U.S. Trade Conjuncture: The Recovery Continues

In the second quarter of 2024, American demand confirmed the positive signals already recorded in the first quarter

Published by Simone Zambelli. .

United States of America Industries Import Conjuncture Global economic trends

The preliminary estimates for the second quarter of 2024, developed by StudiaBo based on data from the US Census Bureau - and available in ExportPlanning in the Datamart Conjuncture USA - allow us to analyze the cyclical dynamics of the United States' international trade during this transition period from the slowdown that characterized 2023 to the early signs of economic recovery that emerged in the first months of 2024.

As mentioned in the previous article “U.S. Foreign Trade Outlook: Recovery on the Horizon for American Demand?”, American imports started the new year returning to positive territory (+2.9% on a quarterly basis), after more than four consecutive quarters of decline.

The preliminary estimates for the second quarter consolidate this trend: in the period from March to June 2023, American demand for foreign goods maintained a positive growth trend, registering +6.5% compared to the same period last year in dollar values.

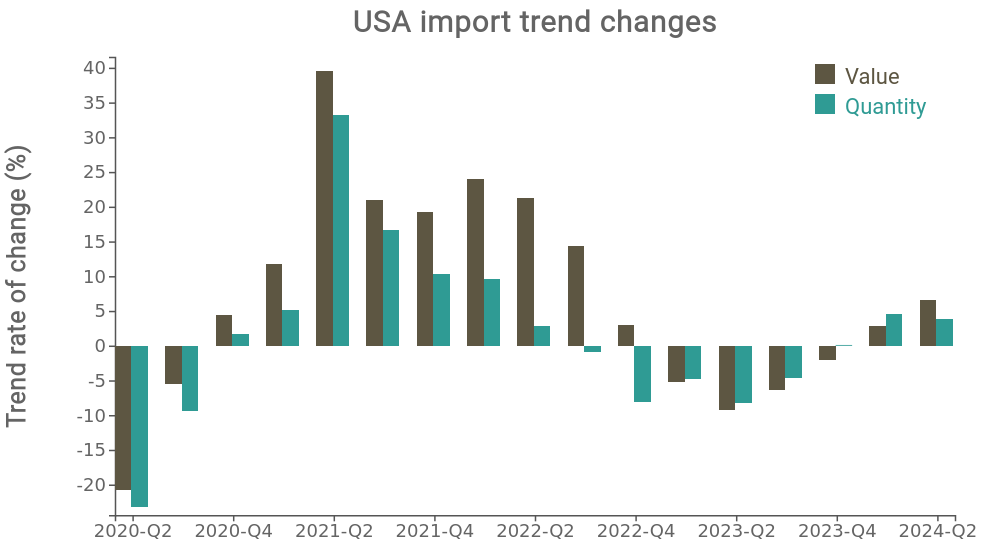

The following chart illustrates the above, showing the quarterly year-on-year changes - in dollars - of US imports in value (brown bars) and quantity (green bars).

Source: ExportPlanning

As repeatedly mentioned, the slowdown was mainly concentrated in the first nine months of 2023, gradually giving way to a relative recovery. The interesting aspect is that the rebound is noticeable both in values and quantities, indicating a recovery in real terms and not just nominal terms.

However, the recovery picture is very heterogeneous in terms of sectors.

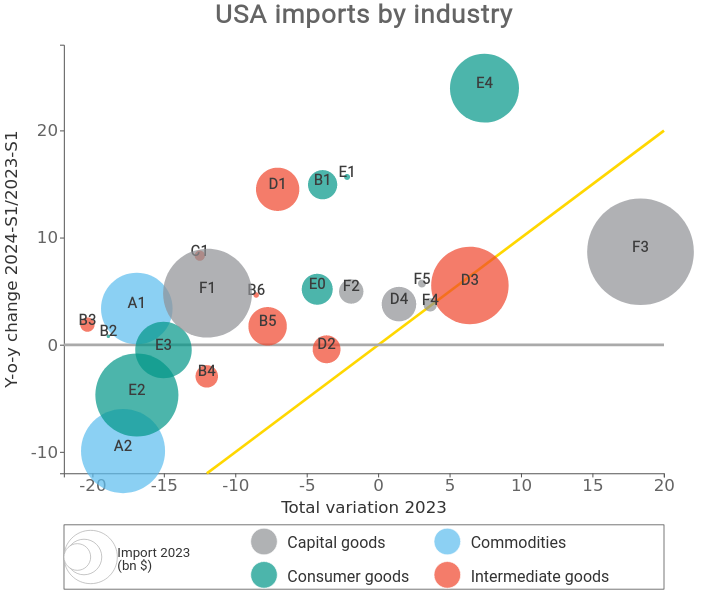

The scatterball shows US imports for different industries, comparing the overall change in imports in 2023 (x-axis) with the year-on-year change recorded in the first half of 2024 (y-axis). The size of each ball is proportional to the 2023 level of US imports in billions of dollars.

Source: ExportPlanning

The first point of interest is that almost all industries are positioned above the yellow bisector, indicating that the recovery is broadly affecting all different sectors. However, the intensity of the recovery is far from uniform, even within the same cluster of goods.

All investment goods have returned to positive territory in the first half of 2024, again led by transportation and agricultural equipment (F3), a sector that demonstrated its particular resilience even in 2023. However, even for this sector, the dispersion of results is high, as described in the article "US demand for capital goods: signs of strengthening in Q2 2024, but with sectoral differences".

Consumer goods are also divided into two groups: on one side, the excellent performance of health products and instruments (E4) and the food sector (B1, E0), which confirmed their counter-cyclicality to the economic cycle in 2023, and on the other side, the relatively greater difficulties of the home system (E3) and finished products for the person (E2).

A relative dispersion of results is also affecting intermediate goods. The gradual recovery indicates a restart of the manufacturing sector; however, the best results are marked by electronic components (D1) and components for transportation equipment (D3), driven by the good performance of downstream industries.

In summary, the chart reveals a clear distinction between sectors where signs of optimism appear more significant and those that, although improving, are still in negative territory.

Conclusions

In the first half of 2024, US imports show signs of moderate recovery, with an increase in both value and quantity compared to the same period last year. However, the high dispersion of sectoral results is particularly pronounced, indicating structural challenges and an evolving context.

Understanding these dynamics is essential to outline effective economic strategies to support international positioning.