The Threat of New U.S. Tariffs Against China

The increase in tariffs on Chinese imports could lead to inflation and drive the search for alternatives, but is it really possible to replace China?

Published by Simone Zambelli. .

United States of America Trade war Uncertainty Global economic trendsThe Trump administration has promised to introduce new and heavy tariffs on imports from China, a move aimed at reducing the trade deficit and strengthening the competitiveness of the U.S. domestic market. However, it is reasonable to imagine that this decision could have a significant impact on certain sectors where China holds a substantial share of the U.S. market. These are sectors for which the introduction of a 60% tariff, as per the campaign promises of the newly elected President Trump, would be particularly burdensome, leading to an increase in product prices on one hand and the potential gradual replacement of the Chinese player on the other.

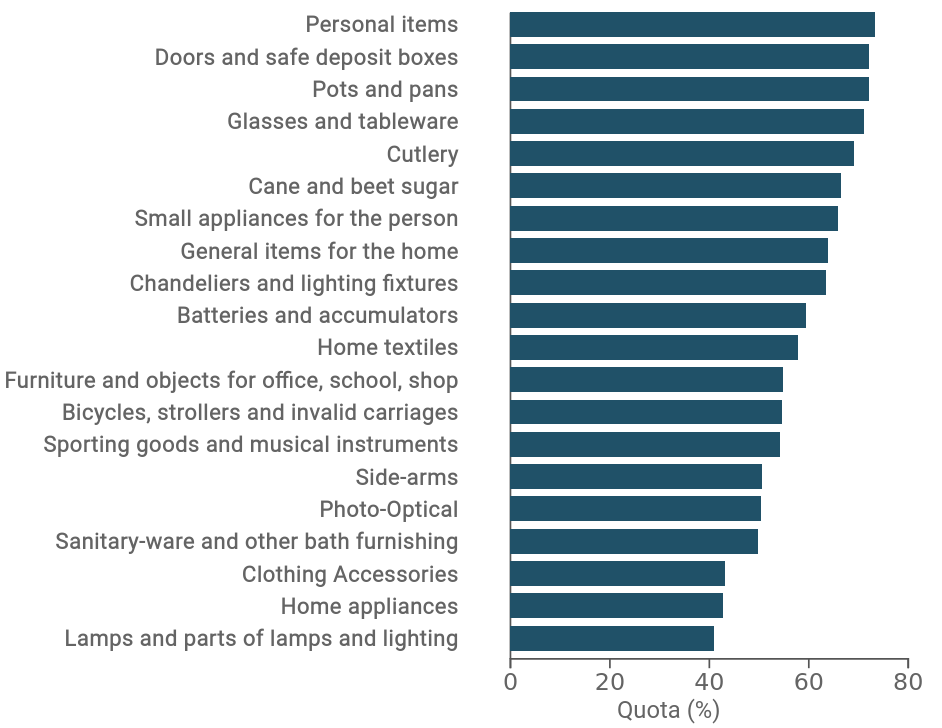

Fig. 1 shows the U.S. import sectors where China holds a large share of the American market; these are segments where the Dragon Country appears highly specialized, with a significant competitive advantage on the international stage.

Fig. 1 – Sectors with the highest Chinese market share in the U.S. (2023 data)

Source: ExportPlanning

As shown in the chart, the sectors where China's market leadership is substantial are diverse, primarily including everyday products, household appliances, and home goods. Leading the list are Personal Items (razors, brushes, buttons, pins, lighters, etc.), referring to small everyday objects, followed by small personal care appliances (epilators, hair dryers, electric irons, and flat irons). Next is a highly varied list of household goods, ranging from safes to cookware, utensils, and cutlery.

China supplies between 50% and 75% of imports in these categories, thanks to its capacity for large-scale production, competitive prices, and established infrastructure. These advantages have made Chinese goods, which are essentially mass-consumption products, particularly affordable. Imposing tariffs will inevitably result in higher costs for American consumers, as businesses will be forced to pass the burden of duties onto final prices. According to analysts, this increase in the cost of living will directly impact low-income families, unless the new administration plans specific subsidies or welfare actions.

However, there is another effect that deserves attention: the possible reorganization of supplier countries for these goods. Replacing China as a producer, however, will require considerable effort from other cost-advantaged economies, such as Vietnam, India, or Mexico. These countries, however, are not equipped to replicate China's entire production ecosystem. For example, China not only manufactures but also integrates all the elements needed for producing complex goods, such as household appliances and technological devices, into its advanced logistical supply chains. Replicating this network of infrastructure and suppliers elsewhere would take years to develop.

Conclusions

The new tariffs imposed by the Trump administration represent a significant challenge for the U.S. economy and consumers, who will face higher prices for everyday goods. While the stated goal is to strengthen domestic production and reduce dependence on China, the reality is that the transition is likely to be long and complex. The central question remains: Will the United States truly succeed in replacing China as the dominant supplier of these goods, or will the economic impact of the tariffs, as a whole, outweigh the expected benefits?