The EU-US arms trade: an opaque market

Un'analisi delle informazioni di commercio estero disponibili a fronte della sfida del riarmo europeo

Published by Veronica Campostrini. .

United States of America Europe Foreign market analysisA Re-Arming Europe: Between Official Declarations and Shadow Zones

With the announcement of the €800 billion ReArm Europe plan, presented on March 4 by European Commission President Ursula von der Leyen, the issue of European rearmament has gained new prominence. At the center of the debate is the EU's historical dependence on the United States for defense.

Since the end of World War II, Europe has delegated much of its security to NATO’s umbrella and, in effect, to U.S. military power. However, with growing transatlantic tensions and uncertainty surrounding the new Trump administration, the EU has realized the need to strengthen its strategic autonomy. One of the key questions is: how dependent is Europe on the American arms industry?

To answer this, we analyze foreign trade data and customs information, a method that allows for a more objective measurement of trade volumes across the Atlantic.

A Sector Designed to Stay in the Shadows: The Peculiarity of Customs Information

Unlike other markets, the arms trade operates in a gray area where economics, diplomacy, and military strategy intertwine. Transactions are often shrouded in secrecy and subject to government authorizations, making it difficult to accurately track their volume. Many transfers bypass official channels, while private intermediaries and specialized companies facilitate confidential agreements between governments and private entities. Not infrequently, weapons are moved through third countries, evading controls and regulations, and even when available, data is often fragmented for national security reasons.

Despite these challenges, international trade statistics represent one of the richest sources of economic information on different countries worldwide, characterized by unique aspects:

- A Globally Shared Customs Classification

All countries use the same goods classification system: the Harmonized System (HS), developed and maintained by the World Customs Organization. This allows for the comparison of data across different countries. Additionally, the richness of European customs data enables further segmentation of these flows (CN), adding another level of detail. - Dual Measurement of the Same Trade Flow

The most important feature of this data is dual measurement. Every trade flow between two countries is measured twice, independently: it is recorded both at the customs of the exporting country and at the customs of the importing country. This dual measurement is fundamental for trade analysis, as it not only provides economic insights but also allows for an assessment of data accuracy. If a given trade flow presents two independent measurements (one by the exporter and one by the importer), it becomes statistically more robust.

Both aspects offer a significant advantage in analyzing an "opaque" market like the arms trade.

The Customs Classification of Armaments: Weapons and Dual-Use Products

When discussing the arms trade, the breadth of customs information allows us to divide it into two main categories:

- Weapons and Military Equipment: These are specifically designed for defense, including firearms, ammunition, tanks, warships, and aircraft. Notably, there is ambiguity in the customs classification of military aircraft: while exports are recorded, their military use is not explicitly stated. For this analysis, therefore, available commercial data, referring to aircraft in general, has been used.

- Dual-Use Products: These are technologies and components that can have a dual purpose, both civilian and military. Examples include advanced software, microchips, sensors, or special materials that can be used in both industrial sectors and sophisticated weapons systems. The dual nature of these products makes them difficult to categorize alongside the previous category, as tracking their end use is complex.

Dual Declaration: The ExportPlanning Method

The ExportPlanning approach allows for the measurement of the EU’s import declarations of these product categories from the United States, comparing them with the export declarations from U.S. customs. This method can be broken down into three phases:

- Collection and integration of customs information published by major international statistical offices

- Comparison between export and import declarations of the same trade flow (Mirror Flow)

- Identification of potential discrepancies

This process helps uncover trade triangulations, intentional omissions, and strategies to bypass restrictions.

European Imports from the USA: A Growing Trend

In the fourth quarter of 2024, European imports of weapons, military equipment, and dual-use products reached a value of $1.548 trillion.

Based on the previous methodological clarifications, we can now map the significance of the United States in supporting European defense.

