Conjunctural Overview of Global Trade: Trends in the First Nine Months of 2024

Published by Marzia Moccia. .

Global demand Conjuncture Global economic trendsThe recent publication by the International Monetary Fund of the World Economic Outlook for October presents a resilient economic picture, but with growth performance falling short of expectations. The economic growth outlook remains deeply differentiated: while forecasts for the United States show improvement, the situation is much weaker for other advanced economies, particularly the main European countries. The availability of ExportPlanning's pre-estimates for the first nine months of 2024 – accessible through the Global Conjuncture datamart – allows us to describe how the current situation in global goods trade mirrors this international context, where the specter of uncertainty remains considerable.

As repeatedly reported, 2023 was the year of a slowdown in global demand, particularly in the first nine months of last year, when, for the first time since the start of the new post-pandemic expansion cycle, it entered negative territory.

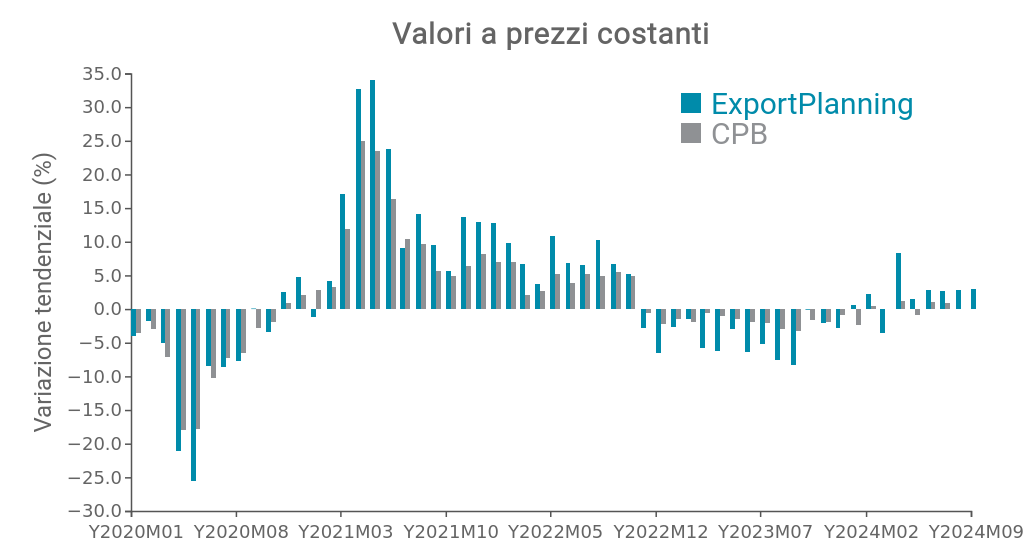

This phenomenon is evident in Fig.1, which shows the series of monthly quarterly changes in global imports of manufactured goods at constant prices, i.e., adjusted for price and exchange rate dynamics, comparing data collected and systematized by ExportPlanning with those from the Central Planning Bureau, an institution that also collects and processes information on international trade in goods.

Fig.1 - Global demand in quantity

(CPB data vs ExportPlanning data, trend variation)

Source: ExportPlanning Elaborations.

Both sources document how the repressive pace of demand for manufactured goods gradually dissipated over the past few months, eventually reversing the trend starting in the first quarter of 2024. This recovery in the quantities of traded manufactured goods has characterized all the months of the current year, albeit with moderate intensity.

Overall, ExportPlanning's pre-estimates indicate a trend recovery in global demand of 2% in the first nine months of 2024 compared to the same period last year, suggesting that, ceteris paribus, global trade will close 2024 with a 2.4% growth compared to 2023.

