Trump's tariff war: opportunities for Italian food in Canada

Alcoholic beverages, milk, yogurt, and cheese among the Italian sectors with the greatest potential in Canada

Published by Silvia Brianese. .

Trade war Food&Beverage AgribusinessThe trade strategy of the Trump administration increasingly seems to favor uncertainty and threats of trade restrictions, although it is becoming more difficult to understand the real intentions behind the tycoon's tariff threats.

The threat of Trump's tariff axe has primarily fallen on America's "historic" allies: Canada and Mexico. The measure, announced shortly after his arrival at the White House and postponed for a month after both countries committed to doing more against fentanyl trafficking and the entry of irregular migrants across the U.S. border, proposes the introduction of new tariffs on all non-energy goods (with a rate of 25%) and on all energy-related goods from Canada (with a rate of 10%). This is in addition to the 25% tariffs on all U.S. imports of aluminum and steel.

If these measures are confirmed, they could have a significant impact on the North American economy, given the strong trade interdependence among these countries. In light of these uncertainties, trade relations between the U.S. and Canada could deteriorate, and Canada might consider diversifying its imports by involving other partners, such as European countries. However, for this to happen, there must be compatibility between the supply available in the U.S. market and that of other potential partners.

To this end, consider, for example, the food sector, in which Italy and France already have a well-established presence in the Canadian market, positioning themselves as potential alternative suppliers should the United States introduce trade restrictions and Canada decide to impose retaliatory tariffs against the U.S.

Italy’s current position in the Canadian food market

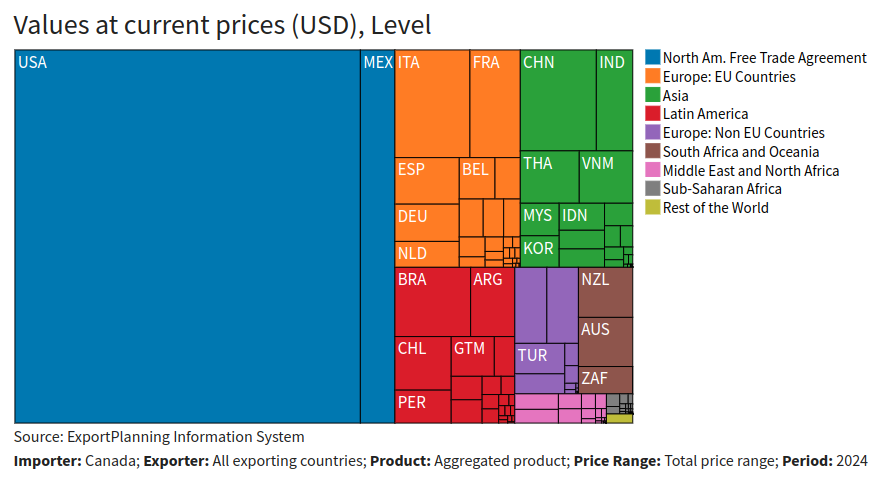

Analyzing Canadian food imports by exporting country, it is evident that, after the U.S. and Mexico, Italian agri-food products hold a significant position in the Canadian market, surpassing French exports (see the following chart).

With over 25 billion dollars in exports in 2024, the United States accounts for more than half of Canada's food imports, both packaged and unpackaged. Italy, on the other hand, with 1.5 billion dollars in exports, ranks third after the United States and Mexico. In recent years, Italian imports have been supported in part by the CETA (Comprehensive Economic and Trade Agreement), which is currently in provisional application and has reduced tariff barriers on numerous Italian agri-food products. In a scenario of potential trade restrictions between the U.S. and Canada, this agreement could further strengthen Italy’s position in the food sector: indeed, if Ottawa were to diversify its supply sources to reduce dependence on the United States, Made in Italy products could benefit, increasing their market share and consolidating Italy as a reliable trade partner.

