Industrial metals and basic chemicals: the EU seeks a strategy to tackle supply risks

Given China's leadership in the industrial metals and basic chemicals sectors, the European Union seeks to mitigate supply risks in critical raw materials

Published by Silvia Brianese. .

Export Asia Importexport Europe Foreign markets Foreign market analysisAs is now well known, China is consolidating its position as a global leader in key sectors relevant to the green and digital transition, such as automotive, energy, and high-tech. This achievement results from a combination of factors, including the control of raw materials, such as rare earths, industrial metals, and basic chemical products, and the adoption of industrial and trade policies, such as the development of high-tech extractive supply chains, direct investments in mining activities in Africa and Latin America, and overseas refining operations, all interconnected through the Belt and Road Initiative. These strategies have enabled China to establish itself as the world's leading supplier of critical raw materials, securing a competitive and strategic advantage.

This rise has highlighted the dependence of the European Union on imports of critical raw materials, which are essential for achieving the climate and technological goals planned for the coming years. The high demand for raw materials, combined with the concentration of supply in a few countries, exposes the European Union to various risks related to the supply of these resources, making it necessary to implement a foreign and trade policy focused on the security of raw materials. In this context, the Draghi Report (September 2024) proposes a series of measures, including new free trade agreements and diversification of supply chains, which represent an initial step toward greater resilience in the European market for critical raw materials.

This article highlights China’s achievements in recent years in the sectors of industrial metals and basic chemicals, essential for producing goods needed in all industrial processes.

The Shift in Global Trade of Industrial Metals

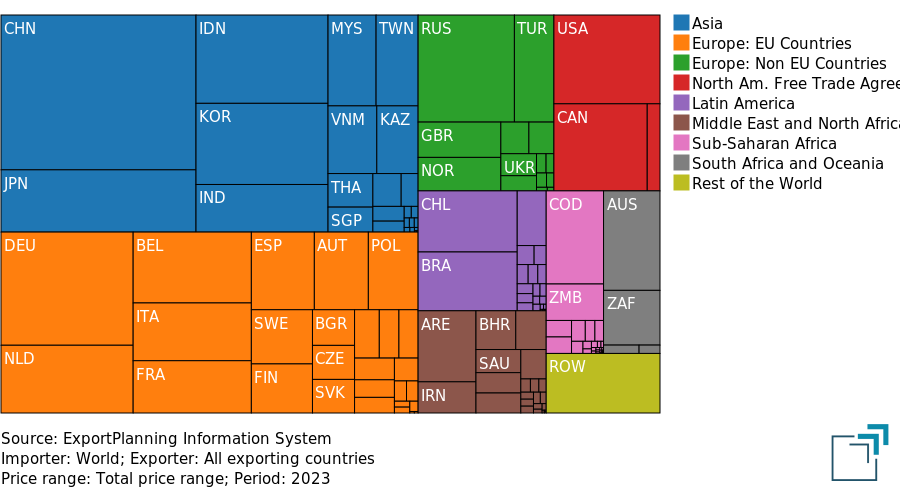

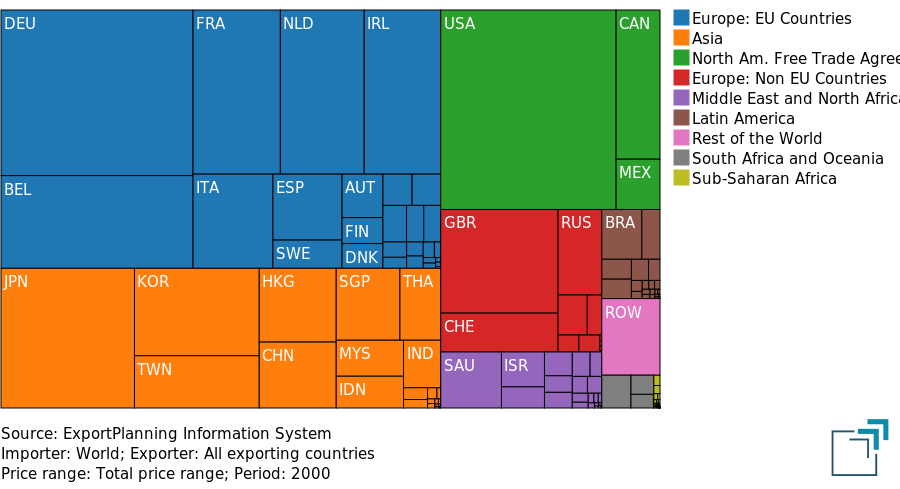

Comparing the export values of industrial metals (steel, copper, aluminum, lead, zinc, tin, nickel, and other non-ferrous metals) across countries in 2000 and 2023 reveals a significant shift in leadership within this sector. While in 2000 Europe, led by Germany, dominated the global market, by 2023 China had become the world's leading exporter of industrial metals.

