Global Trade: between recovery and new uncertainties

Published by Simone Zambelli. .

Global demand Check performance Conjuncture Global economic trendsAs highlighted on several occasions, 2023 marked a year of slowing global demand. This phenomenon was particularly significant during the first nine months of the year, during which, for the first time since the start of the post-pandemic expansion phase, international trade in goods experienced a contraction. The recently concluded year, 2024, progressively marked the transition toward recovery, although with a lower intensity than initially expected.

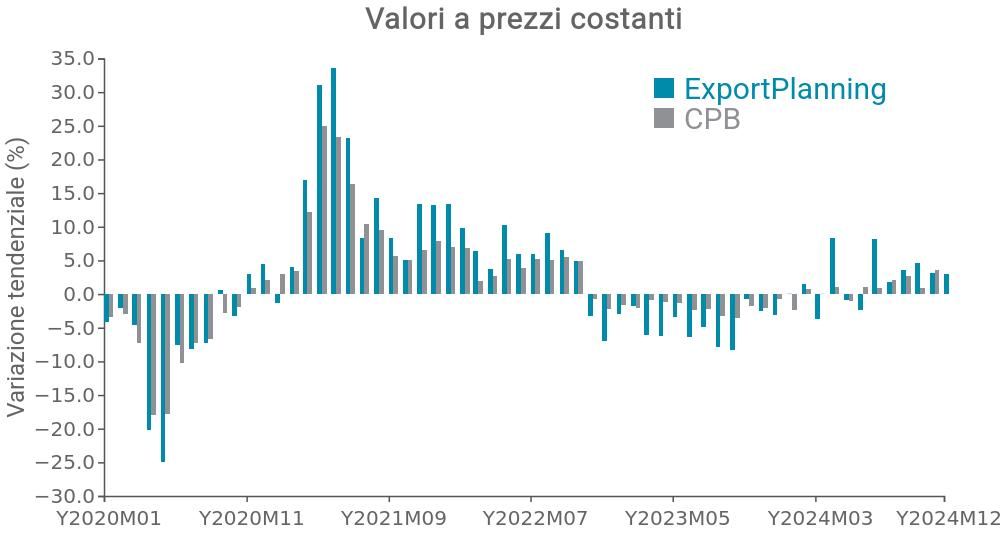

The phenomena just described are evident in Fig.1, which shows the series of monthly quarterly changes in global imports of manufactured goods at constant prices – a series adjusted for price and exchange rate dynamics – comparing data collected and systematized by ExportPlanning with those of the Central Planning Bureau, an institution that also collects and processes information on international goods trade.

Figure 1 - Global Demand in Quantity

(CPB data vs ExportPlanning data, year-on-year variation)

Source: ExportPlanning

Both sources help document how the restrictive pace of demand for manufactured goods gradually diminished in recent months, eventually reversing starting from the first quarter of 2024. This recovery in the quantities of traded manufactured goods characterized all months of the year, although with moderate intensity during the summer months and stronger recovery dynamics mainly concentrated in the second half of the year. The final data for 2024 confirm this trajectory: overall, ExportPlanning’s preliminary estimates report a recovery in global demand – measured as imports of goods by various international countries – of 2.2% compared to 2023.

