Trump's America and the Challenge to the Global Economic Order

Debt, the Dollar, and Deindustrialization: Why the U.S. Is Rethinking Its Economic Model

Published by Veronica Campostrini. .

United States of America Dollar Foreign markets Economic policy Foreign market analysisDonald Trump wasted no time. Upon returning to the White House, he made his goal clear: to rewrite the rules of the global economy. But what is driving this new strategy? And what will be the consequences for the United States and the rest of the world? Analyzing this shift is no easy task, not least because of the president’s often provocative statements. However, one thing is certain: America is changing course.

The Global Economic Shift of the 1980s and 1990s

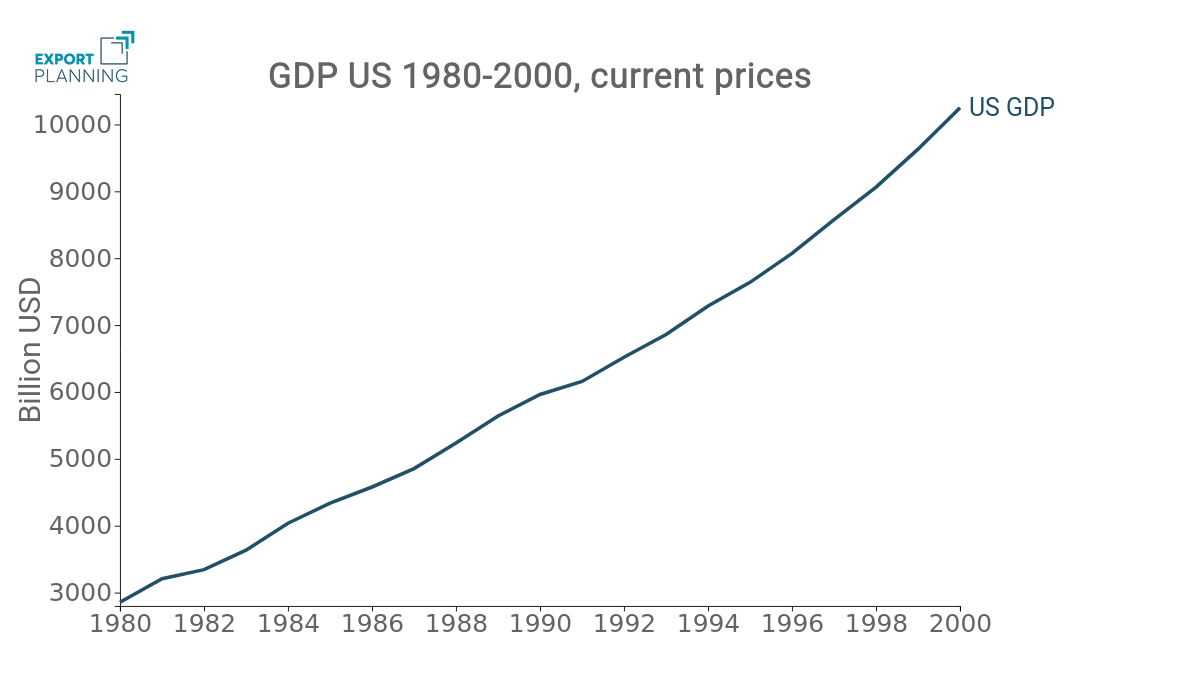

From the end of the Cold War to the early 2000s, the United States not only led the global economy but did so at a time of profound transformation. With the collapse of the USSR in 1991, Washington found itself without a geopolitical rival, consolidating its dominance just as the global economic order was undergoing a revolution. The European Single Market took shape in 1993, NAFTA expanded U.S. economic influence in 1994, and China—on a rapid ascent—was preparing to join the WTO in 2001, reshaping global trade dynamics.

At the same time, the Federal Reserve pursued expansionary monetary policies, cutting interest rates and fueling an economy driven by abundant liquidity and rising debt. The result? A steady process of deindustrialization, with manufacturing outsourced to emerging economies like China. Meanwhile, the dollar cemented its role as the cornerstone of the global monetary system, reinforcing Wall Street’s financial dominance. But no equilibrium lasts forever.

Pic.1 - Trend of U.S. GDP from 1980 to 2000

Source: ExportPlanning Analysis

Debt and the Dollar: A Fragile Balance

Between 1992 and 2024, U.S. public debt—adjusted for inflation—has surged by $31.4 trillion (Source: Fiscal Data - U.S. Treasury). Yet inflation has remained surprisingly contained, averaging just 2.5% annually with only occasional spikes. How was this possible?

