USA Market: The Evolution of the Competitive Arena from 2019 to Today

Winners and Losers of American Trade Policy

Published by Simone Zambelli. .

United States of America Import Foreign market analysisThe United States has been one of the markets characterized by particularly rewarding performances in the post-pandemic period, but at the same time, it has become the reference example of so-called “decoupling” and friendshoring policies, having inaugurated a return to growing protectionism with the trade and technology war against China that began in 2018.

Ahead of the upcoming elections, and given the further protectionist escalation threatened by candidate Donald Trump (for more details, see the article Challenges and Changes in Global Trade), it is particularly significant to frame the evolution of the market shares of the United States' main trading partners, in order to assess the current competitive arena.

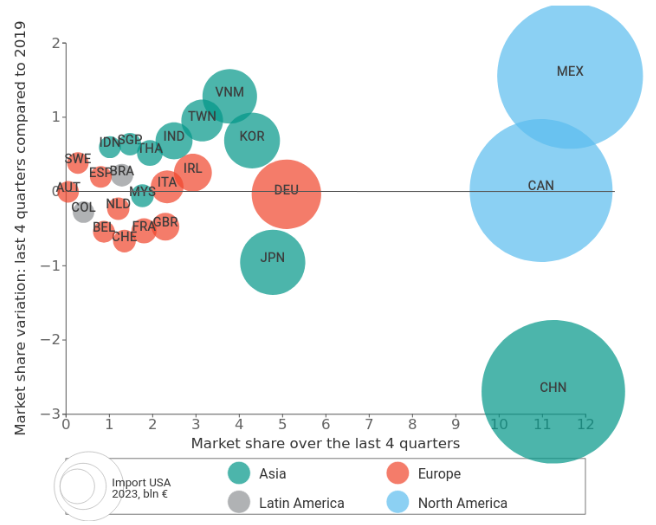

The analysis of the market shares of the main countries exporting to the United States, visualized in the bubble chart, provides a clear overview of how the positioning of key active markets has changed. On the x-axis, the market share held by each exporter in the last available domestic year is shown, while on the y-axis, the variation in that share between the last four quarters and the last pre-pandemic year is indicated. The size of the bubbles is proportional to the value of American imports in the year 2023.

This representation is useful for identifying those exporters who have strengthened their competitive position in the U.S. over the past four years, located above the zero line on the y-axis; conversely, exporters who have experienced a decline in their market share are positioned below the zero line.

Main Players in the U.S. Market: Market Share Analysis

The first strong evidence naturally relates to the different positioning of the two major suppliers to the market: Mexico and China.

As we have mentioned several times, neighboring Mexico has now become the United States' largest supplier. The proposed representation clearly shows how the market share variations of the two countries have been diametrically opposed over the past four years.

The current U.S. trade policy towards China can be summarized into three models:

- economic decoupling as a geopolitical tool to contain the rise of the strategic rival;

- protection of national security;

- implementation of a “protectionist” industrial policy in sectors considered “strategic.”

While this phenomenon is leading to a massive increase in Chinese interest in locating operations in the Mexican market to bypass tariffs, what can we highlight about the other U.S. suppliers?

Asia

While China's role in the Asian front has diminished, the same cannot be said for other economies in the region. After Mexico, the suppliers that have strengthened their position in the market are several Asian economies. Among them, Vietnam (VNM), Taiwan (TWN), India (IND), and South Korea (KOR) stand out.

In particular, Vietnam's rise is also a reflection of the "decoupling" of supply chains from China, with many companies relocating production to avoid the uncertainties stemming from Washington-Beijing tensions. Similarly, Taiwan and South Korea, both known for producing technology and semiconductors, have benefited from the growing demand for electronic products and components, following China's decline.

India's gain can be seen as the result of the Indian government's aggressive trade policies and the growing interest of American companies in diversifying their suppliers.

During the period under analysis, Japan (JPN) has lost market share, partly due to some internal challenges.

Europe

The picture is more complex for the economies of the Old Continent.

The main European economies, such as Germany (DEU), France (FRA), the United Kingdom (GBR), Switzerland (CHE), and Belgium (BEL), have shown a contraction in market share compared to 2019. Germany, in particular, despite remaining a significant exporter to the United States, has experienced a significant decline, due in part to structural and cyclical difficulties in the national economy.

Among the more resilient economies, we must mention Italy, which, along with Spain, Ireland, and Sweden, has maintained its market position.

Conclusions

The analysis of U.S. imports offers a snapshot of the latest trends in global trade, but it paints a picture of both light and shadow.

While U.S. tariff policy has certainly led to a gradual "decoupling" from China, the need to diversify supply sources, combined with growing global competitiveness, has nonetheless led to the strengthening of other Asian economies in the market. However, the European Union does not appear to have benefited from this trend, with overall mixed results.

The outcome of the upcoming U.S. elections will surely be a turning point for assessing future trends and the intensity of the protectionist phenomenon.