Capital Goods Cycle: weak signs of strengthening globally in the 2nd quarter of 2024, in a context still of uncertainty

In the April-June period, a trend increase of +3.1% at constant prices, accelerating compared to previous quarters

Published by Marcello Antonioni. .

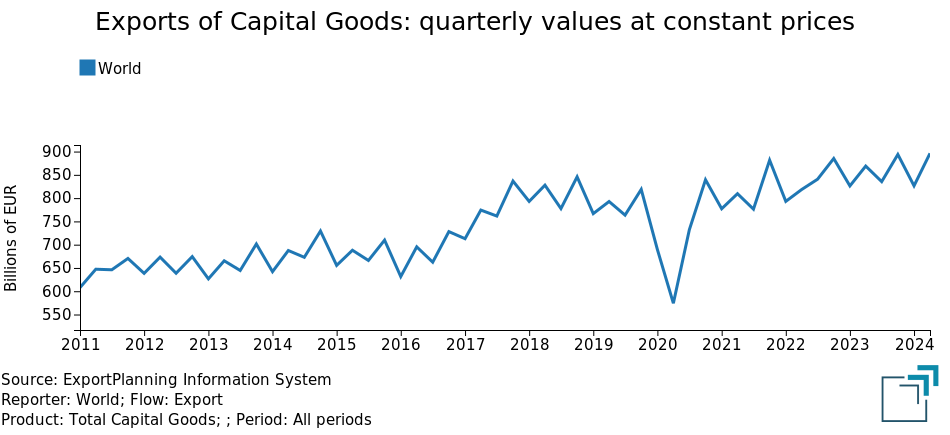

Uncertainty Conjuncture Metal industry Global economic trendsWorld trade data for the second quarter of 2024, available in the World Trade Datamart, highlight a positive sign in the demand for capital goods1, after three quarters of stable or declining trends: in the most recent period, global exports of the sector, measured at constant prices2, grew by more than 3 percentage points compared to the corresponding period of 2023, accelerating compared to the previous three quarters (when the average performance was of substantial stability (+0.1% at constant prices).

Confirmations of trend growth for the sectors Tools and Equipment for ICT and services, Tools and Equipment for industry, Automotive and Industrial Machinery

The second quarter of the year saw accelerations in the growth rate (already positive in the first quarter of the year) of world exports of Tools and Equipment for ICT and services3 (+7.7% at prices compared to the corresponding period of 2023, after +0.7% in the first quarter of the year), Tools and Equipment for industry4 (+4.6% at constant prices, confirming the favorable dynamics of the first three months of the year [+3.7%]), Automotive5 (+2.3% at constant prices, a slight improvement compared to the first quarter [but decelerating compared to the average 2023]) and Industrial Machinery6 (+3.7 % at constant prices, after +3.2 percent in the previous quarter).

World Exports by Capital Goods sectors

(% Year-over-Year at constant prices)

| 2023 | Q1-2024 | Q2-2024 | H1-2024 | |

| Electrotechnical Engineering | -2.6 | -6.1 | -0.9 | -3.5 |

|---|---|---|---|---|

| Tools and Equipment for ICT and services | -7.1 | +0.4 | +7.7 | +4.0 |

| Tools and Equipment for industry | +0.4 | +3.7 | +4.6 | +4.1 |

| Automotive | +14.7 | +2.2 | +3.1 | +2.6 |

| Earth-moving Machinery | +5.6 | -1.7 | -3.4 | -2.6 |

| Agricultural Machinery | -6.9 | -11.2 | -6.2 | -8.7 |

| Industrial Machinery | -1.2 | +3.2 | +3.7 | +3.5 |

| Mechanical Engineering | +1.5 | -6.1 | -2.4 | -4.2 |

| TOTAL Investment Goods | +2.6 | +0.0 | +3.1 | +1.6 |

Source: ExportPlanning - Data - Quarterly Trade Data, World Trade Datamart

World exports of Electrotechnical Engineering, Agricultural Machinery and Mechanical Engineering are improving (although still in negative territory)

In the second quarter of the year, performance was also improving (even if still negative, when measured at constant prices) of world exports of Electrotechnical Engineering7 (-0.9%, improving from -6.1% in the first quarter and from -2.6% of the 2023 average), Agricultural Machinery8 (-6.2%, after -11.2% in the first quarter of the year) and Industrial Engineering9 (-2.4%, from -6.1% in the first three months of the year)

Finally, it is worth mentioning the deterioration which occurred in the second quarter of the year for global exports of Earth-moving Machinery10 (-3.4% trend in measurement at constant prices, after -1.7% in the first quarter and - above all - after +5.6% annual average of 2023).

Conclusions

The economic outlook of global demand for capital goods shows signs of improvement in the most recent quarter, despite still overall weak performances.

Furthermore, this picture appears diversified at a level of sectors, with the presence of sectors whose global demand appears to be in positive territory when measured at constant prices, and others - instead - which, although generally improving, are confirmed in negative territory.

Such a heterogeneous picture (and evolving, as shown by the dynamics of global exports in the sector during the last quarter), suggests that exporting companies of capital goods constantly monitor the situation of the markets of interest for their business area.

Thanks to the series of new services, named Market Insights, ExportPlanning can support the market monitoring of exporting companies, providing updated information in real time on the evolution of the markets of interest for a specific business area.

1) The aggregate considered refers to the following industries: Electrotechnical Engineering, Industrial Machinery, Tools and Equipment for industry, Tools and Equipment for ICT and services, Mechanical Engineering, Automotive, Earth-moving Machinery and Agricultural Machinery.

2) The measure Quantities at constant prices (Q). This measure includes a deflation operation, in which the historical series of monetary values (V) has been transformed into an analogous series of values expressed at constant prices, with a reference to a given year, known as the base year. For a description of the methodology applied, please refer to Methodological Note on the World Trade Datamart.

3) For a list of sectors included in this industry, please refer to the relevant industry profile.

4) For a list of sectors included in this industry, please refer to the relevant industry profile.

5) This industry includes the following sectors:

- Cars, buses and caravans;

- Cars for the transport of goods;

- Special vehicles;

- Ships and pleasure boats;

- Planes and other aircraft;

- Trains and rolling stock;

- Motorcycles;

- Forklifts and handling.

7) For a list of sectors included in this industry, please refer to the relevant industry profile.

8) For a list of sectors included in this industry, please refer to the relevant industry profile.

9) For a list of sectors included in this industry, please refer to the relevant industry profile.

10) For a list of sectors included in this industry, please refer to the relevant industry profile.