How to Prepare for Tariffs with an Effective Pricing Strategy

Price elasticity of demand as a tool for defining a smart pricing policy

Published by Simone Zambelli. .

International marketing International marketingThe 90-day suspension of U.S. tariffs represents a strategic opportunity for Italian companies exporting to the American market: it allows them to analyze and proactively plan the most effective strategies to manage the impact of tariff increases on the prices of exported products.

A tariff is a tax applied to imported goods. The increase can be managed in various ways along the value chain: it can be fully passed on to the final customer, partially or totally absorbed by the importer, distributor, or exporter. Depending on the choices made by the various actors involved, the final effect on consumer prices may differ significantly from what would be expected from a purely mechanical application of the tariff increase.

The definition of the optimal strategy depends on a key economic variable: the price elasticity of demand. In other words, how much does the demand for a product respond to a change in its price?

If demand is highly elastic (i.e., very sensitive to price changes), it is in the interest of all actors in the value chain (exporter, importer, and distributor) to cooperate and absorb part or all of the tariff, in order to keep the final price competitive. On the other hand, if demand is inelastic (i.e., not very sensitive to price), it may be more efficient to pass the tariff cost on to the final consumer, with limited negative effects on sales volume.

Price elasticity of demand can be classified into five main categories, each corresponding to a "recommended" pricing strategy:

| Price Elasticity of Demand | Recommended Pricing Strategy (percentage of tariff absorbed by the value chain) |

|---|---|

| Near zero | 0% |

| Less than 1 | 25% |

| Approximately 1 | 50% |

| Between 1 and 3 | 75% |

| Greater than 3 | 100% |

The percentage of the tariff absorbed by the value chain (and therefore not passed on to the final customer) associated with the different "optimal" pricing strategies should be considered a reasonable approximation. Precise calculation, in fact, requires a detailed understanding of the company's cost structure and of the factors driving its variation. Only the two extremes of the strategy range can be considered robust values.

If price elasticity of demand is close to zero, this means that demand will change only marginally in response to a final price increase. In such a case, no actor in the value chain has an incentive to absorb even part of the tariff.

Conversely, when demand is highly elastic, even a small price increase can lead to a sharp drop in demand. In this context, the most convenient strategy is for the value chain to absorb the entire tariff: the reduction in unit margin is preferable to the risk of a collapse in total revenue, which—given fixed costs—could quickly turn into economic losses for the various players involved.

To choose the most appropriate strategy, it is therefore essential to know the price elasticity of demand for your product. This article focuses on the method for reliably estimating that elasticity, providing a sound basis for pricing decisions.

Factors Determining the Price Elasticity of Demand

Typically, the calculation of the price elasticity of demand for a product is based on econometric estimates of how demand has changed in response to price variations in the past. These estimates can be carried out at the sector level and then adapted to the specific product offered by the company.

In this particular case, however, such an approach is not feasible: the proposed tariff increase by the Trump administration represents a unique historical event with no recent precedent in the available data. In the absence of comparable historical series, it is necessary to adopt an alternative approach based on identifying the key factors that influence the price elasticity of demand for a specific product.

Economic literature identifies several key elements that influence the degree of price elasticity of demand:

- Product differentiation: The more a product is perceived as unique or distinctive compared to competitors, the lower the customer's sensitivity to price increases—especially if the price increase is justified by features that are recognized and valued.

- Market appreciation for quality and variety: In markets where consumers place a high value on quality or product variety, demand tends to be less elastic, as price is not the primary driver of purchase decisions.

- Competitors’ pricing strategies: Demand sensitivity is often more influenced by relative price than absolute price. If competitors are also forced to raise their prices (e.g., due to the same tariffs), the impact of a price increase by a single company will be reduced.

Product Differentiation

Each company should have a clear understanding of the degree of product differentiation recognized by the market. This is a specific, internal insight that cannot be generalized or derived from external sources or aggregate industry data. Only the company itself can evaluate this aspect based on its knowledge of its customers and product positioning.