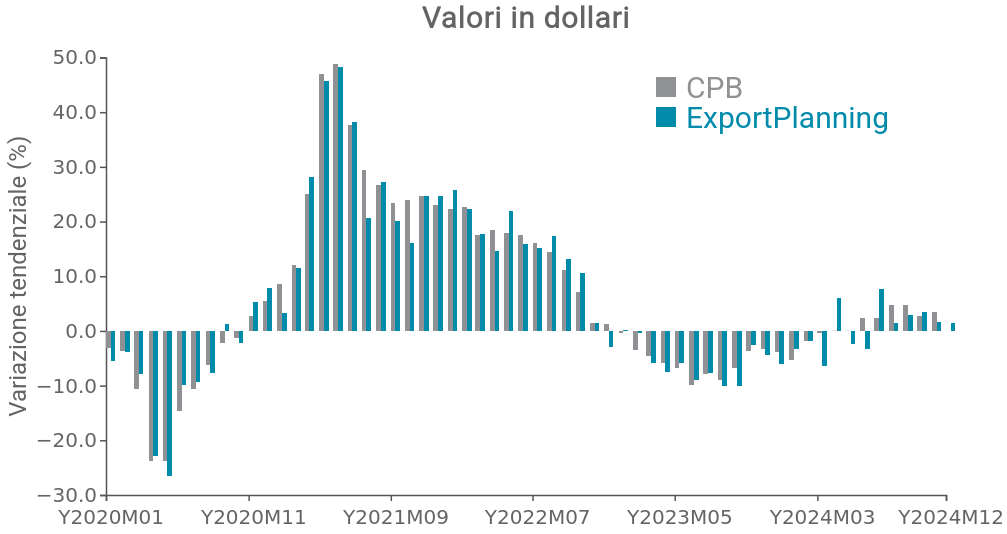

However, a key aspect of recent trends concerns the bifurcation between global trade trends in nominal terms and at constant prices. As also highlighted by the World Economic Outlook, the global economy is undergoing a significant disinflationary process. The gradual reduction of inflation has influenced the prices of raw materials and manufactured goods, reducing the impact of growth in monetary terms. Figure 2 illustrates the dynamics of global demand expressed in dollars, showing how the recovery was less pronounced in nominal terms compared to what was observed in constant price data.

Figure 2 - Global Demand in Dollars

(CPB data vs ExportPlanning data, year-on-year variation)

Source: ExportPlanning

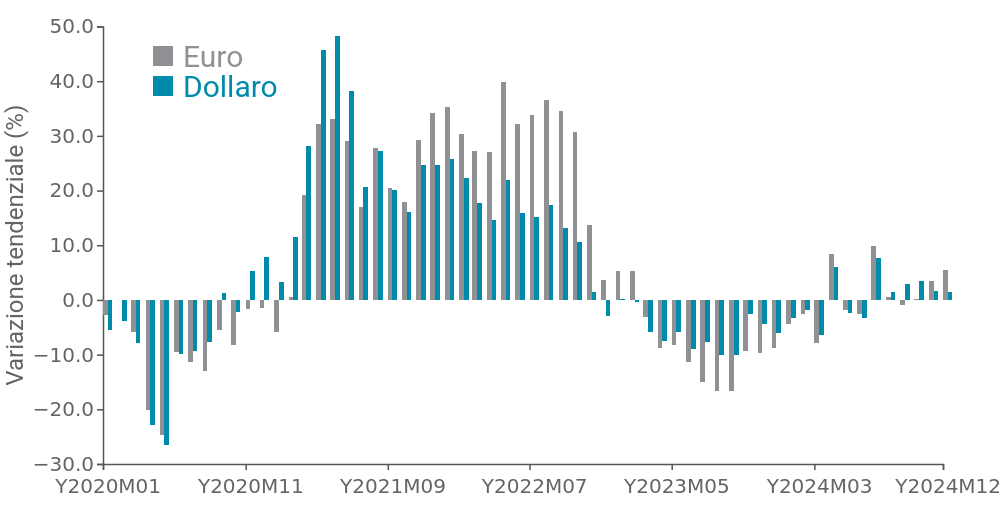

In nominal terms, ExportPlanning’s preliminary estimates indicate that year-end closure is expected to be around 1%. This figure is even less rewarding in euro terms due to the recent evolution of exchange rates, with a 2024 result of 0.5%.

Figure 3 - Global Demand: Dollars vs Euros

(ExportPlanning data, year-on-year variation)

Source: ExportPlanning

Conclusion

2024 certainly marked a turning point compared to the slowdown in 2023. However, the macroeconomic context remains particularly uncertain, influenced primarily by geopolitical factors and the fight against inflation, which does not seem to be completely over. The outlook for 2025 remains strongly dependent on the fate of multilateralism and the choices of the new Trump administration, given its strong belief in protectionist trade policies. The increase in tariffs on certain strategic sectors, the revision of existing trade agreements, and a more assertive approach toward China and the European Union could create new tensions in international trade. If geopolitical tensions remain under control and companies continue to invest in flexibility and innovation, 2025 could consolidate the recovery of global trade, paving the way for a phase of sustainable and balanced growth.