Country Analysis for International Expansion

Key Factors for Integrated Evaluation of Economic, Social, Political, and Environmental Aspects of a Country

Published by Veronica Campostrini. .

Macroeconomic analysis Foreign markets Internationalisation Export markets Foreign market analysisFor companies looking at international markets, the analysis and evaluation phase of the target country is essential. The objective is to enable the company to fully understand the context in which it will operate, taking into account a variety of factors.

It provides valuable information on macroeconomic variables and fundamentals, key industrial sectors, the country's foreign trade relations, the labor market situation, and infrastructure.

Macroeconomic Analysis: Understanding a Country's Economic Context

To fully understand a country's economic context, it is necessary to start with the macroeconomic framework.

This includes key indicators such as Gross Domestic Product (GDP), inflation, unemployment rate, and monetary policy.

GDP is a widely used indicator to measure the size and health of an economy. It represents the total gross value added of all producers residing in the economy, and economic growth is measured by the change in GDP at constant prices.

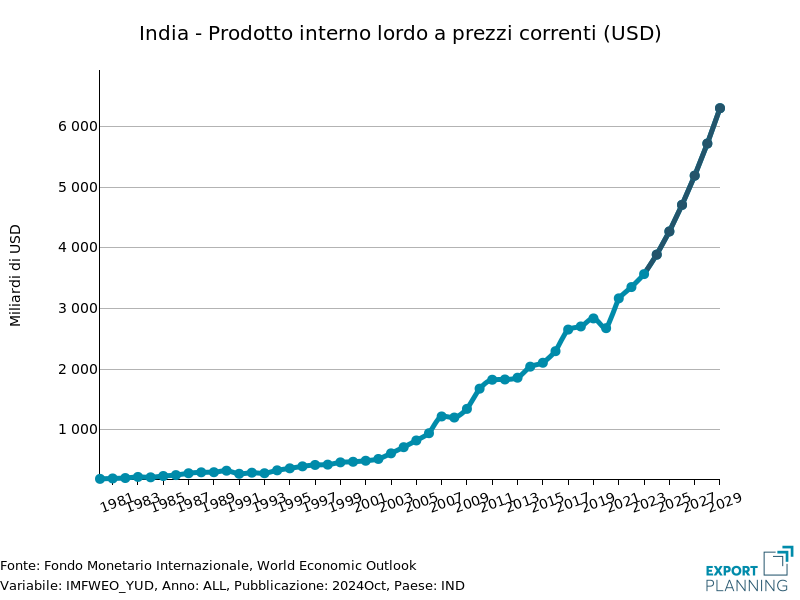

Many WDI (World Development Indicators) indicators use GDP or GDP per capita as a denominator to allow comparisons between countries of socio-economic and other data. For example, the analysis of India's steady GDP growth in recent years, illustrated in the attached graph, highlights robust economic expansion and growing domestic demand. GDP growth, driven by economic reforms and investments in key sectors, has made India an increasingly relevant emerging market on the global economic scene.