Appreciation for Variety and Quality

One effective way to measure how much a market values product variety and quality is to analyze sales distribution across price ranges. If a significant share of the market consists of high-end or upper-mid-range products, this indicates that consumers are willing to pay more to obtain specific features or higher quality. In such markets, demand tends to be less sensitive to price changes.

Competitors’ Pricing Strategies

An estimate of competitors' likely pricing strategies can be derived by analyzing the average tariff increase they are expected to face. Since companies competing in the U.S. market originate from various countries, this average can be calculated by weighting the tariffs by the relative importance of imports from each country.

A Summary Map

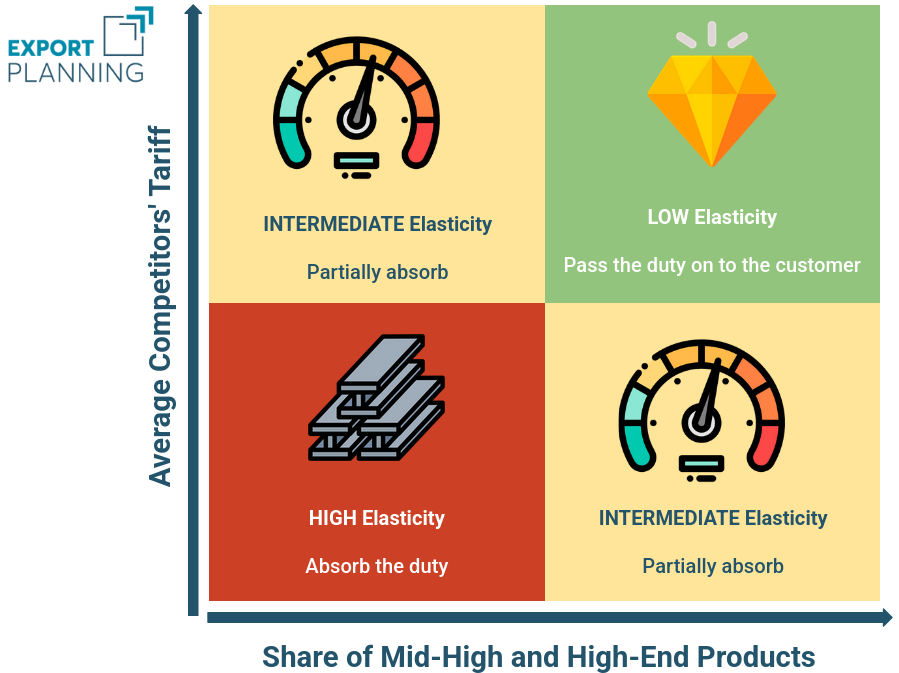

By combining two variables—the market share of high-end and upper-mid-range products, and the expected average tariff applied to foreign competitors—it is possible to construct a matrix with four quadrants:

Fonte: ExportPlanning

- Top-right quadrant: high share of high-end/upper-mid products and high average tariffs for competitors. Assuming a similar level of product differentiation, these products are likely to face low price elasticity of demand, suggesting that companies can transfer most or all of the tariff cost to the final price.

- Bottom-left quadrant: low share of high-end products and low average tariffs for competitors. Products in this area are likely to face high price elasticity of demand, requiring companies to absorb most of the tariff within their own cost structure.

- Intermediate quadrants: these represent mixed situations where, depending on the level of product differentiation, the optimal strategy may involve absorbing part of the tariff and passing on only a portion to the customer.

Conclusions

Italian companies are facing a decisive moment: the suspension of tariffs offers valuable time to plan how to deal with a potential increase in export costs to the United States. The key to deciding whether to absorb or pass on these costs lies in the ability to anticipate the market’s reaction to price changes—in other words, understanding how sensitive demand is.

Without relying on historical data, it is essential to analyze some structural aspects of one's positioning: how distinctive the product is, how much the market values quality, and whether competitors will also be affected by price increases. The combination of these variables provides insight into the "strength" of one’s pricing power.

In the next article, we will present a concrete mapping of sectors and products based on these criteria, to help companies better understand where they stand across different possible scenarios. It will be a practical tool to guide decision-making in uncertain times.