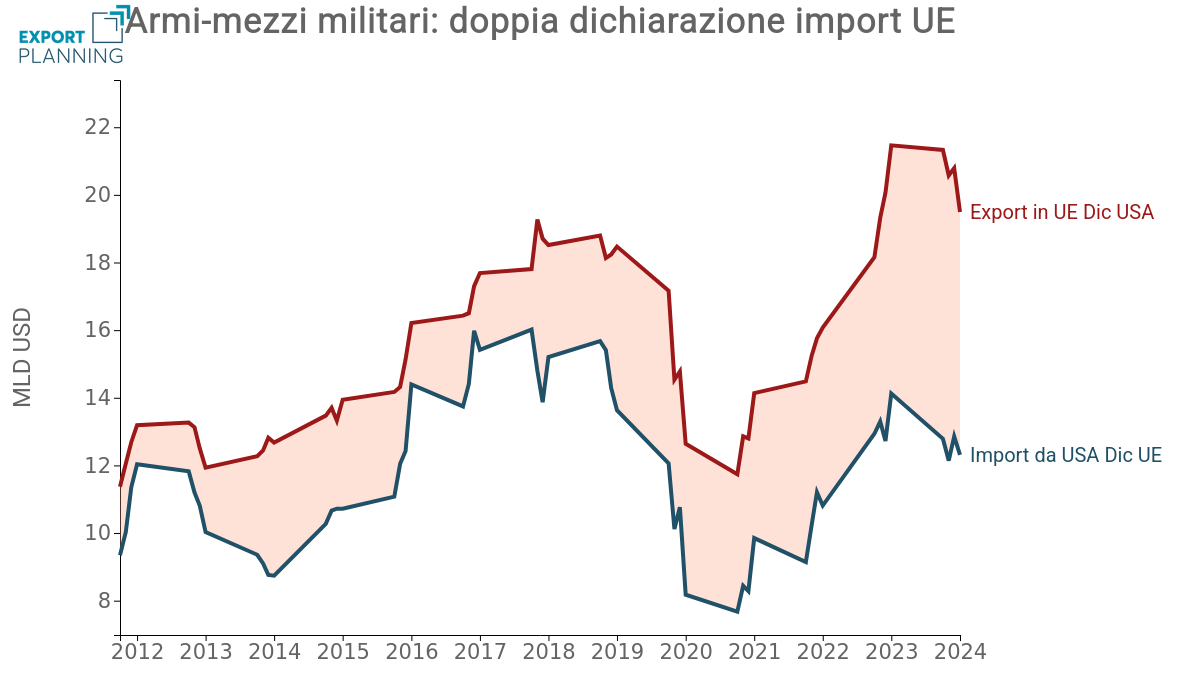

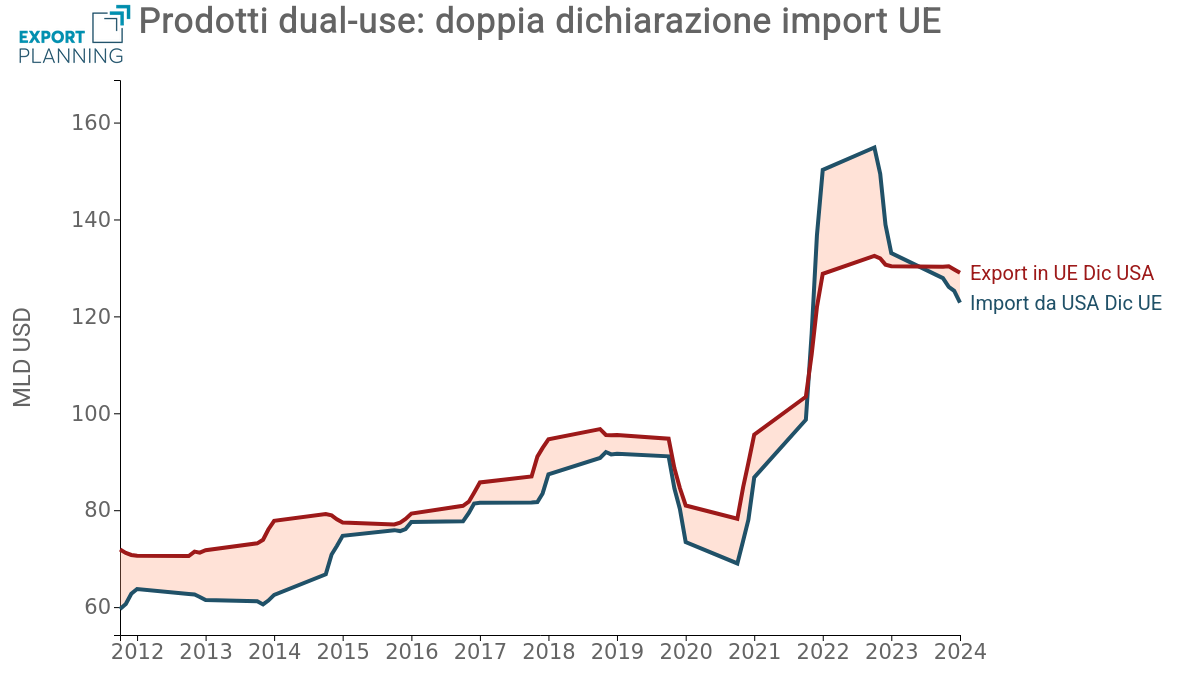

ExportPlanning’s data analysis provides an overview of trade dynamics across the Atlantic, highlighting in red the export data for arms recorded in U.S. exports and in blue the import data recorded in the EU.

Arms and Dual-Use Products Trade

|

|

Source: ExportPlanning elaboration

It is notable that while the volume of arms imports from the United States to the EU has significantly increased since 2022, there are significant discrepancies between the data reported by the U.S. and that recorded by the EU. This phenomenon is clearly visible in the provided graphs, which highlight persistent differences between the two data sources.

In particular, the gap between imports declared by the EU and exports declared by the U.S. appears to be more pronounced in the category of weapons and military equipment, whereas for dual-use products, the discrepancy is less marked. However, the growth of trade in a strategically important sector like dual-use products raises challenges in terms of traceability and transparency.

Overall, it is evident that the United States remains the primary supplier of weapons and military equipment to Europe. In 2024, American-origin arms and dual-use products accounted for approximately 30% and 8.5% of total European imports in these sectors, respectively. Even more significant is the trend over the past decade: in the weapons and military equipment sector, the share of imports from the U.S. has increased by ten percentage points, signaling a growing dependence of the EU on American suppliers.