the growing need to put in place initiatives that can stimulate domestic manufacturing and ensure the supply of critical minerals.

It is, for example, in March 2023 that the European Commission proposed the Net-Zero Industry Act, which "will help strengthen the European manufacturing capacity of net-zero technologies and overcome barriers to scaling up the manufacturing capacity in Europe. The measures in the Regulation will increase the competitiveness of the net-zero technology industrial base and improve the EU’s energy resilience". The goal is thus to promote "investments in the production capacity of products that are key in meeting the EU’s climate neutrality goals".

Among the technologies whose development the Union aims to promote we can find, for example, photovoltaics, renewable energy and, certainly, batteries. The goal is to increase the manufacturing capacity of net-zero technologies to cover, by 2030, at least 40 percent of domestic need, creating conditions that can facilitate manufacturing investment in these sectors. For the specific battery sector, the goal is even more ambitious, aiming for 90 percent domestic production by 2030.

There are, therefore, clear growth prospects for the sector, according to experts. Risk factors, however, inevitably remain on the scene, and the coming years will reveal the actual chances of success of an ambitious project.

1. Although electric vehicles themselves require cooling systems, these are often less complex than those of internal combustion engine vehicles.