German Locomotive in Trouble: Signals from Market Imports

The nearby German market is undoubtedly a key focus of European economic conditions, given the ongoing significant economic weakness, which is particularly affecting the manufacturing sector

Published by Marzia Moccia. .

IMF Uncertainty Made in Italy Conjuncture Export markets Global economic trends

The neighboring German market is undoubtedly a focal point of European economic conditions, given the prolonged significant economic weakness, which is particularly impacting the manufacturing sector.

The economic indicators of what has been dubbed the "sick man of Europe" continue to signal general difficulties. After a GDP decline of -0.3% in 2023, the latest forecasts confirm another negative result for 2024, with a -0.2% according to the International Monetary Fund in its latest update on January 17.

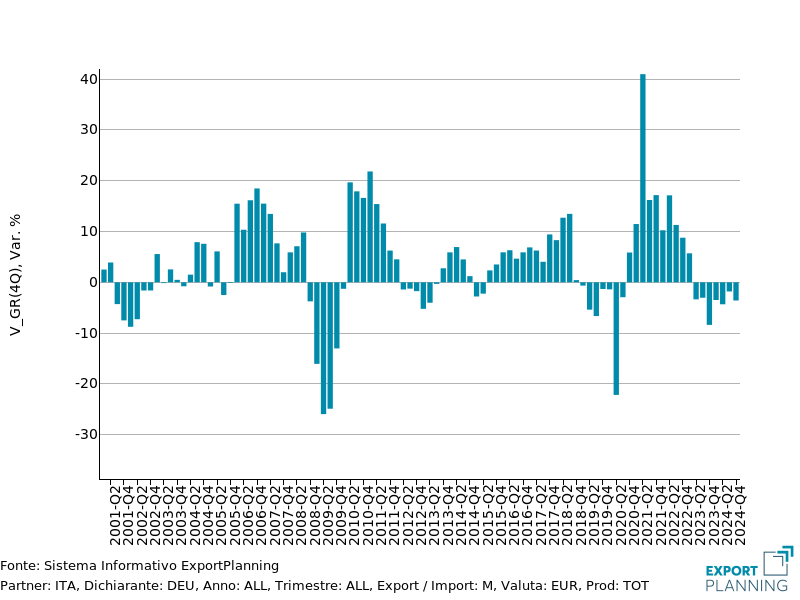

Furthermore, industrial production remains in decline, and the most recent publication of the Ifo Business Climate Index, which measures the perception of German economic agents regarding the current and six-month economic outlook, has confirmed the "chronicity" of this weakness, reaching its lowest level since May 2020. Specifically, for the manufacturing sector, this index—based on the combination of three indicators (order levels, inventory changes, and production expectations)—has shown a marked deterioration in both expectations and orders.

Fig.1 – Germany: Ifo Business Climate Index

Source: Ifo Institute

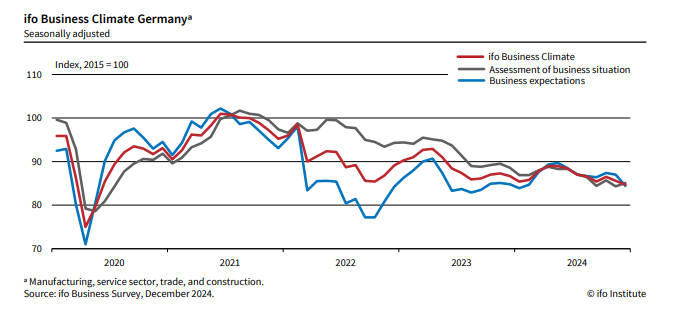

In light of the complex biennium just concluded, customs statistics on goods trade also document the slowdown of the German economy: after a 9.4% decline in imports in 2023, ExportPlanning pre-estimates forecast a 2024 closure with a 1.7% drop.

