European export trends: instability and divergences at the end of 2024

Despite mild signs of recovery, european exports remain weak and fragmented

Published by Simone Zambelli. .

Slowdown Export Europe Conjuncture Global economic trends

Over the past two years, the European Union's exports have shown a slowdown, reflecting the deceleration of global trade in goods and the resulting difficulties faced by the area’s leading export economy: Germany.

The initial signs of a slowdown that emerged in 2023 later evolved into a structural decline, affecting intra- and extra-EU exports to varying degrees. The year 2024 has undoubtedly brought some signs of recovery, although the overall picture remains uncertain and uneven across different Member States.

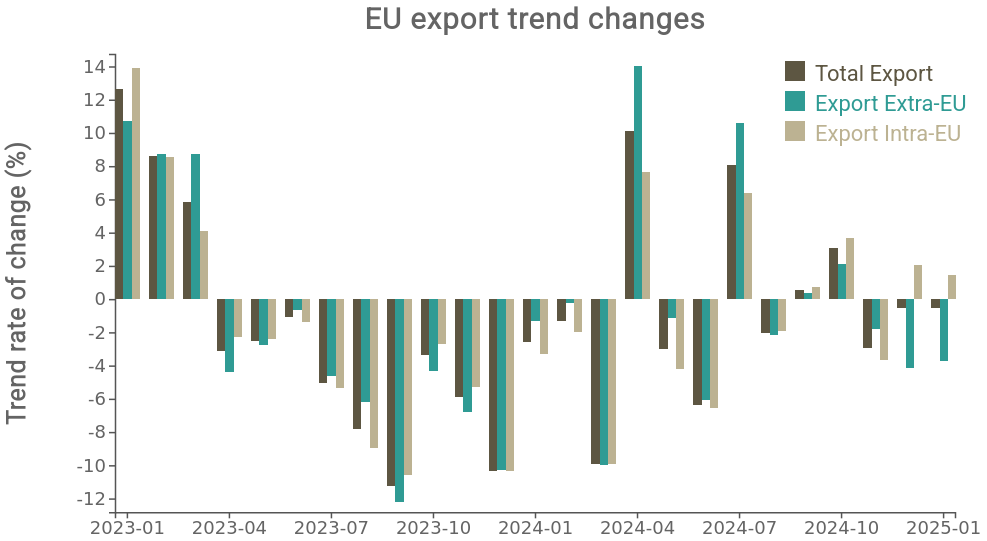

The following chart analyzes the monthly trend of EU exports, distinguishing between total exports, exports to non-EU countries, and intra-EU exports.

Source: ExportPlanning

Following the decline seen in 2023, it is clear that the pace of export recovery has been highly volatile throughout 2024, despite rather optimistic expectations for the year. The recovery, therefore, cannot yet be considered "solid" and reflects the ongoing weaknesses of EU economies. In particular, the end-of-year total for European exports remained essentially at 2023 levels (-0.8%), with extra-EU exports performing better (-0.2%) than intra-EU ones (-1.2%). However, it is worth noting that in the past two months, intra-EU exports have reversed the trend, unlike extra-EU exports, which have fallen into negative territory.

National performances

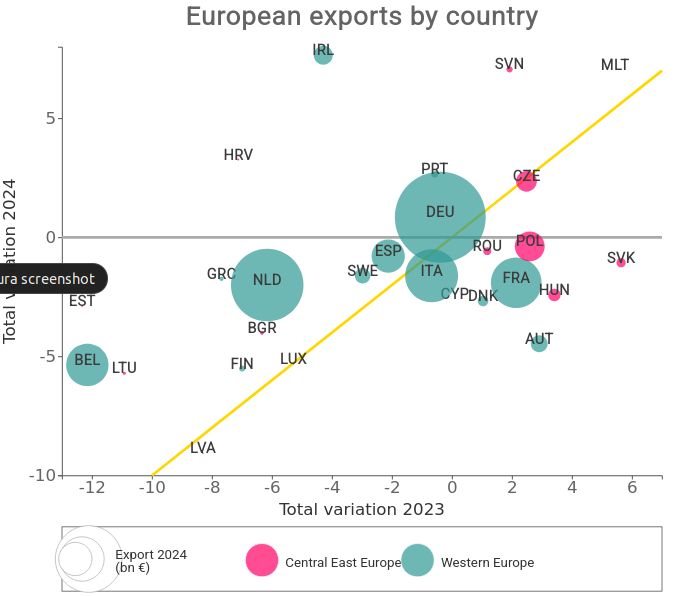

The following chart shows a comparison between the annual change in exports for each EU country in 2023 and the change in 2024. The size of the bubbles represents the export value in 2024, while the colors distinguish Central-Eastern Europe (pink) from Western Europe (green).

Source: ExportPlanning

The yellow line represents the bisector: countries located along it in 2024 maintained a growth rate similar to that of 2023; the bubbles above the line represent countries that improved their performance compared to the previous year, while those below indicate a worsening trend.

In the top-right quadrant are the countries that achieved positive results in both years: this is the case, for example, of Slovenia (SVN). In the bottom-left, we find countries with negative performances in both 2023 and 2024, such as Belgium (BEL) and the Baltic Republics (Estonia, Latvia, and Lithuania), which show persistent difficulties.

All major European exporting economies (Italy - ITA, Germany - DEU, Spain - ESP) cluster around zero, essentially confirming the results of 2023.

On the decline, however, are the economies of France - FRA and Austria - AUT.

A particularly interesting fact is the loss of momentum in 2024 experienced by several Eastern European economies, which had ended 2023 in negative territory. The ongoing difficulties in the automotive sector and German industry appear to have negatively impacted export dynamics in this region. The only exception is the Czech Republic - CZE.

Conclusions

The balance of the 2023–2024 biennium for European exports is relatively heterogeneous, with signs of a partial recovery.

The growing volatility of the global scenario, geopolitical fragmentation, and ongoing technological transitions (such as digitalization and the green transition) represent both a threat and an opportunity for the European system. The year 2025 will be crucial to understand whether EU exports will be able to regain structural balance or remain hostage to global uncertainties.