First half of 2024: Global Trade Economic Outlook

ExportPlanning's preliminary estimates for the second quarter of 2024 confirm the economic recovery that began earlier this year; however, uncertainty remains high

Published by Simone Zambelli. .

Uncertainty Global demand Conjuncture Global economic trends

The availability of ExportPlanning's preliminary estimates for the second quarter of 2024 - accessible through the Global Economic Outlook datamart - provides an overview of the first half of 2024.

After a difficult 2023, the early months of 2024 showed a slow recovery, though highly differentiated by sector and geographical area, as documented in the previous article "First Quarter 2024: Global Trade Outlook".

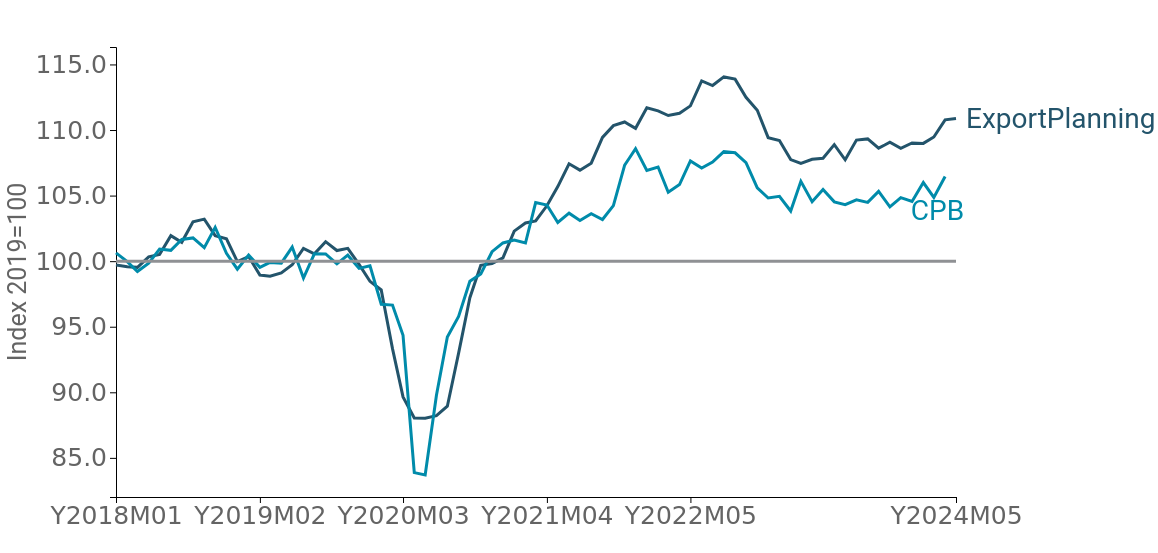

The signals for the second quarter confirm the hypothesis of a strengthening in global trade, as shown in Fig.1, which reports the trend in global demand in quantity, adjusted for price and exchange rate effects, allowing for an analysis of the cyclical trend in real terms.

Fig.1 – Global Demand Trend in Quantity

(CPB data vs ExportPlanning data, 2019 index=100)

Source: ExportPlanning

The two curves allow for a comparison between data processed by ExportPlanning (EP) and the Central Planning Bureau (CPB), which collects and processes information on international goods trade.

It is evident that both measures show a very similar trend, with the difference in levels mainly due to different methodologies in constructing the global trade index, summarized as follows:

- CPB uses aggregated official data by country, while EP uses data at the flow level: product, reporting country, and partner country, aggregating by country only after deflation;

- To deflate trade flows, EP uses appropriate price indices obtained using unit average values at the 6-digit Harmonized System code level, while CPB uses production and consumer prices;

Overall, the graph clearly shows the reversal in the trend of global demand for goods starting from the early months of 2024.