Fig.2 – Dynamics of German imports, year-on-year change

(annual series in euros)

Source: ExportPlanning Information System

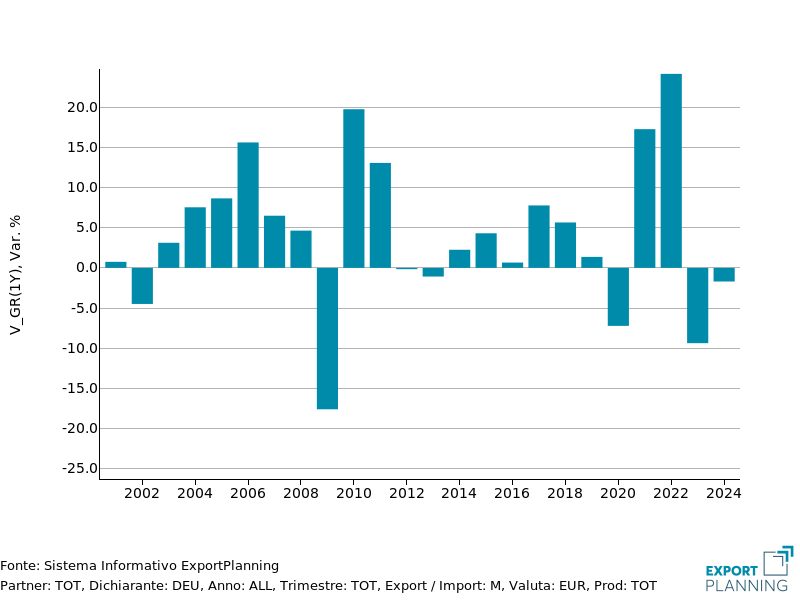

However, an interesting aspect pertains to the recovery signals visible starting from the second half of the past year, when the country's imports of goods returned to positive territory for the first time since 2022.

Fig.3 – Dynamics of German imports, year-on-year change

(quarterly series in euros)

Source: ExportPlanning Information System

In particular, the gradual rebound has been primarily driven by German imports of Consumer Goods (in yellow in the graph below), in line with the progressive recovery of consumption recorded by national indicators starting from the third quarter. To a lesser extent, but also improving, are imports of Raw Materials (in green), which, like Consumer Goods, were in positive territory throughout the second half of 2024.

Fig.4 – Dynamics of German imports by sector, year-on-year change

(quarterly series in euros)

Source: ExportPlanning Information System

Conversely, the situation remains challenging, albeit improving, for the demand for Intermediate and Investment Goods from abroad. Not surprisingly, for Italian exporters—who heavily rely on these segments in their export basket to the German market—the trade dynamics have not shown signs of recovery in the latest available quarters.

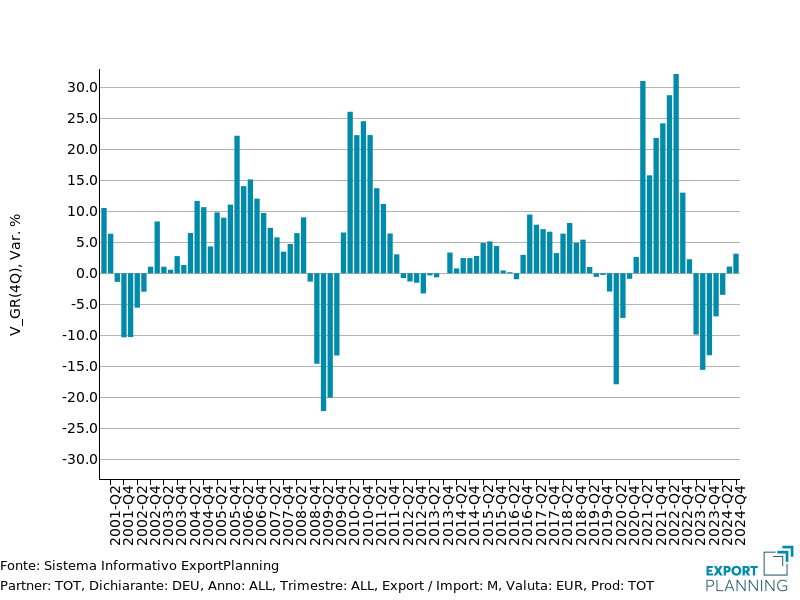

As illustrated in the following graph, German imports from Italy remain firmly in negative territory, closing 2024 with an overall decline of 3.3%.

Fig.5 – Dynamics of German imports from Italy, year-on-year change

(quarterly series in euros)