Fashion Products: after the last two years of high uncertainty, which destinations have high potential for 2025?

Opportunities from markets undergoing structural growth of imports in the industry

Published by Silvia Brianese. .

Fashion Uncertainty Foreign markets Export markets Foreign market analysisIn 2024, a new slight decline in world trade of Fashion Products in euro values...

Last year, world trade in finished products for the person1, after having marked a decline of 3.6 percentage points in euro values in 2023, confirmed a disturbed dynamic, with a final result of -0.2 percentage points according to the ExportPlanning pre-estimates (on values of 1362 billion euros, over 54 billion lower than those of two years earlier).

.. but slight growth in the measurement at constant prices

However, it should be highlighted that, net of price and currency dynamics (constant prices2), last year world trade in finished products for the person showed a recovery: after the drop of almost 2 percentage points recorded in 2023, the evolution of world trade measured at constant prices has, in fact, shown an increase of 3.2 percentage points on average in 2024, returning - thus - to absolute maximum levels.

In essence, also in 2024 - as already happened the previous year - average prices offered a negative contribution to the growth of world trade in finished products for the person, signaling a significant process of disinflation along the supply chain (overall -5.1% over the two-year period).

Despite highly disrupted turnover, the 2024 recovery in the measurement at constant prices involved almost all the main sectors of the Fashion industry

Last year, almost all the main sectors of the Fashion industry analyzed - with the exception of Jewellery and Watches - showed a recovery in the rate of development of international trade in the measurement at constant prices.

World trade in Fashion Products

| Values 2024E |

% changes at current prices |

% changes at constant prices |

|||

| Sector | (Bn €) | 2024/2023 | 2024/2022 | 2024/2023 | 2024/2022 |

| Outerwear | 301 | - 0.4 | - 7.0 | + 4.0 | - 5.3 |

|---|---|---|---|---|---|

| Jewellery and Watches | 254 | - 7.0 | - 4.7 | - 0.1 | +20.4 |

| Footwear | 150 | + 0.4 | - 5.0 | + 0.3 | - 8.5 |

| Underwear and Hosiery | 138 | + 5.5 | - 2.0 | + 8.2 | - 1.8 |

| Perfumes and Cosmetics | 118 | + 7.1 | +14.3 | + 7.0 | + 9.9 |

| Leather Goods | 78 | - 1.2 | + 1.6 | + 3.8 | + 2.9 |

| Lenses and Glasses | 32 | + 1.1 | + 0.9 | + 0.5 | - 7.6 |

| Other Fashion Products | 291 | + 0.8 | - 7.9 | + 4.7 | - 8.4 |

| TOTAL | 1 362 | - 0.2 | - 3.8 | + 3.2 | + 1.3 |

Source: ExportPlanning-Annual Trade Flows Datamart

In particular, the greatest accelerations involved the Underwear and Hosiery sectors (with global trade increasing by 8.2 percentage points compared to 2023 if measured at constant prices, recovering at least in part the penalties of 2023), Perfumes and Cosmetics (+7% compared to 2023 at constant prices, strengthening the positive trend already glimpsed in 2023), Outerwear (+4%, but without recovering the decline recorded the previous year) and Leather Goods (+3.8%, largely recovering the reduction experienced the previous year).

As for Jewellery and Watches, it is also true that 2024 has seen declines in values both in euros and - to a lesser extent - at constant prices, but the comparison with 2022 shows a large surplus in the measurement at constant prices (+20.4%).

It is also worth highlighting the only partial recoveries - after the penalties of 2023 and the moderate growth in 2024 - of world trade in Footwear (+0.3% last year in the measurement at constant prices, but -8.5% compared to 2022) and Lenses and Glasses (+0.5% in the measurement at constant prices, but -7.6% compared to 2022).

In euro values, the international outlook of the Fashion industry still appears far from solid

The quarterly evolution of global exports of finished products for the person denominated in euro (see the graph below) highlights, however, still a disturbed profile, with only the last quarter of 2024 showing a weak return to positive territory (after 6 consecutive quarters of trend declines in global sales of the sector in euro values).

In particular, the geographical profile of growth still appears uneven. Proof of this is the fact that at the end of 2024, many relevant markets show levels of imports in the sector that are significantly lower than those of two years earlier; above all United Kingdom (-9 billion euros), Belgium (-7 billion €), Germany (-6.1 billion €) and France (-3.4 billion €) in Europe; United States (-44.5 billion euros, equal to 15.3 percent), China (-7.5 billion euros, equal to 12.1 percent), Japan (-7.2 billion euros) outside Europe.

Fashion Products' Markets in the Growth Phase: some Case-Studies

The current global economic and political instability increasingly highlights the need to diversify destination markets for exporters, including finished products of the Fashion/Personal system. From this perspective, the use of a model based on machine learning techniques, applied to international trade data, allows us to identify those countries in which imports of specific products are experiencing a structural phase of growth3. These are, therefore, markets that offer the greatest potential for development in the export of finished products for the person.