Food industry sectors of opportunity for Italy in Canada

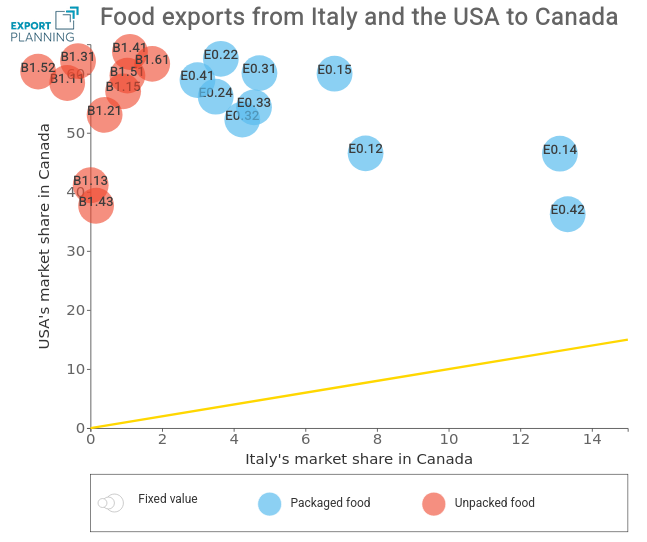

By analyzing the market shares of Italy and the United States across various sectors of the Canadian food industry for 2024, some key areas emerge where Italy could strengthen its presence if Canada were to impose tariffs on food imports from the United States.

The following chart illustrates the market share held by Italy in the Canadian market (x-axis) and that held by the U.S. (y-axis).

While in the B1 sector (intermediate and final unpackaged food products), Italy's export share to Canada is relatively low, the E0 sector (packaged food and beverages) presents interesting opportunities. Specifically, segments where Italian export shares are comparable to those of the United States include:

- Alcoholic beverages (E0.42)

- Milk, yogurt, and cheese (E0.14)

- Oil and other condiments (E0.12)

- Rice and pasta (E0.15), although with a slightly lower share.

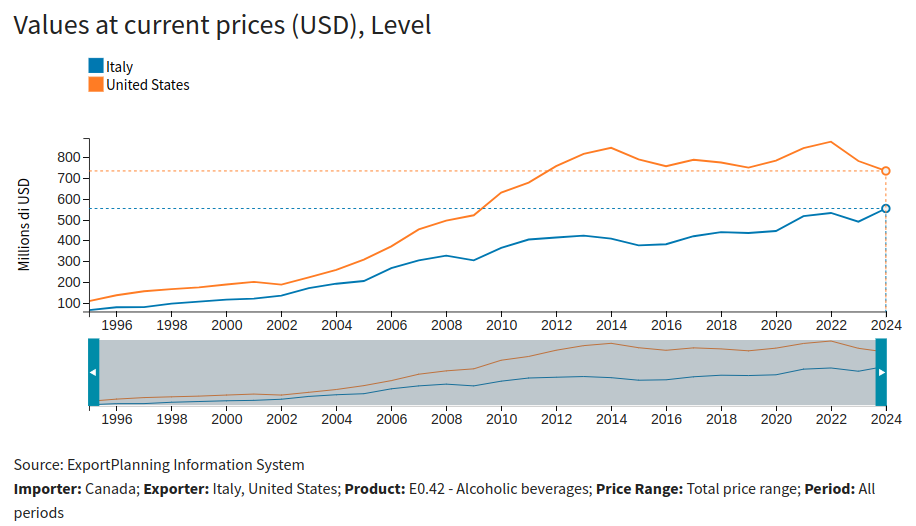

Notably, when comparing the historical trends of Italian and U.S. alcoholic beverage exports to Canada, there has been a steady increase in Italian exports since 2017, the year CETA came into effect. Over the past two years, this growth has accelerated even further, suggesting a strengthening position for Italian wine products, driven by the recognition of their quality and value.

Conclusions

In a context of increasing instability in global trade dynamics, fueled by Trump's tariff war, the Italian food sector could find growth opportunities in a strategic market like Canada. By taking advantage of the tensions between Ottawa and Washington and leveraging the strong international reputation of Made in Italy products, Italian businesses could strengthen their presence in the Canadian market.

Therefore, in response to U.S. protectionist policies, Italian companies could see these changes as a potential advantage, carefully evaluating alternative markets to the United States for their exports.