Exporting countries of industrial metals in 2000

Source: ExportPlanning

Exporting countries of industrial metals in 2023

Source: ExportPlanning

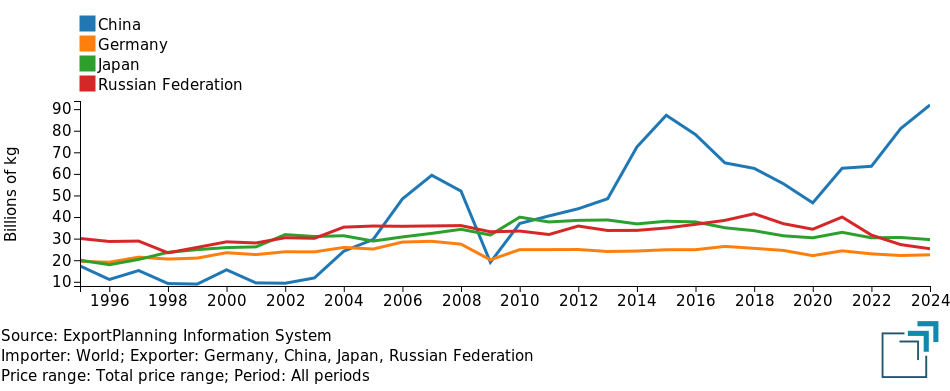

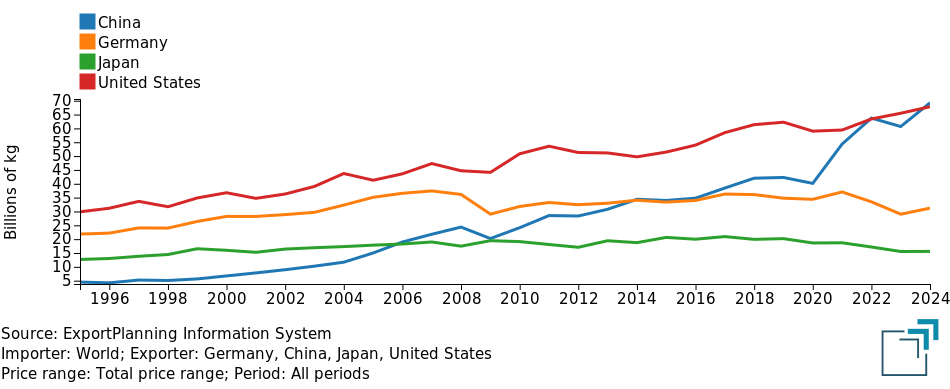

This change becomes even more evident when observing the trend in Chinese exports of industrial metals in terms of quantity, which have shown significant growth since the 1990s. As shown in the graph below, in 2024, China exported an amount of industrial metals equivalent to the combined exports of the top three exporting countries of the last century, compared to export volumes that, in the early years of this century, were still a fraction of those of each of the three countries individually.

Main exporting countries of industrial metals (quantity)

Source: ExportPlanning

The causes of this shift in leadership are linked to the industrial and trade strategies implemented by China over the last two decades. With its entry into the WTO in December 2001, a phase of growth in Chinese exports of industrial metals began, which accelerated in the following years. Despite significant challenges during the Great Recession (2008-2009) and the Chinese financial crisis of 2015-2017, Chinese exports continued on a long-term growth trajectory, consolidating China's position as the leader in global trade of industrial metals, even during the pandemic period.

The Shift in Global Trade of Basic Chemicals

The basic chemicals sector includes basic organic and inorganic chemicals, plastics, and rubber in primary forms—fundamental materials that serve as inputs in almost all industrial processes. Often, China’s gains in this sector receive limited attention from the mass media, even though experts recognize their strategic role.