From the analysis of the sectors of the Fashion industry, some expanding markets emerge, including Vietnam, Azerbaijan, Kazakhstan, Philippines, Serbia, Chile and Thailand, which are characterized by a large number of products whose imports are increasing.

The following table shows the number of products in the growth phase of imports from the seven countries analyzed, divided by the main sectors of the Fashion industry.

Number of products according to the Harmonized System (HS) classification

identified, for each country, in the phase of import growth

| Underwear and Hosiery | Outerwear | Clothing Accessories* | Jewellery and Watches | Sum of Sectors | |

| Vietnam | 31 | 56 | 9 | 7 | 103 |

|---|---|---|---|---|---|

| Azerbaijan | 6 | 27 | 10 | 9 | 52 |

| Kazakistan | 15 | 19 | 2 | 8 | 44 |

| Philippines | 8 | 23 | 3 | 3 | 37 |

| Serbia | 8 | 22 | 2 | 3 | 35 |

| Chile | 7 | 18 | 3 | 6 | 34 |

| Thailand | 7 | 9 | 1 | 2 | 19 |

Source: StudiaBo on ExportPlanning Information System

* Gloves, shawls, belts, ties, hats

Note: the table does not include all the sectors of the Fashion industry, but only those that record the highest number of products with growing imports

It should be noted that, in addition to the sectors described above, Vietnam, Philippines and Thailand are also experiencing a phase of structural growth in imports of Footwear, especially for sports shoes, rubber boots and sandals and slippers.

The results of the table are further confirmed by the analysis of the historical series of imports for each sector of the Fashion industry, focusing on the countries with the greatest number of growing products.

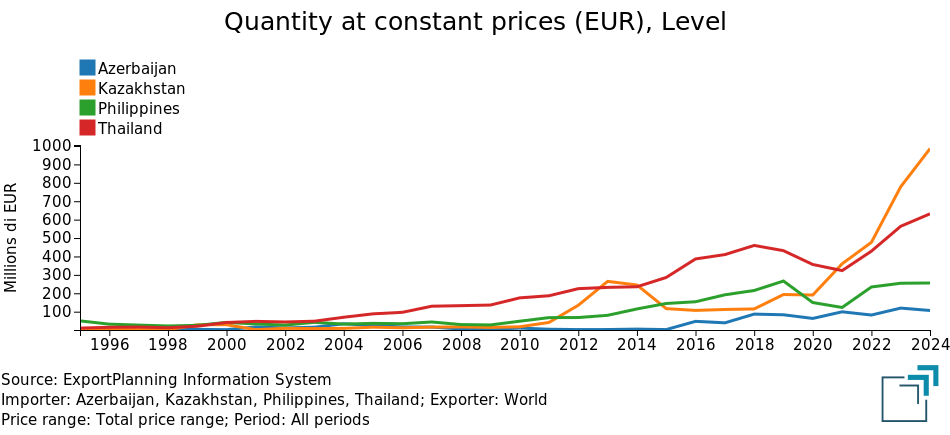

In particular, Azerbaijan, Kazakhstan, Philippines and Thailand emerge as markets in structural growth for Underwear and Hosiery imports, especially for nightgowns and pyjamas, slips and dressing gowns.

Underwear and hosiery: imports of Azerbaijan, Kazakhstan, Philippines, Thailand

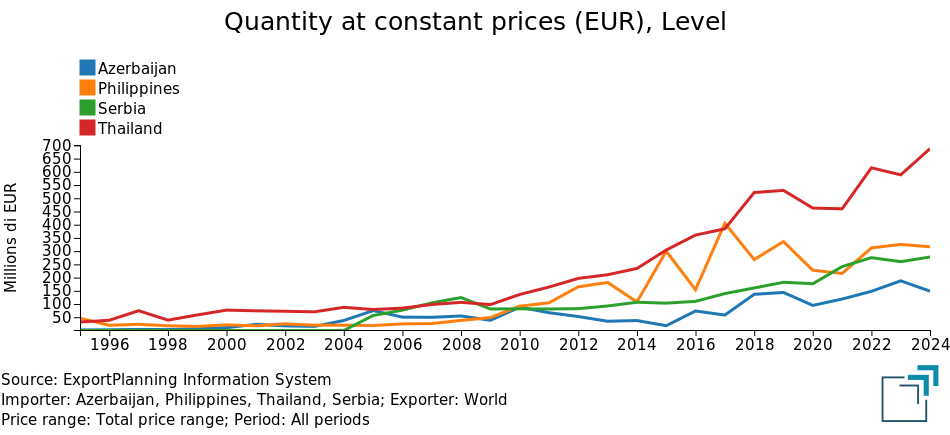

As for Outerwear, in addition to Azerbaijan, the Philippines and Thailand, Serbia also emerges as the market with the largest number of products undergoing structural growth in imports, with increasing demand especially for coats, jackets and windbreakers, swimsuits, trousers, tracksuits and one-piece suits.