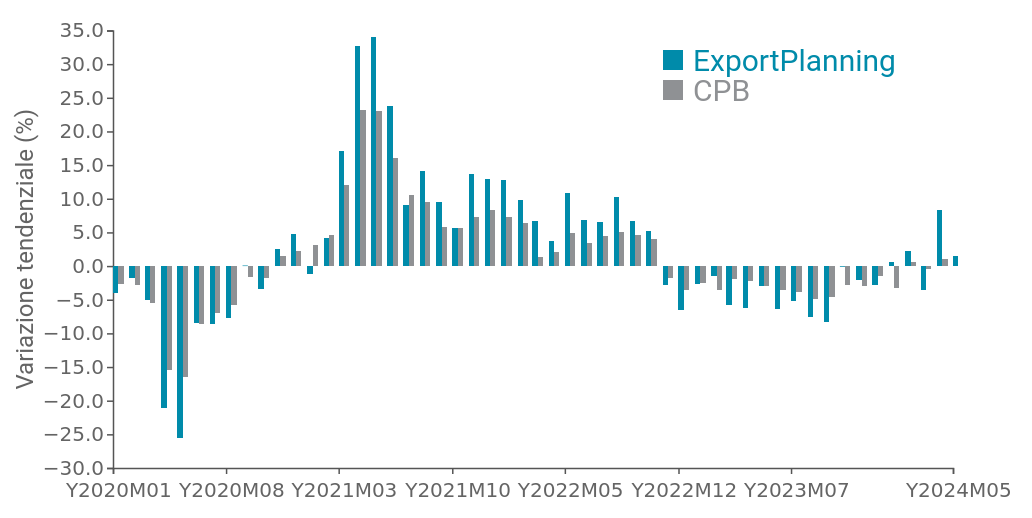

To provide a broader view, let's look at the monthly year-over-year changes in global trade (still in quantity).

Fig.2 - Global Demand in Quantity

(CPB data vs ExportPlanning data, year-over-year change)

Source: ExportPlanning

The historical series of monthly changes highlights how the slowdown in 2023 was mainly concentrated in the first nine months, followed by a relative progressive recovery that still cannot be called "structural," presenting a picture of "cautious optimism."

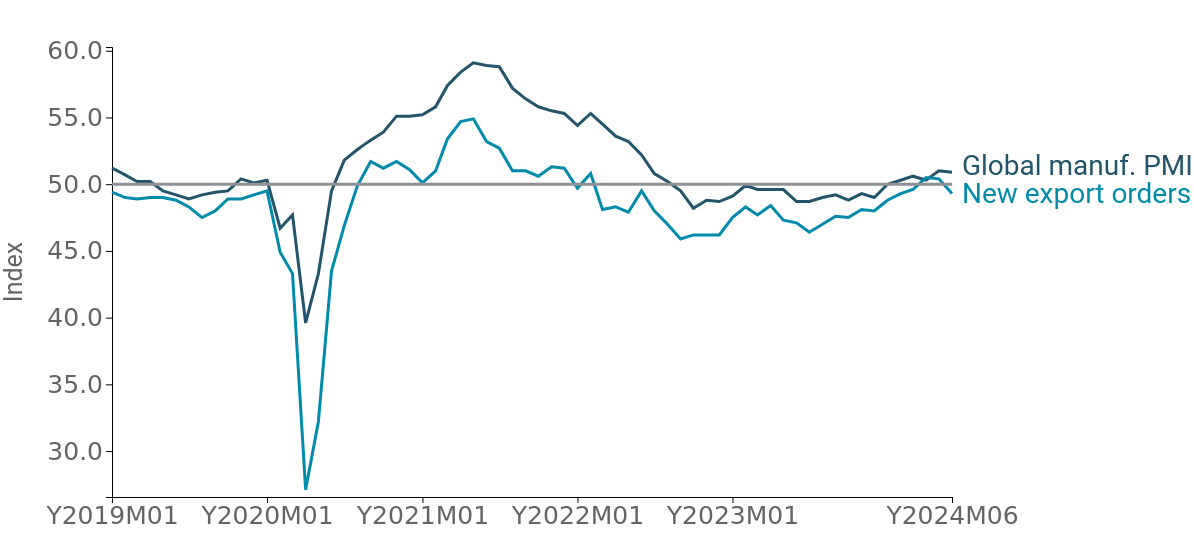

Confirming these dynamics are the signals we can derive from the manufacturing Purchasing Managers' Index (PMI), which offers a snapshot of the manufacturing industry using data collected from surveys of company purchasing managers about their expectations for future output.

The PMI thus represents market "sentiment": a value above the threshold of 50 indicates expectations of a rise in manufacturing activity, while values below signal bearish expectations.

Particularly interesting is the New Export Orders component of the Global Manufacturing PMI, a leading indicator of the global trade dynamics of manufactured goods.

Fig.3 - Global Manufacturing PMI and New Export Orders

(the gray line indicates the neutrality threshold of 50)

Source: ExportPlanning

It is evident that starting from the second half of 2022, the two indices have stabilized below the threshold of 50, which separates expansion (values above 50) from contraction (values below 50) of economic activity, indicating the complexity of the manufacturing picture. Only in the early months of 2024 did the two indices return above the neutrality threshold (with still somewhat variable trends for the New Export Orders component, indicating the degree of uncertainty in the economic outlook). However, even the signals from this leading indicator confirm a picture of the beginning of a recovery in global trade, which nonetheless is not without its ups and downs.

Conclusions

The presented analysis provides a "cautiously optimistic" cyclical picture for global goods trade, highlighting a progressive recovery in global demand.

Is the current situation sufficiently robust to hope for significant acceleration in the coming months? Or is it still a weak recovery, and we will return to recording zero or negative changes in the coming months? Only continuous monitoring of the economic outlook will allow us to answer these questions in a global economic situation that remains fragile and uncertain.