Source: ExportPlanning

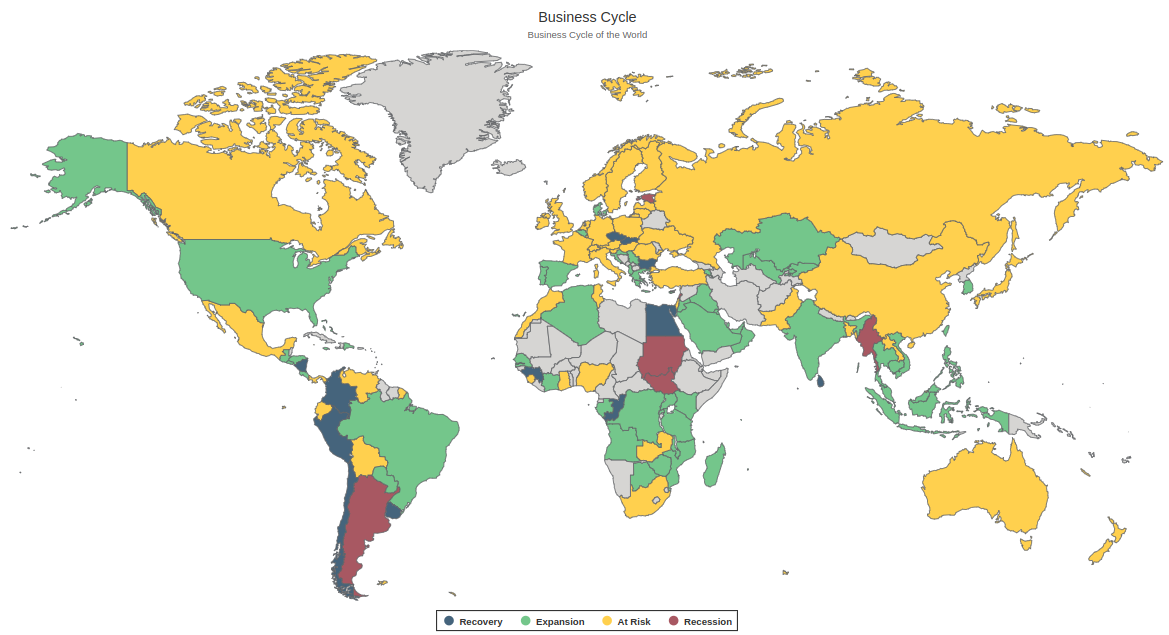

Another key aspect of macroeconomic analysis is identifying the phase of the economic cycle in which the country is. The cycle represents fluctuations in economic activity over time, alternating periods of growth and contraction. Understanding this dynamic is crucial for companies, as it directly influences investment decisions, timing, and market entry strategies.

According to economic literature, four different phases can be distinguished:

- Recovery: The phase that follows a recession, where the economy begins to show signs of recovery. Companies can find opportunities to enter the market while prices are still low and conditions start to improve.

- Expansion: During this phase, the economy grows rapidly, surpassing pre-recession levels. It is an ideal time to invest, taking advantage of growth and consumer confidence.

- Overheating: In this phase, the economy shows signs of overloading, with a possible imminent slowdown. Companies need to be cautious, closely monitoring market signals to avoid risky investments.

- Recession: Economic activity contracts, creating a challenging environment. However, this phase can offer opportunities to acquire assets at lower prices and prepare for the next recovery.

Understanding the phase of the economic cycle in which a country is can make a difference. For example, a country in the expansion phase may offer more growth opportunities, while a country in recession may involve higher risks but also opportunities to acquire assets at lower prices. Below is a summary map of the phase of the cycle in which different world economies are.

Source: Global Business Cycle Map : Moody's Analytics

Foreign Trade Relations: Industrial Sectors and Opportunities

After outlining the aggregate economic framework, it is important for exporting companies to have an overview of the country's foreign trade relations.

This phase allows identifying specific existing opportunity niches, with relevant economic implications on:

- degree of trade openness and relevant players

- balance of payments of the country and ability to attract foreign investments

- currency pressures and dynamics

Firstly, as anticipated, the analysis of trade flows allows identifying the segments and products most imported by the country as a market. This phase examines both the demand for consumer goods (B2C) and industrial goods (B2B).

- Consumer goods demand: Understanding consumer preferences and spending trends is crucial. The growth of the middle class in many emerging countries can indicate a growing demand for electronics, fashion, and luxury goods.

- Industrial goods demand: The industrial sectors offer numerous opportunities for companies providing materials, machinery, and technologies. Evaluating the demand for green technologies, advanced machinery, and other industrial solutions can provide indications on where to focus marketing and sales efforts.

