The export of Prosecco PDO in light of Trump’s new tariffs

Which alternative markets for Prosecco PDO following the new U.S. tariff measures

Published by Silvia Brianese. .

Export Importexport Italy Uncertainty Made in Italy United States of America Foreign markets Export markets Foreign market analysisFollowing the D-Day of April 2, the Italian wine sector finds itself once again facing a situation similar to what was experienced in 2019, during the first Trump administration: the introduction of new tariff measures on wine exports to the United States, one of the main destination markets for Italian wine.

As discussed in the article "Transatlantic Relations and Trump Tariffs", the U.S. market plays a key role in Italian alcoholic beverage exports, representing the highest share among agri-food products exported to the USA.

The new tariffs impose an overall rate of 10% on European goods, effective from April 5, along with an additional 10% rate that has currently been suspended for 90 days. Among the affected products is also Prosecco PDO, an excellence of Made in Italy with a well-established presence in the U.S. market and growing global popularity.

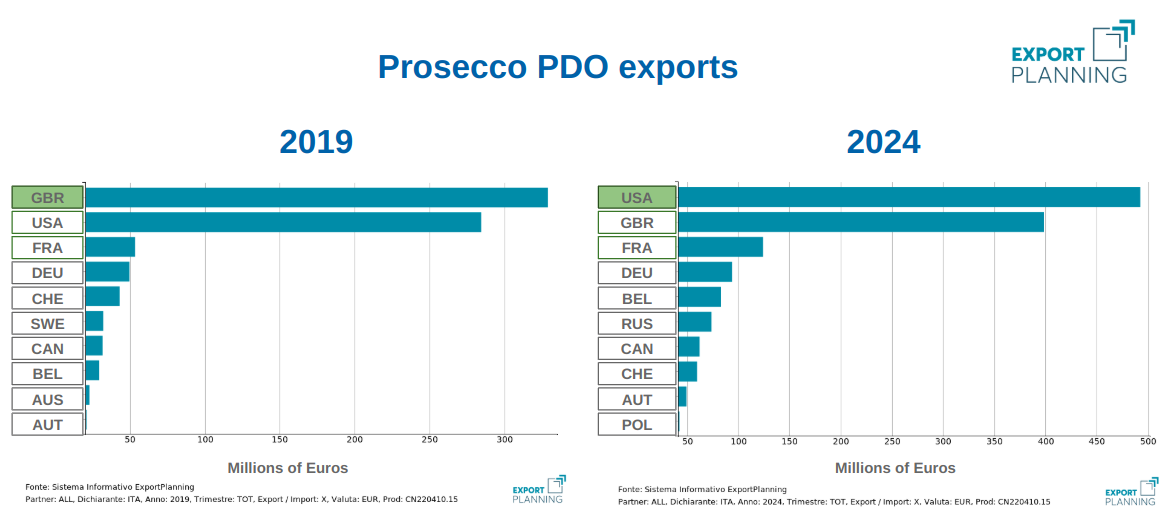

From the United Kingdom to the USA: How the World's Main Prosecco Importers Have Changed

In 2019, the United Kingdom was the leading destination for Prosecco PDO exports. Five years later, partly due to the United Kingdom's exit from the European Union, the situation has changed significantly: in 2024, the United States leads the list of importers of the famous Veneto sparkling wine, with an import value close to 500 million euros, followed by the United Kingdom, France, and Germany.

The U.S. demand for Prosecco appears to be growing rapidly, both in volume and in quantity. In particular, the amount of Prosecco exported to the United States in 2024 far exceeds French Champagne exports, with around 107 million liters exported compared to the 19 million liters of the French competitor.

Furthermore, as shown in the table below, it is interesting to note that approximately 40% of Prosecco exports destined for Non-EU markets go to the United States. This is a significant share that, in light of the new tariff measures introduced during D-Day, could have a major impact on Prosecco sales abroad.

Percentage Impact of Prosecco PDO Exports by Geographical Area

| Year | Intra-EU (%) * | Extra-EU (%) ** | USA share of Extra-EU (%) *** |

|---|---|---|---|

| 2024 | 33% | 66% | 40% |

Source: Elaborations by StudiaBo on ExportPlanning database

* Share of Prosecco exports to Intra-EU markets out of total Prosecco exports

** Share of Prosecco exports to Extra-EU markets out of total Prosecco exports

*** Share of Prosecco exports to the USA out of total Prosecco exports to Extra-EU markets

The Current Conditions of the U.S. Prosecco Market

The success of Prosecco in the United States has primarily been driven by a strategy focused on increasing production volumes, which has allowed it to be positioned in a mid-to-low price range, around €4 per liter. This makes Prosecco more accessible, but at the same time, more vulnerable to substitutions by alternative products, especially when compared to “premium” sparkling wines like Champagne, which occupy much higher price ranges. This vulnerability becomes particularly evident in a context of tightening trade policies: Prosecco, being prone to substitution, risks suffering significant impacts on sales if tariffs are not absorbed through margin reductions or if U.S. demand elasticity proves to be high.

