The US trade deficit on the brink of Trump's inauguration

On the eve of newly elected President Donald Trump's inauguration at the White House, an overview of the trade deficit in the U.S. goods balance

Published by Marzia Moccia. .

United States of America Economic policy Importexport Trade balance Global economic trends

With the return of newly elected President Donald Trump to the White House, January 20 will mark the beginning of a decisive phase for U.S. and international trade policy agendas.

As announced during the election campaign, one of the priorities of the new administration will be to strengthen protectionist policies against China and, more broadly, against the major U.S. trading partners, including traditional allies, particularly targeting those with which the U.S. has significant trade deficits.

These campaign promises, which must face the test of reality this year, have introduced a crucial uncertainty factor in shaping the economic scenario of the near future, with significant impacts not only on the U.S. but also on the entire global landscape and the multilateral system as a whole.

Dynamics of the U.S. Trade Deficit

The United States has been one of the markets characterized by particularly rewarding performances in the post-pandemic period, especially for Italian companies. However, it has simultaneously become a prime example of so-called “decoupling” and friend-shoring policies, having inaugurated a return to increasing protectionism with the trade and technology war against China in 2018. While U.S. tariff policy has certainly led to a gradual "decoupling" from China, the need to diversify supply sources, combined with increasing global competitiveness, has strengthened the market presence of other supplier countries.

An interesting aspect to explore pertains to the current trade balances between the U.S. and the rest of the world, identifying those trading partners with which the U.S. has significant trade deficits, which are likely to attract greater attention from the new Trump administration.

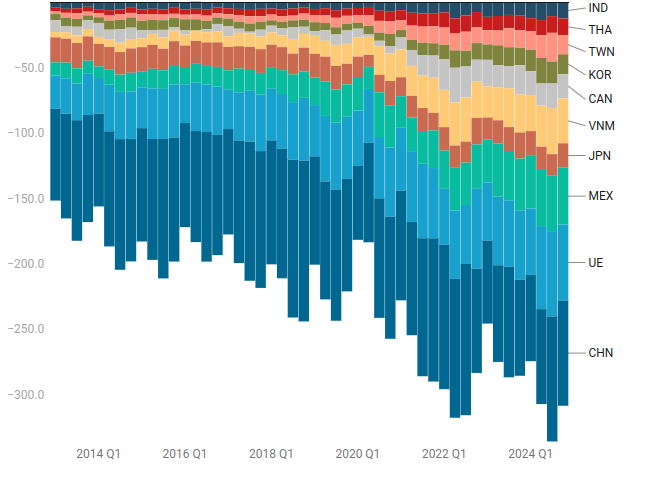

The chart below shows the quarterly historical series of the U.S. trade balance in goods (equal to U.S. imports of goods net of corresponding American exports to the country) segmented by different trading partners.

Fig.1: U.S. Trade Balance Deficit in Goods by Partner Countries

(billion $, quarterly data)

Source: ExportPlanning

The first point to highlight concerns the Land of the Dragon: the phenomenon of commercial "decoupling" from China has indeed led to a modest reduction in the trade deficit with China, which decreased from over $430 billion in 2018 to just over $314 billion at the end of 2024. However, the same cannot be said for other Asian economies.

Supplier countries that have progressively strengthened their commercial position in the U.S. market since 2018 include Vietnam (VNM), South Korea (KOR), Taiwan (TWN), Thailand (THA), and India (IND).

The performance of Japan has remained significantly more stable, as despite being in Trump’s sights, the overall U.S. trade balance with Japan has not worsened.

On the western front, one of the countries that has carved out a significantly larger role as a U.S. supplier is Mexico (MEX), which has replaced China as the top trading partner. The U.S. trade balance deficit with Mexico has significantly worsened, increasing from $75 billion in 2018 to $170 billion in 2024. The U.S. deficit with Canada (CAN) has also worsened.

Another particularly interesting position is that of the European Union (EU): today, the EU is essentially the second-largest trading partner in terms of trade deficit after China and has also strengthened its role in the U.S. market. Compared to 2018, the U.S. trade deficit with the EU widened from $170 billion to $237 billion in 2024, increasing risks for future transatlantic relations.

Overall, despite the moderate reduction of the deficit with China, the differentiated pattern of trade relationship evolution has led to an increase in the U.S. trade deficit since 2018. It is estimated that the country will close 2024 with a trade deficit of over $1.23 trillion, compared to $900 billion in 2018.

Conclusions

Predicting the evolution of the United States' trade relations with the rest of the world under the leadership of newly elected President Trump is complex, as it will depend on how the announced policies are implemented and the approach taken in introducing new tariffs, whether broadly applied or targeted at specific goods. However, given the administration's stated goal of reducing the trade deficit, it is foreseeable that economic tensions with various global regions will intensify.

In this scenario, it is essential for the future to expand and diversify export markets while maintaining constant monitoring of international trade developments.