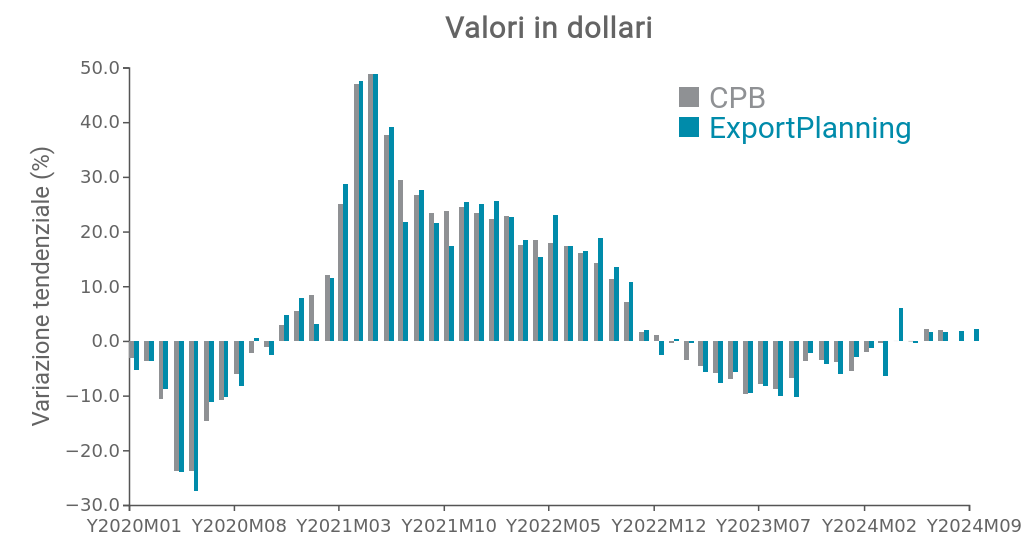

However, the key feature of all recent economic cycles lies in the bifurcation still observed between global trade trends in nominal terms and at constant prices.

As highlighted by the World Economic Outlook, the global economy is undergoing a significant disinflationary process, bringing inflation increasingly in line with the targets of major central banks. If we reproduce the same series of monthly quarterly changes in dollars, it becomes clear that the recovery in global demand in terms of quantity is significantly weaker in nominal terms, reflecting the price downturn.

Fig.2 - Global demand in dollars

(CPB data vs ExportPlanning data, trend variation)

Source: ExportPlanning Elaborations.

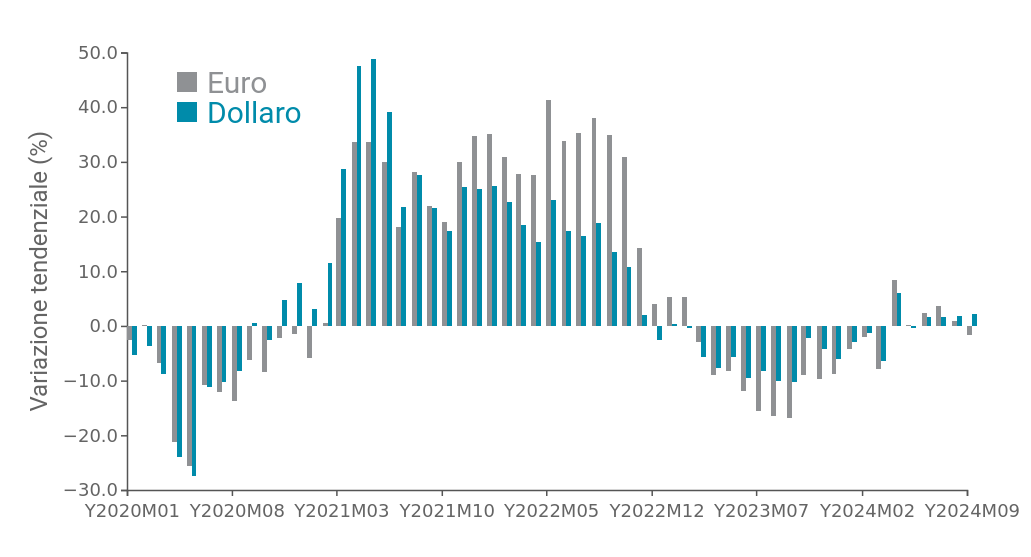

In nominal terms, ExportPlanning's pre-estimates show a trend recovery of 0.2% in the first nine months, with a year-end forecast of around 1%. This figure is even less favorable in euro terms due to the recent evolution of exchange rates, with a 2024 result of 0.5%.