Outerwear: imports from Azerbaijan, the Philippines, Thailand, Serbia

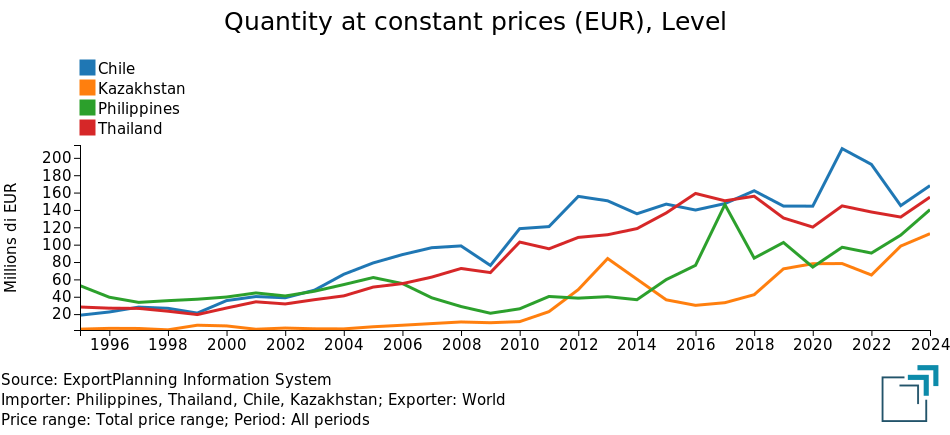

In the Clothing Accessories sector, Chile joins the list of markets undergoing structural growth, with particular reference to imports of knitted gloves and mittens, hats (headgear and other knitted headgear), shawls, scarves, foulards, neckerchiefs and ties.

Clothing accessories: imports from Chile, Kazakhstan, Philippines, Thailand

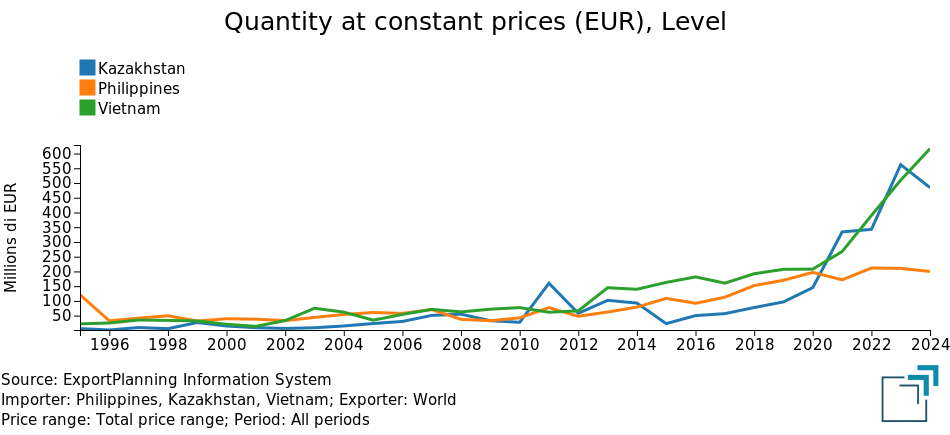

Finally, in the Jewellery and Watches sector, the markets with the highest number of products in the growth phase of imports are Vietnam, Kazakhstan and Philippines. The main categories of imports in expansion include jewelry in precious metals, self-winding wristwatches, as well as precious and semi-precious stones.

Jewellery and Watches: imports of Kazakhstan, Philippines, Vietnam

Conclusions

Despite some signs of recovery in world trade and the slow return to growth in exports of products from the Fashion/Personal system, the uncertain dynamics that characterized 2024, together with the current global economic tensions, confirm the importance of adopting a destination market diversification strategy.

In this context, it is strategic for exporters to both strengthen their presence in already consolidated markets and to be able to identify those foreign markets that are going through a phase of structural growth in imports, and which therefore offer greater development opportunities for exports.

These markets, in fact, are characterized by favorable dynamics, such as the entry of new players in distribution, investments in logistics, as well as imitative effects in consumer behavior, which contribute to accelerating the demand for foreign products.

To support this process, ExportPlanning adopts a data-driven approach based on machine learning techniques, already applied for the Household Products ("Household Products: after a recovery in 2024, which high-potential destinations for sectoral exporters?"), which allows to precisely identify the markets with the greatest development potential.

1) For a list of the sectors analysed, please refer to the relevant industry description.

2) The measure Quantities at constant prices (Q) includes a deflation operation, in which the historical series of monetary values (V) has been transformed into an analogous series of values expressed at constant prices, with a reference to a given year, known as the base year. For a description of the methodology applied, please refer to Database Ulisse: Methodological Note.