The differentiated profile of recovery: a Geographical Analysis

China and the United States lead the recovery

Published by Marzia Moccia. .

Uncertainty Foreign markets Conjuncture Global economic trends

The first months of the new year have brought signals of cautious optimism for the gradual - albeit still moderate - recovery of the global manufacturing industry, which has been reflected in the dynamics of international goods trade. For the first time since the end of 2022, the global PMI has returned close to the neutral threshold of 50, following a progressive improvement starting from the last months of 2023 (see the article First Quarter 2024: Global Trade Outlook).

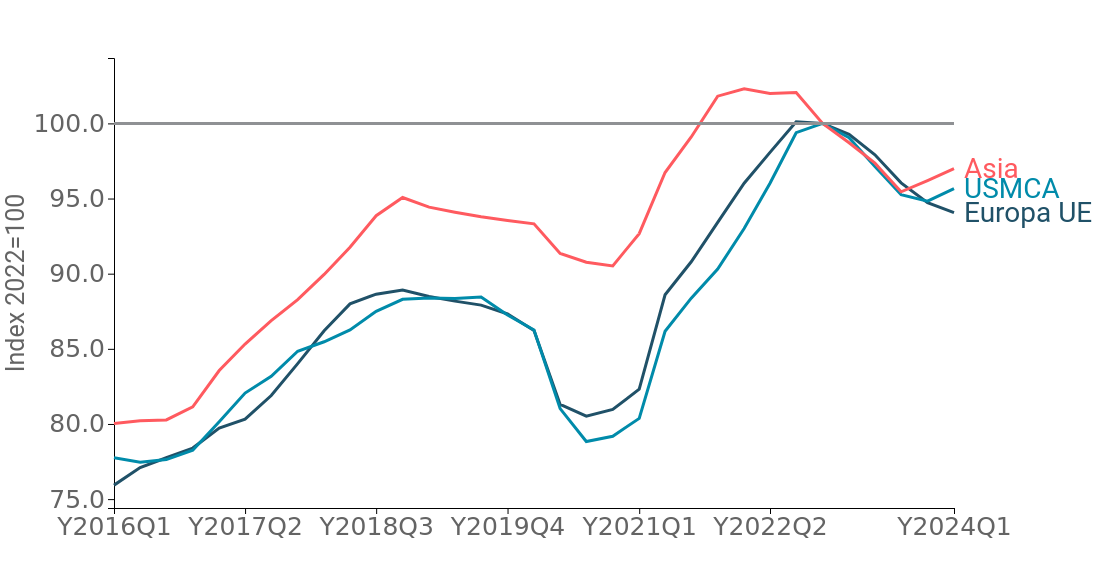

However, these signals are not homogeneous, in terms of intensity and trend, across different regions of the world. In particular, focusing on the front of global goods trade, the following graphs depict the dynamics at constant prices - that is, in quantity - of imports from the major trading areas: USMCA (North America), Asia, and EU Europe, with the value of 100 in 2022, the last year of trade growth.

Fig.1 - North America vs EU Europe vs Asia: Dynamics of Imports from the World

(imports at constant prices, annual cumulative, index 2022=100)

Source: ExportPlanning

After a 2023 characterized by a progressive reduction in demand for all three areas, anticipated by Asia due to Chinese challenges, the most interesting aspect concerns the different dynamics that are characterizing the North American (USMCA) and Asian areas compared to EU Europe in recent months. While the former two are marking a reversal of trend for the first time, the same cannot be said for the European Union.

