US demand for capital goods: signs of strengthening in Q2 2024, but with sectoral differences

In the most recent quarter, the trend growth of US imports in the sector rose to +9% in euro values

Published by Marcello Antonioni. .

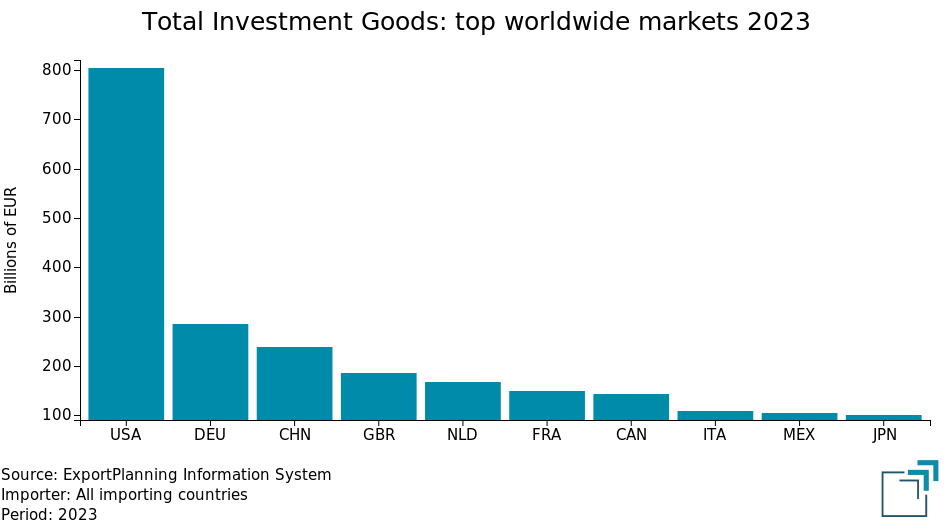

Check performance Metal industry Industrial equipment Automotive Conjuncture United States of America Global economic trendsSecond quarter 2024 US foreign trade data, available in the US Trade Datamart, highlight a strengthening of demand for investment goods1 for what is largely the main market global market of the sector: in the most recent period, US imports of the sector grew by approximately 9 percentage points compared to the corresponding period of 2023, a significant acceleration compared to the first quarter of the year (+3.4% trend) and, even more so, to the 2023 average (-0.2%)2.

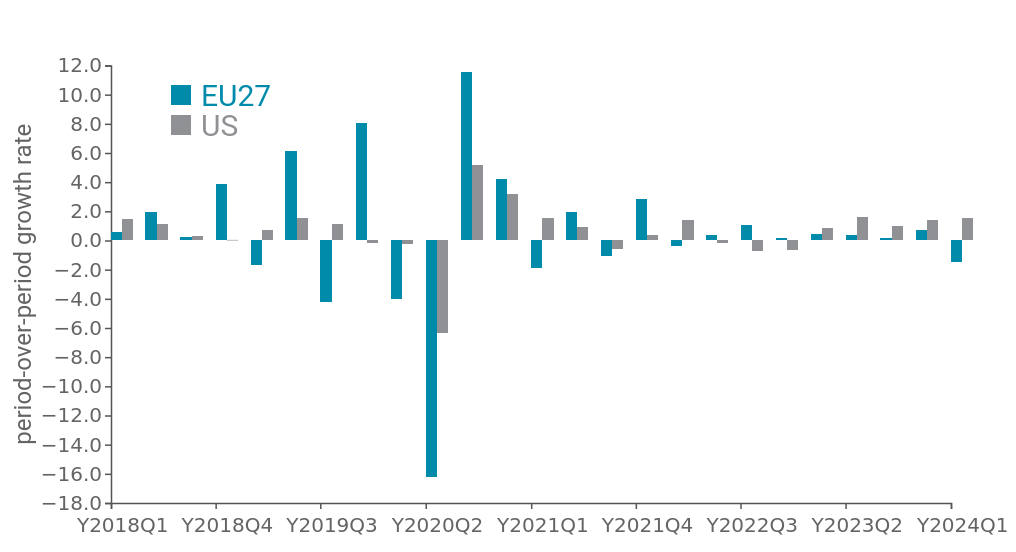

The acceleration phase in the most recent quarter of U.S. demand for imports of capital goods confirms the better investment cycle of the U.S. market than that of the EU area. The chart below shows the Gross Fixed Capital Investments component of GDP for USA and EU27: in contrast to the EU economy (which recorded a negative q-o-q trend in Q1-2024), for the U.S. economy it has been growing for five consecutive quarters (albeit at a pace that is not particularly accelerated, also discounting the effects of restrictive monetary policy and a framework of political uncertainty).

Gross fixed capital investments: quarterly trends in US and EU-27 economies

Source: OECD data

The gradual, albeit still sluggish, recovery in U.S. Gross Fixed Investments also appears to be broadly differentiated: in positive territory is the buildings, land and intellectual property acquisition component, while the conjuncture regarding investment in industrial equipment and machinery is still weaker.

This complex picture is reflected in a U.S. demand for foreign capital goods that conceals a picture of lights and shadows, with uneven evidence of restart for different segments.