The answer lies in imports: domestic demand, fueled by government spending and ample liquidity, was absorbed by a massive inflow of foreign goods, preventing inflationary pressures. Over the past 30 years, the U.S. trade deficit has accumulated to $20 trillion, yet the dollar has not only held firm but even strengthened.

The key to this apparent paradox is the dollar’s unique role in the global financial system. As the world’s primary reserve currency and the dominant medium for international transactions, the U.S. dollar is in constant demand from governments, investors, and markets worldwide. This structural demand has neutralized downward pressures, allowing the U.S. to accumulate debt, print money, and sustain record import levels without facing significant economic repercussions.

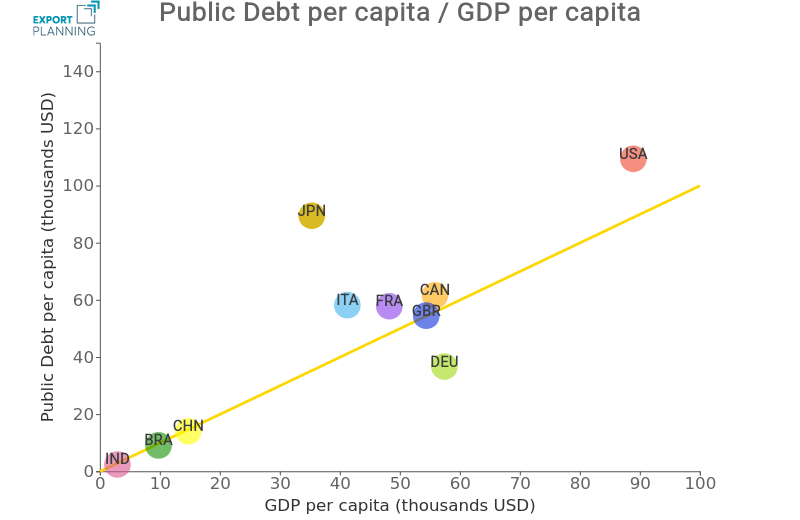

Pic.2 - Relation between GDP per capita and public debt per capita of economic global powers

Source: ExportPlanning Analysis

This dynamic is evident in the relationship between public debt per capita and GDP per capita across major global economies. As the chart illustrates, the U.S. stands out with an exceptionally high level of indebtedness, well above the bisector line. Japan, long known for its reliance on public debt, also ranks among the most indebted nations, while countries like Italy, France, and Canada show high but comparatively more moderate levels. This underscores a crucial reality: despite having one of the world’s highest GDP per capita levels, America's debt burden remains extraordinary—reinforcing the notion that the dollar’s role as the world’s reserve currency sustains this unique financial equilibrium.

Why Trump Wants to Change This Economic System

Four key factors are pushing the U.S. to rethink its economic model:

- Rising inequality: the system has favored financial elites while leaving millions of Americans behind.

- China’s rise: U.S. debt-fueled consumption has strengthened its primary geopolitical rival, both economically and technologically.

- Dependence on imports: while low inflation has benefited consumers, it has made the U.S. vulnerable to global supply chain disruptions.

- The decline of dollar dominance: after 30 years of monetary supremacy, the world is actively seeking alternatives to the U.S. currency.