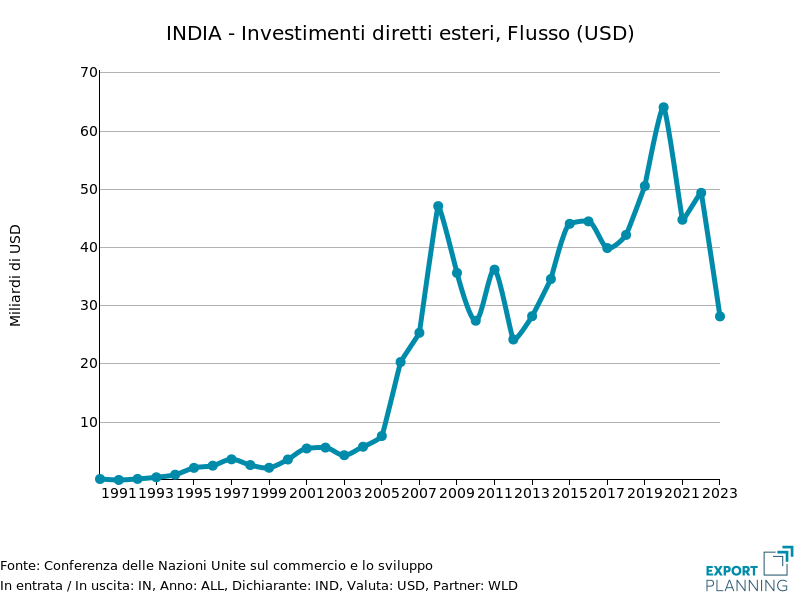

The analysis of trade flows allows identifying the productive specializations of the analyzed country, focusing on its manufacturing transformation capacity. To this end, a particularly significant factor is represented by Foreign Direct Investments.

Foreign Direct Investments (FDI)

Foreign Direct Investments are much more than simple capital flows: they are a concrete signal of global confidence in a country's potential. When an economy manages to attract international investors, new opportunities are created, key sectors are fueled, and global competitiveness is strengthened.

Observing FDI flows offers a privileged window on a country's economic dynamics. It is crucial to highlight how increases in investments in strategic sectors reflect the country's industrial policy directions.

In the case of India, incoming FDI flows have been particularly significant in recent years. This is a direct reflection of growing investor confidence in the country's stability and growth potential, which, as we have seen, is experiencing sustained economic expansion, as evidenced by the increase in its GDP. India, thanks to business-friendly government policies, tax incentives, and increasing openness in strategic sectors, is rapidly consolidating as one of the most attractive FDI destinations globally.

Source: ExportPlanning

The Labor Market

An in-depth understanding of the labor market is essential to comprehend the economic ecosystem, the relative availability of skilled labor, labor costs, and working conditions.

Labor productivity is not just an economic measure but an indicator of a country's ability to offer decent job opportunities with fair wages. Productivity increases, achieved through investments, technological progress, or organizational innovations, can improve social protection and reduce working poverty. A growing economy, indeed, is capable of decreasing vulnerable work and increasing the quality of life of its workers.

A country's competitiveness is often linked to labor costs and the technical skill level of the workforce. A low labor cost, combined with high qualification, can make a nation particularly attractive to manufacturing companies. Additionally, a high level of education and continuous training policies promote innovation and productivity, creating a fertile environment for development and economic growth.

Infrastructure

Infrastructure is the operational backbone of a country and has a direct impact on business efficiency.

A well-developed transport network, including roads, railways, ports, and airports, facilitates trade and logistics, making the movement of goods and people easier. A country's strategic geographical position can amplify these advantages, turning it into a significant commercial hub.

Besides transport, energy resources, and telecommunications play a crucial role. The availability of reliable energy and robust telecommunications networks is essential to support industry and promote technological innovation. A country with advanced infrastructure can attract investments, support business expansion, and stimulate economic growth.

PESTEL: A Complete and Multidimensional Analysis

For a comprehensive analysis of a country, the PESTEL model (Political, Economic, Social, Technological, Environmental, Legal) is an indispensable tool. This approach allows exploring not only the economic aspects just listed but also the various external factors that can influence the success of business operations.

- Political: Government policies, political stability, and institutional transparency are essential to determine a company's operational environment. A country with investment-friendly policies and political stability offers better conditions for commercial expansion;

- Economic: In addition to the macroeconomic factors already discussed, it is important to consider the availability of financing;

- Social: Social trends, including demographic changes and cultural preferences, influence the demand for goods and services. Understanding how consumers will react to the offered products and services is crucial for commercial success.

- Technological: Technological innovation is an engine of economic growth. A country with advanced technological infrastructure offers opportunities to leverage new technologies in production processes and final products;

- Legal: Local laws, intellectual property rights, and tax regulations are fundamental to operate in safety and compliance. The protection of investors' rights and legal stability are determining factors.

- Environmental: Environmental issues, including regulations on emissions and sustainability policies, are becoming increasingly important. Companies must adapt to these requirements to operate responsibly and profitably.