Confirmations of double-digit growth trends for the automotive sector, significant accelerations for tools and equipment for ICT and services electrotechnical- and mechanical-engineering; improvements also for tools and equipment for industry

The second quarter of the year saw confirmation of the highly dynamic demand for US imports of automotive: +10.6% in euro values compared to the corresponding period of 2023, consolidating the trend result of the first quarter of the year.

We also note the strengthening of the US demand framework for electrotechnical engineering (+6.9% in values in euros compared to the corresponding period 2023, gaining over 6 percentage points compared to the previous quarter), mechanical engineering (+8.7% in the most recent quarter, gaining over 6 percentage points compared to the first quarter of year) and, above all, tools and equipment for ICT and services (+12%, by over 14 points percentages more dynamic than the previous quarter).

Furthermore, US demand for tools and equipment for industry was confirmed to be moderately growing (and clearly improving compared to 2023), with imports growing by 5.3 percentage points in euro values, slightly more dynamic than the most recent quarter.

U.S. Imports by capital goods sector

(% Year-over-Year in Euro)

| 2023 | Q1-2024 | Q2-2024 | H1-2024 | |

| Electrotechnical Engineering | -1.3 | +0.7 | +6.9 | +3.8 |

|---|---|---|---|---|

| Tools and Equipment for ICT and services | -14.6 | -2.3 | +12.0 | +4.8 |

| Tools and Equipment for industry | -5.7 | +4.8 | +5.3 | +5.1 |

| Automotive | +18.8 | +10.5 | +10.6 | +10.5 |

| Earth-moving Machinery | +27.7 | -8.8 | -2.1 | -5.4 |

| Agricultural Machinery | -9.0 | -8.8 | -7.8 | -8.3 |

| Industrial Machinery | +1.5 | +9.0 | +0.7 | +4.6 |

| Mechanical Engineering | +1.1 | +2.6 | +8.7 | +5.6 |

| TOTAL Investment Goods | -0.2 | +3.4 | +8.9 | +6.2 |

Source: ExportPlanning - Data - Quarterly Trade Data, US Trade Datamart

On the other hand, still "minus" signs for agricultural machinery and earthmoving machinery, and slowing down performances for industrial machinery

Despite an improvement compared to the previous quarter, US imports of earthmoving machinery continued to remain in negative territory (-2.1% year-over-year, in euro values) and, above all, of agricultural machinery (-7.8%). However, these are different cases: in the first case it is a worsening compared to 2023 which - on average for the year - had recorded particularly favorable results (+27.7% compared to 2022); in the second case, however, the negative dynamic already highlighted last year is confirmed (-9% on average for 2023).

In the second quarter of the year, there was also a slowdown in performance again (after the acceleration in the first quarter) of US imports of industrial machinery: although confirming itself in positive territory (+0.7% in euro values), US imports of the sector report a loss of over 8 percentage points compared to the quarter previous year (thus returning to the same pace as last year's average).

In particular, the sharp decline in imports of semiconductor manufacturing machines (-23.3) contributed to penalizing the overall performance of the machinery sector. % in euro values, after +6.6% in the previous quarter), printing machines (-24.2%, after +12.9% of the previous quarter) and, to a lesser extent, of paper-making machines (-14%, also repeating the decline of the previous quarter ).

On the other hand, the food machines segments maintain significantly positive growth rates (+11.5% trend in euro values, confirming the favorable dynamics of the first quarter4), packaging machines (+8.8%) and metalworking machines (+8.2%, also decelerating compared to the previous quarter).

Conclusions

After 2023 which showed overall weak dynamics in US demand for investment goods, the first part of 2024 highlighted a progressive strengthening of the economic context.

In particular, most of the sectors considered recorded a second quarter with positive year-over-year performances (above all: automotive), and an overall acceleration. However, there is no shortage of results that go against the trend, as in the cases of agricultural machinery, earth-moving machinery and various segments of the industrial machinery sector.

Given the importance of the US market for the demand for investment goods, it becomes essential for exporting companies in the sector to be able to monitor the evolution of market imports, both at an overall level and for each individual American State5.

1) The aggregate considered refers to the following sectors: Electrotechnical Engineering, Industrial Machinery, Tools and Equipment for industry, Tools and Equipment for ICT and services, Mechanical Engineering, Automotive, Earth-moving Machinery and Agricultural Machinery.

2) Even when measured in dollar values, the ongoing acceleration phase is confirmed: in the second quarter of the year, US imports of investment goods recorded a year-over-year growth of +7.7% in $, after +4.7% in previous quarter and after +2.9% of the average 2023.

3) The GDP component of Gross Fixed Capital Formation represents the acquisitions (net of disposals) of fixed assets made by resident producers to which increases in the value of non-produced tangible assets are added. The variable considered includes, in particular, the following assets: buildings, land, equipment and machinery, software, and vehicles.

4) See the further information contained in the article "Food Machines: United States continues to be the leading market. Which states are driving the growth?" .

5) In the Quarterly Trade of American States Datamart there are quarterly foreign trade data of the American states are available, broken down by partner countries, at a product-/sector-/industry- level.