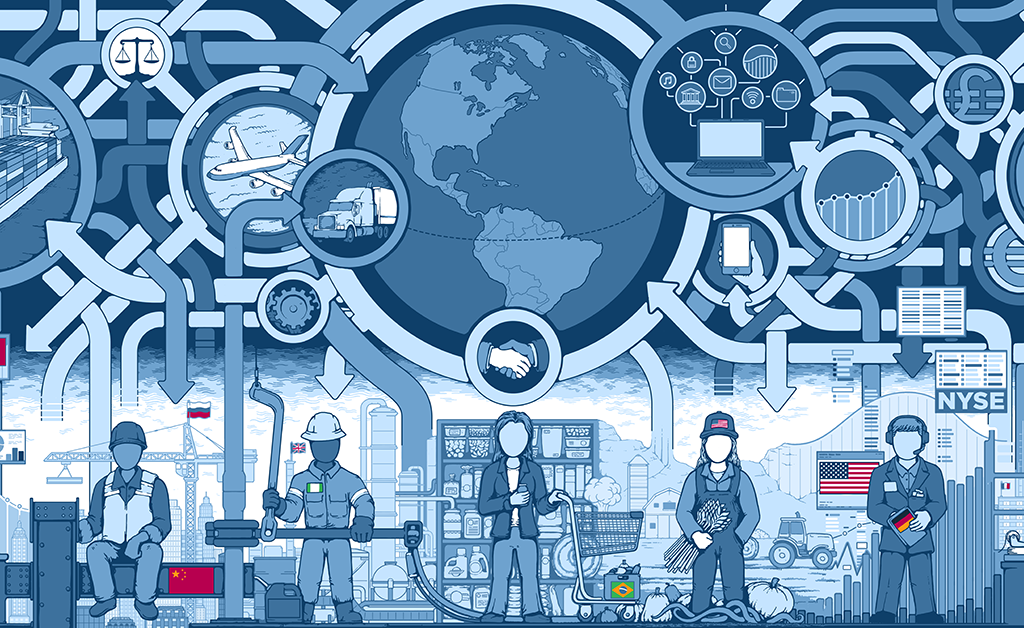

Advantages and Costs of international Trade Liberalization

Benefits of international trade and Liberalization according to international trade theory

Published by Silvia Brianese. .

Export Uncertainty Foreign markets Importexport Global economic trendsThe decision to embark on a path of internationalization requires an assessment of the potential of individual foreign markets. These, in turn, are influenced by the global economic context, especially in a period characterized by growing geopolitical tensions. The dynamics of international trade are heavily influenced by the political choices of the world's major economies. A significant example is represented by the protectionist agenda that will characterize the potential Trump presidency, highlighting a possible return to clearly restrictive policies on international trade.

Although opinions on the future of global trade are diverse, there is broad consensus among economists that trade liberalization improves the global economy. In particular, the models of the "new-new" international trade theory suggest that a reduction in trade restrictions has positive effects on sector-wide productivity and helps improve overall economic welfare.

Referring to the article Theories of International Trade: from Old Trade Theory to New-New Trade Theory, the main models of international economic theory will be analyzed here, focusing on the gains from trade and the effects of trade liberalization on the global economy.

The Gains from International Trade According to Different Economic Theories

Considering that resources in the world are not evenly distributed, the exchange of goods and services allows various countries to use these resources more efficiently, improving their overall allocation.

Classical and neoclassical theories of inter-industry international trade are based on the concept of comparative advantage to explain the economic benefits derived from such trade exchanges. According to these theories, the gains from trade, in terms of welfare, stem primarily from the specialization of each country in the production of goods for which it holds a comparative advantage. This specialization not only increases global production but also allows countries to purchase goods at a lower cost than they would have incurred if they had produced them domestically.

The study of intra-industry trade, a central element of the New Trade Theory, has also provided a more accurate explanation of trade flows, which often involve goods from the same sector.

According to this theory, welfare gains mainly derive from the combination of two factors: economies of scale and the expansion of the variety of products available to consumers. The former leads to greater production efficiency, thanks to more pronounced labor specialization, optimal use of resources and facilities, and consequently, lower production costs. At the same time, greater product differentiation allows consumers to better satisfy their preferences, enabling them to access goods that are not available domestically or that offer higher quality compared to domestic alternatives.

With the beginning of the new millennium, the recognition of firms as key players in trade led to the emergence of the New New Trade Theory and the development of theoretical models that assume the existence of heterogeneous firms even within the same sector. This hypothesis, combined with the greater availability of firm-level data, has allowed for a deeper analysis of the relationship between firm productivity and export activity, revealing another source of welfare gains from trade: the growth of aggregate productivity, driven by the “self-selection” mechanism of the most productive firms in export markets.

Source: What Is Globalization? - Peterson Institute for International Economics.

Trade Liberalization Generates Economic Welfare

Empirical evidence based on the main models of the New New Trade Theory shows that trade liberalization leads less productive firms to exit the market, as they can no longer compete with more efficient ones. On the contrary, more productive firms expand and capture a larger market share. This selection process results in a reallocation of resources (capital and labor) from less efficient firms to more successful ones, leading to a rise in the sector’s average aggregate productivity.

A study by Nina Pavcnik (2002) on Chilean manufacturing firms, conducted during the period of intense trade liberalization in the 1970s and 1980s, shows that liberalization not only increases aggregate productivity due to the exit of less efficient companies but also stimulates the remaining firms to improve their efficiency and competitiveness.

An additional effect generated by the progressive trade liberalization between countries is the increase in competition in international markets, which, by reducing firms' profit margins, contributes to lowering the prices of goods, bringing benefits to consumers. The increase in competition and productivity also raises real incomes, resulting in an overall improvement in economic welfare.

Distortionary Effects of International Competition

Over time, economic theory has widely recognized the existence of aggregate benefits from international trade; however, it is useful to analyze the factors that have led to an increasingly less optimistic view regarding the effects of trade liberalization.

First, it is important to recognize that not all firms can enjoy the benefits of trade, especially when the purchase of a cheaper good produced abroad leads to the loss of a (more expensive) sale by a domestic producer.

Furthermore, international trade leads to a redistribution of incomes and an increase in the relative remuneration of the factor used more intensively, reducing the remuneration of less intensively used factors. This mechanism can exacerbate inequalities within an economy, penalizing “unskilled” workers (or infant industries in developing countries). These dynamics contribute to social imbalances, generating greater political support for protectionist policies.

In addition to the redistributive disadvantages, various empirical studies show that weaker economies must bear higher adjustment costs with trade openness. These costs include the loss of trade advantages due to the liberalization of previously protected markets; the decline in state revenues resulting from reduced customs tariffs; and increased exposure to external shocks. Another significant cost concerns the creation and destruction of jobs, a central issue in political debates about trade openness. On this point, economic theory focuses on the distribution of incomes between factors of production (such as labor and capital), and while it acknowledges that temporary imbalances may occur in the short term due to labor market rigidities, it predicts that, in the long run, the market will tend to rebalance itself, ensuring full employment.

Conclusions

Economic theory has highlighted how international trade liberalization not only expands the variety of goods available and reduces costs through country specialization, but also leads to greater overall efficiency due to the reallocation of resources. However, the empirical experience of the latest cycle of globalization has shown that, despite the overall benefits, significant internal distortions can arise within countries, with different economic agents being either advantaged or disadvantaged by the changes brought about by the globalization of the world economy.

What path global trade will take in the coming years will therefore also depend on which opinion tends to prevail among the many decision-makers.