Fig.3 - Global demand: dollars vs euros

(CPB data vs ExportPlanning data, trend variation)

Source: ExportPlanning Elaborations.

Thus, 2024 has certainly marked a trend reversal compared to the slowdown of 2023; however, the intensity and duration of this recovery seem to fall short of expectations, particularly due to recent dynamics.

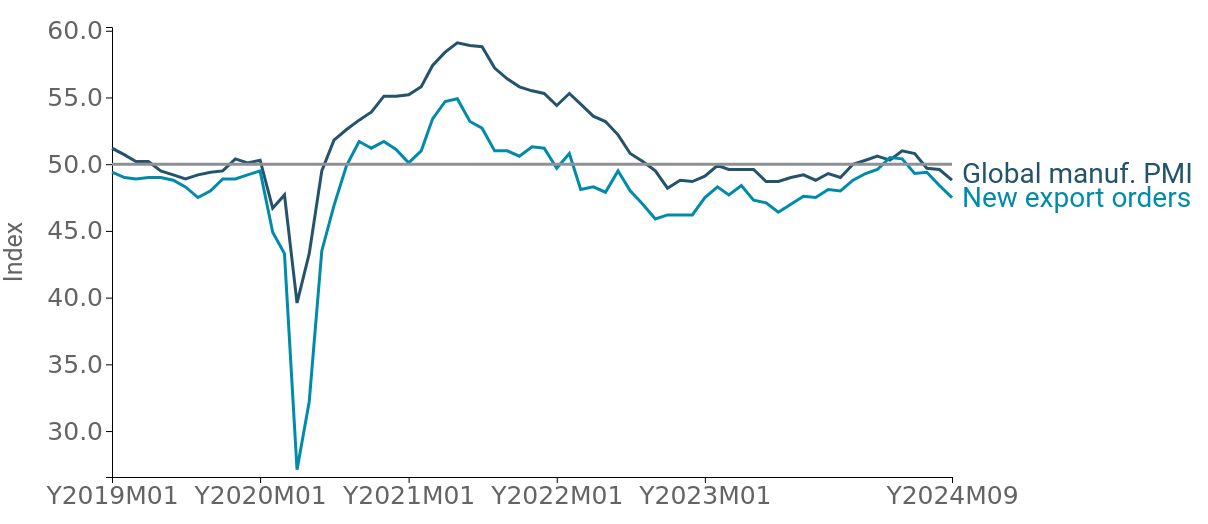

Supporting this evidence are signals from the global manufacturing Purchasing Managers Index (PMI), a "real-time" indicator of economic performance that summarizes future prospects regarding industrial activity levels, based on companies' purchasing declarations (Fig.4): values above the threshold of 50 indicate expectations of expansion, while lower values indicate a worsening of expectations.

Fig.4 - Global manufacturing PMI and New Export Orders

(the gray line indicates the neutrality threshold of 50)

Source: ExportPlanning Elaborations based on J.P.Morgan Global Manufacturing PMI™ data.

It is clear that expansionary and improvement expectations by economic operators characterized the first six months of 2024, registering a progressive slowdown starting in July. This is true both for expectations regarding overall output and for the New Export Orders component of the Global Manufacturing PMI, a leading indicator of global manufactured goods trade dynamics.

The indicators therefore suggest a more complex year-end than initially anticipated, with the persistence of an uncertain climate in a still fragile and uncertain, yet resilient, scenario. As mentioned earlier, the latest World Economic Outlook reports a stable but disappointing global growth outlook, with downside risks. The main burdens on the economic outlook include risks related to an escalation of regional conflicts, particularly in the Middle East, which could lead to serious instability in commodity markets; increasingly aggressive protectionist industrial and trade policies; and monetary policy that could remain restrictive for too long, worsening global financial conditions.

The nature of the scenario also presents a fragmented and differentiated international landscape in geographic and sectoral terms, making constant monitoring of information imperative.