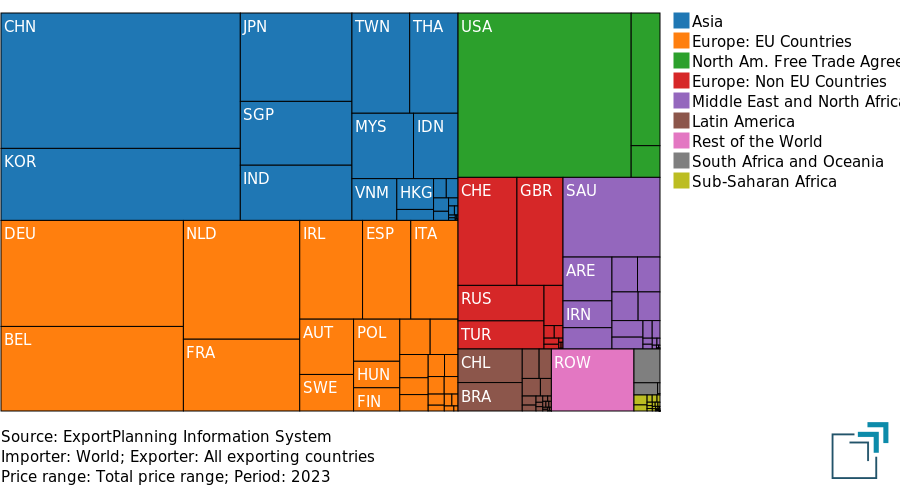

The graphs below, showing the export values of basic chemicals in 2000 and 2023, reveal a scenario similar to that observed in the industrial metals sector: in 2023, China emerged as the leading exporter of basic chemicals, unlike in 2000, when Germany led global exports.

Exporting countries of basic chemicals in 2000

Source: ExportPlanning

Exporting countries of basic chemicals in 2023

Source: ExportPlanning

More specifically, when observing the dynamics of global exports of basic chemicals (in terms of quantity), it is clear that, starting from 2020, China has achieved significant growth in its exports in this sector, surpassing Germany first and then, in 2024, even the United States.

Global exports of basic chemicals (quantity)

Source: ExportPlanning

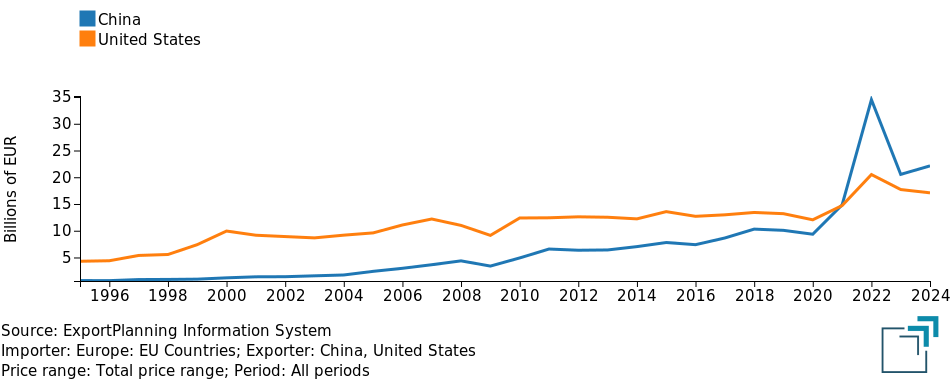

The success of China over the United States becomes more evident when focusing on European imports. The graph below shows how, since 2022, China has significantly surpassed the United States as an exporter to the European Union markets, confirming its relevance among the main suppliers of basic chemicals in Europe.

EU imports of basic chemicals (values in euros)

Source: ExportPlanning

Europe’s Dependence on Raw Material Imports and Supply Risks

In general, the European Union heavily depends on imports of critical raw materials, especially from China, facing several risks related to the supply of these resources. Indeed, the concentration of supply in a few countries (where China is often at the top) creates vulnerabilities on multiple fronts: price volatility affects investment decisions, while export restrictions (often used as geopolitical tools) can compromise access to resources. A recent example is the restriction imposed by China on the export of gallium, germanium, and antimony to the United States, highlighting the growing use of raw materials as strategic levers of political and economic influence.

EU Strategies on Raw Material Security

The European strategy to reduce its vulnerability in the raw materials market has been extensively discussed in the Draghi Report on the Productivity and Competitiveness of European Enterprises (September 2024), emphasizing the need to implement a foreign policy plan capable of mitigating the risks related to the supply of these materials. In practice, as stated during the inauguration of the new European Commission, the main guidelines that will guide the Commission are as follows:

- Preferential trade agreements (Free Trade Agreements)

- Direct investments in countries with abundant natural resources;

- Creation of stockpiles for strategic sectors;

- Industrial partnerships to safeguard technological supply chains

Conclusions

The rise of China as a global leader in the export of critical raw materials, including many industrial metals and basic chemical products, combined with Europe's strong dependence on these resources, highlights the urgency for the European Union to adopt a clear and targeted strategy to ensure supply security.

The guidelines set by the European Commission outline a path to address this challenge. However, it is important to emphasize that maintaining an open global trade system is an essential condition for improving access to basic materials. Past crises, particularly the recent one triggered by Russia's invasion of Ukraine, have shown how crucial it is to preserve the freedom of global trade to mitigate risks related to supply security.

In this context, it is desirable that the strategy outlined by the Commission places greater emphasis on the importance of safeguarding an international trade system that is as free and non-discriminatory as possible, as a key element in addressing the supply vulnerabilities of European industry.