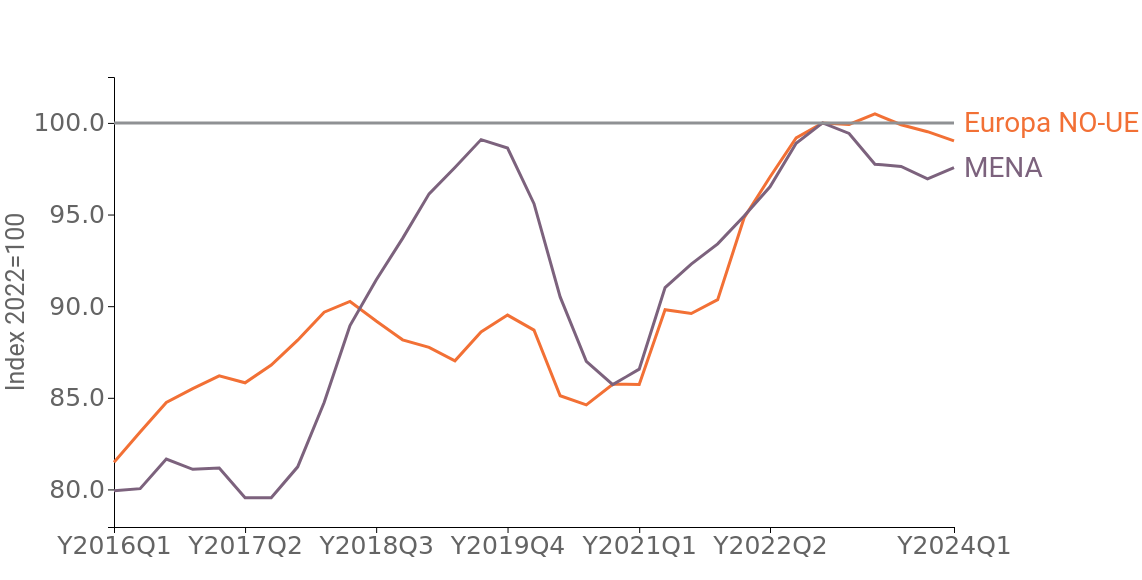

Signs of timid recovery are also coming from the MENA region, although it is the only division among those under analysis to settle on values slightly lower than those of 2019.

In significant contrast is the considerable resilience of imports from Non-EU Europe, which experienced much less pronounced weakness compared to the previous areas during 2023.

Fig.2 - Non-EU Europe vs MENA: Dynamics of Imports from the World

(imports at constant prices, annual cumulative, index 2022=100)

Source: ExportPlanning

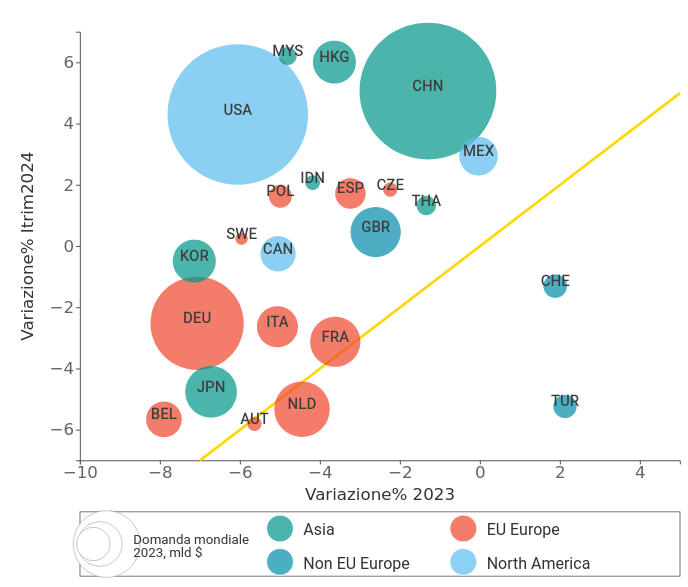

Also particularly informative is the breakdown of these aggregated trends in relation to the major markets.

The following bubble map positions the world's major economies based on the rates of change in imports of goods at constant prices recorded in 2023 (X-axis) and in the first quarter of 2024 (Y-axis). Imports are measured at constant prices to provide an understanding of real dynamics, net of price variations.

The yellow line represents the bisector, allowing the identification of two different areas: above it, countries experiencing a gradual recovery compared to the average trend in 2023, while below it, those intensifying the slowdown.

Fig.3 - Map of the World's Major Importers at Constant Prices

Source: ExportPlanning

The first aspect to underline is how the gradual recovery is a phenomenon affecting various international economies, but with varying intensity. It is indeed led by the United States for the North American region and by China for the Asian region, amidst greater weakness characterizing European importers. However, noteworthy are the counter-trend performances of Poland, Czech Republic, and Spain.

Expanding the analysis horizon to the "Old Continent," the resilience characterizing Non-EU Europe in 2023 can be traced in the market trends of the United Kingdom, Turkey, and Switzerland, although for the latter two markets, weaker trends were recorded in the first quarter of the new year.

Among emerging economies, the rebound of Malaysia and other ASEAN economies such as Thailand and Indonesia appears particularly significant in Asia, while in the Americas, import growth continues for Mexico, following the substantial resilience recorded in 2023.

Conclusions

In the current international economic environment, the noticeable signs of recovery constitute good news, albeit to be interpreted cautiously. Currently, the recovery seems to mainly characterize the Asian and North American regions, contrasting with a still struggling Europe. The relative dispersion, both geographically and sectorally, of cyclical dynamics suggests to exporting companies a careful analysis of the potential expressed by different foreign markets. Information represents, now more than ever, an important strategic lever to guide efforts towards the most promising markets.