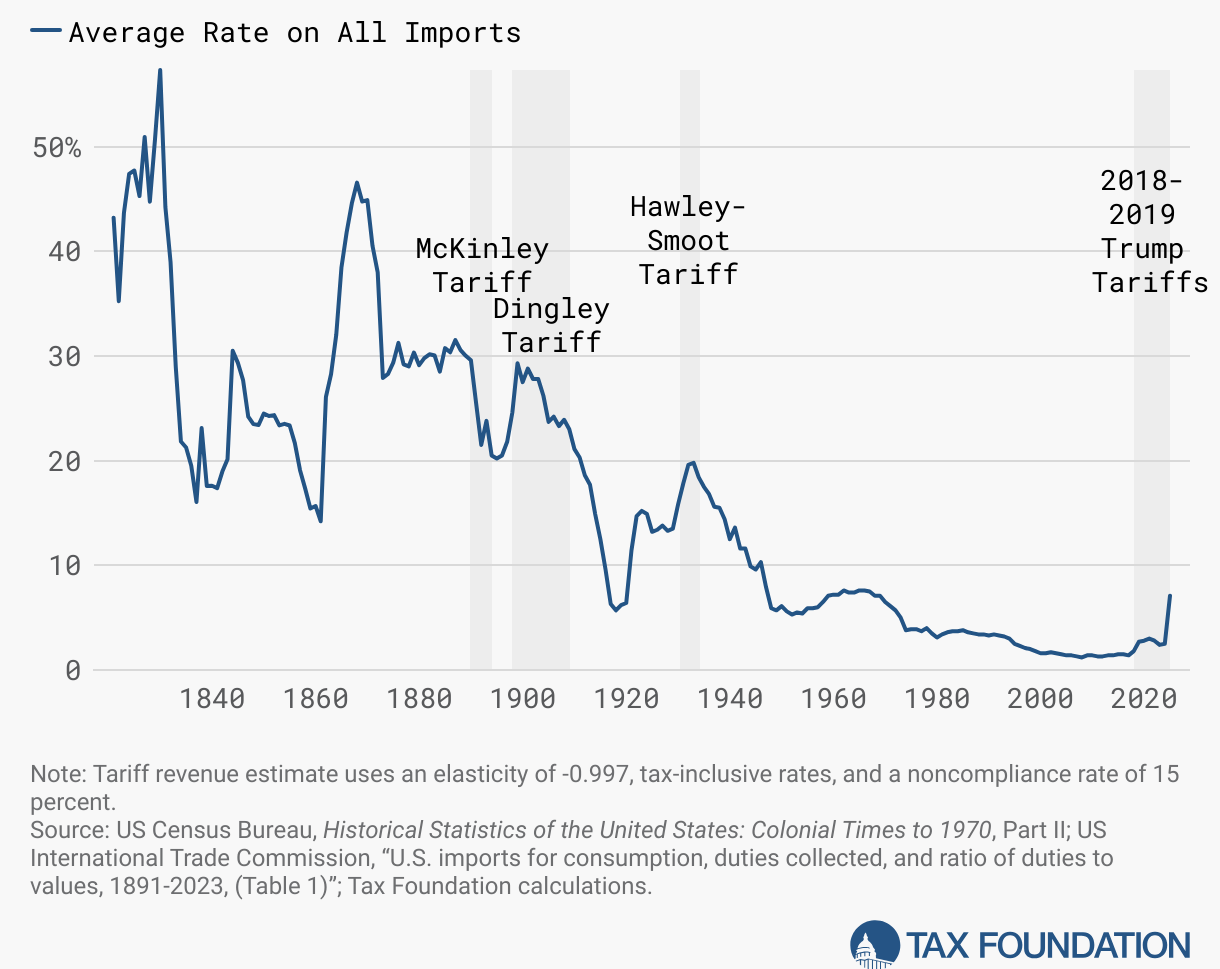

The Return of Protectionism

For the past three decades, America has sacrificed its manufacturing sector on the altar of globalization. The result? An economy dominated by services but incapable of delivering broad-based prosperity. The Rust Belt—Pennsylvania, Ohio, Michigan, Wisconsin—has borne the brunt of this shift: shuttered factories, job losses, and a deep sense of abandonment.

Now, Trump wants to reverse course. He has threatened to impose a blanket 10% tariff on all imports, with even higher duties targeting China. If implemented, these measures could push tariff levels back to their 1969 peak, triggering a new trade war and straining global supply chains. But the biggest risk is elsewhere: the return of inflation.

Pic.3 - Trend of average rates on all imports in history.

Source: Tax Foundation

Is the Dollar Really Untouchable?

For decades, the dollar has withstood every challenge to its supremacy. But the de-dollarization efforts led by China, Russia, and Saudi Arabia are gaining momentum. If credible alternatives—such as the yuan, a digital euro, or state-backed cryptocurrencies—gain traction, demand for U.S. dollars could decline. With inflation-adjusted public debt now at $35.5 trillion, a loss of confidence in U.S. Treasury Bonds could trigger a spiral of depreciation and instability.

A New Era of Uncertainty

For more than 30 years, the United States has fueled its growth with rising debt, printed money, and cheap imports. But cracks in this model are becoming increasingly evident. China’s ascent, growing domestic discontent, and the erosion of dollar hegemony are forcing Washington to reconsider its global role.

The Trump administration’s response? Less international cooperation, more protectionism, and an unprecedented level of economic and geopolitical pressure. Whether this strategy will mark the beginning of a new global equilibrium or a high-stakes gamble that rattles markets remains to be seen.

One thing is certain: the world is entering an era of unprecedented change. And the consequences will be unavoidable.