In this scenario, the need to explore new export opportunities for Prosecco becomes even more crucial, targeting alternative markets to reduce exposure to protectionist policies and maintain export growth.

What Other Destinations for Prosecco Exports?

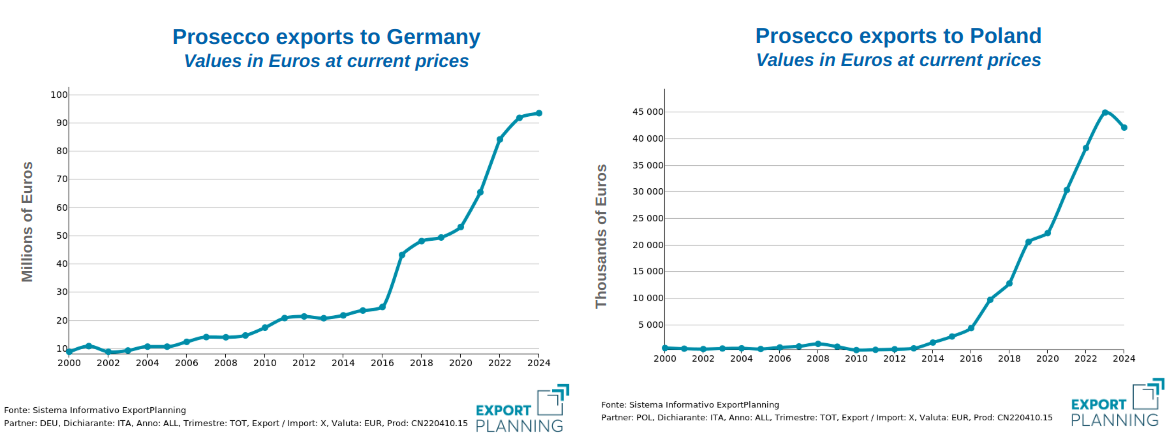

Looking at Intra-EU countries, in addition to France, the Germany, Poland, and Switzerland markets are particularly interesting, as they have been consistently increasing their imports of Prosecco PDO in recent years, also thanks to its competitiveness compared to alternatives like French Champagne.

Trends in Prosecco exports to Germany and Poland

(Annual cumulative)

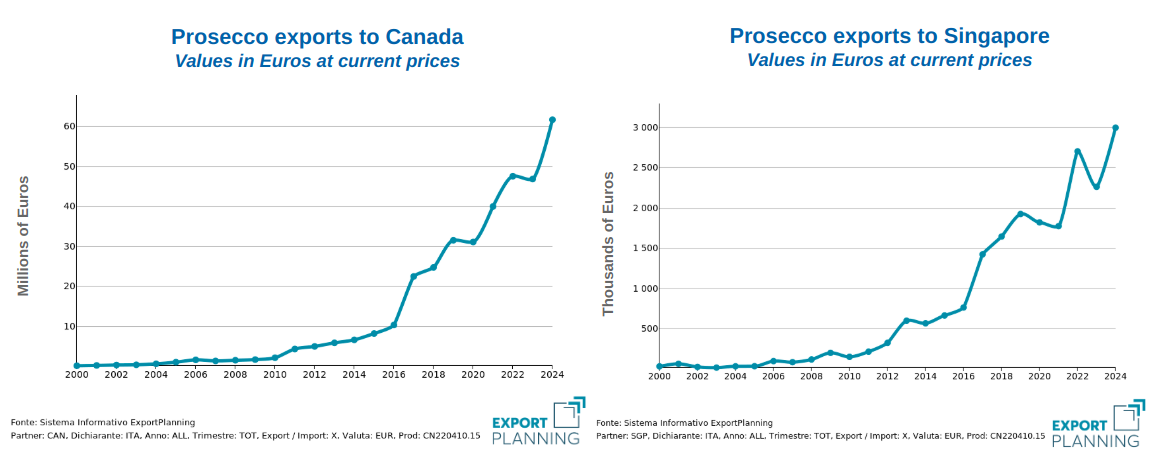

On the Extra-EU front, among the major growing importers are Canada and some Asian markets, particularly Singapore and Hong Kong, which are showing increasing interest in Prosecco.

Trends in Prosecco exports to Canada and Singapore

(Annual cumulative)

Conclusions

The current trade scenario between the United States and Europe has brought the spotlight back onto the vulnerability of some key sectors of Made in Italy, including Prosecco PDO. The significant importance of the U.S. market for Prosecco's Extra-EU exports represents a structural weakness in an environment increasingly prone to political and commercial instability.

In this context, it becomes more desirable for Italian companies to expand their presence in other high-growth emerging markets, such as those in Asia, or to strengthen their position in already receptive areas, like European markets and Canada.

A geographical diversification strategy would not only help contain commercial risks but also further enhance the appeal of the Italian brand on the international stage.