Trump's trade war and the import rush

Published by Simone Zambelli. .

United States of America Import Conjuncture Global economic trends

Based on the latest data released by the U.S. Census Bureau and incorporated into the ExportPlanning Information System, U.S. imports reached unprecedented record levels in December 2024. Trump's electoral victory has indeed driven businesses and consumers to stock up in advance, in response to the protectionist threats from the new administration.

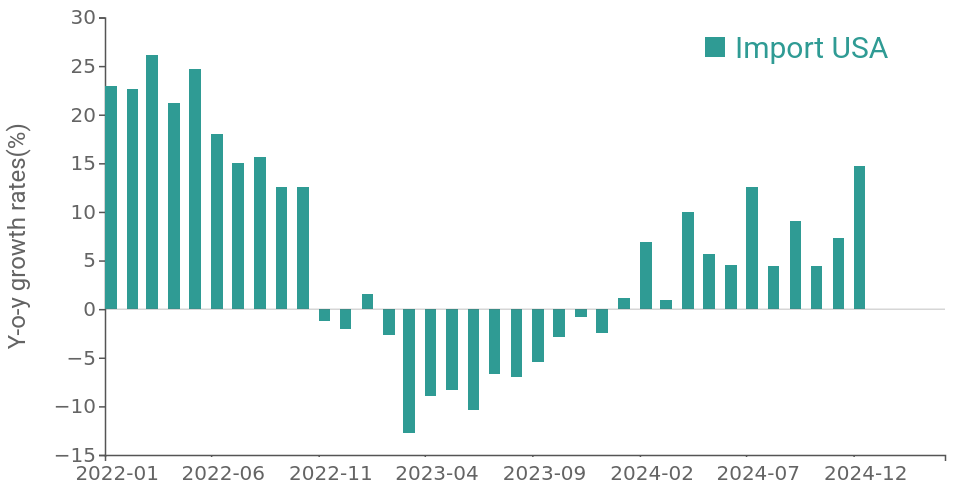

The following chart illustrates this phenomenon, showing the series of monthly trend variation rates of U.S. imports from January 2022 to December 2024.

Figure 1 - Monthly Trend Variation of U.S. Imports

Source: ExportPlanning

It is evident that the recovery, which characterized the market’s imports throughout 2024, culminated in the sharp increase in December, marking a 14.5% growth compared to December 2023.

The year-end surge is largely attributable to a so-called "stockpiling effect," where businesses and importers advanced their purchases amid great uncertainty regarding the evolution of trade relations between the U.S. and various global partners.

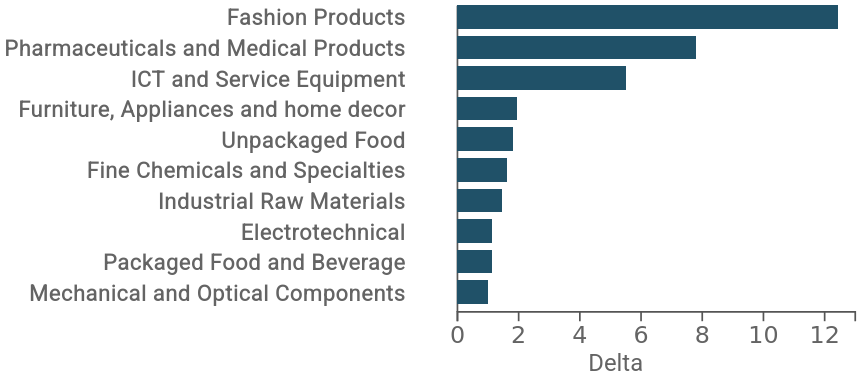

Sectoral segmentation highlights how this dynamic primarily affected high-value-added goods and essential products for the U.S. market, suggesting that importers adopted targeted strategies to ensure supply continuity without facing excessive price increases.

The following chart highlights the sectors that contributed the most to the increase in imports between December 2023 and December 2024.

Figure 2 - Absolute Change in U.S. Imports by Key Sectors

(December 2024 – December 2023, billion dollars)

Source: ExportPlanning

The sector that recorded the highest increase is Finished Products for Personal Use, a category that includes consumer goods such as clothing, accessories, and luxury products. This trend suggests that retailers and distributors have anticipated purchases in expectation of potential future tariffs. Not surprisingly, the commercial partner where this phenomenon has been most evident is Switzerland, an increasingly important logistics hub for major luxury brands.

The second sector with the most significant growth is Health Products and Equipment, a strategic segment with strong supply chain ties to key European trading partners such as Switzerland, Germany, and Italy.

The third sector by growth is ICT Equipment and Services, indicating an acceleration in imports of hardware, electronic components, and digital devices. This sector naturally reflects the technological war with the Chinese giant and highlights the strong dependence of U.S. supply chains on Asian technology, given the increasing role of economies such as Vietnam, Malaysia, and Taiwan.

Conclusions

Trump's protectionist policy, aimed at reducing dependence on foreign supplies and boosting domestic production, has triggered a typical business behavior: advancing purchases to avoid price increases and ensure supply continuity. However, while in the short term companies have sought to take advantage of a window of opportunity to import goods at lower costs, in the long term a "normalization" of this phenomenon is expected.

The so-called "stockpiling effects," typical of periods preceding the introduction of new tariffs, also reflect economic operators' concerns about the ripple effects of these measures on the U.S. economy. The increase in prices for imported goods could translate into higher costs for consumers, impacting household purchasing power and business competitiveness. Secondly, international trade relations could be affected by protectionist policies, leading to possible retaliatory actions from U.S. trading partners.

It will be crucial to monitor data in the coming months to understand the overall impact of these measures on U.S. economic growth. While the Trump administration aims to strengthen domestic industry, it remains to be seen whether U.S. companies will be able to offset the reduction in imports with domestic production sufficient to meet demand. 2025 is shaping up to be a crucial year to assess the actual implementation of the new administration's threats and the related consequences of this "return to protectionism."