US Exports in Q1-2020: Best Performers

Some sectors of US exports grow in the first quarter of 2020

Pubblicato da Marcello Antonioni. .

Intermediate goods Industries Industrial equipment Home items Food&Beverage Fashion Conjuncture Global Economic TrendsIn the first quarter of 2020 (see ExportPlanning's pre-estimates based on the latest U.S. Census Bureau statistics) US exports have demonstrated an overall weak performance: compared to the same quarter of 2019, American exports of total goods recorded a slight decrease (-0.3% in USD values), for the fourth consecutive quarter.

Despite the negative performance of several sectors (Planes, Jewelry and Watches, Cereals, Brown Rice and Oilseeds, Basic Pharmaceutical Products and Agricultural Machinery, among the major ones), several others displayed excellent performance in Q1-2020. Below we will focus on the main sectors that grew in US exports in the first quarter of the year.

US Exports: Best Performers in Q1-2020

In Q1-2020 the most dynamic sectors for US exports (calculated in year-over-year delta values) are the following:- Energy Raw Materials1: +3,974 million USD y-o-y;

- Metalworking Machine Tools2: +1,299 million USD;

- Petroleum Products and Derivatives of Coal3: +1,081 million USD;

- Fresh and Frozen Meat4: +1,048 million USD;

- Precious Metals5: +698 million USD;

- Cars, Buses and Caravans6: +391 million USD;

- Engines and other Aircraft Components7: +341 million USD;

- Unprocessed Textile Fibres8: +329 million USD;

- Medical and Dental Instruments and Equipment9: +302 million USD;

- Chemicals for Industry10: +269 million USD.

Energy Raw Materials

In Q1-2020 US exports of Energy raw materials (+4 Bn USD y-o-y) attained record values (24.4 Bn USD).

Korea (+761mm USD y-o-y), UK (+616mm USD), Singapore (+488mm USD) accounted for the largest contributions to US exports of Energy Raw Materials in Q1-2020.

In particular, exports of Crude Oil (about 18 Bn USD in Q1-2020) have nearly closed the gap with imports.

Metalworking Machine Tools

The very good year-over-year performance (+1.3 Bn USD) of US exports of Metalworking machine tools in Q1-2020 is actually a recovery from the low levels reached in early 2019, but still below the 2018 highs.

Korea (+449mm USD y-o-y), Taiwan (+395mm USD) and China (+371mm USD) were by far the driving markets for US exports in Q1-2020.

Fresh and Frozen Meat

A quite remarkable growth trend was clear in Fresh and Frozen Meat (+1,048 millions USD year-over-year). The first quarter of 2020 marked a new high point for US exports in this sector, exceeding 1.5Bn USD in quarterly values for the first time ever.

China (+518mm USD y-o-y) and, to a lesser extent, Mexico (+231mm USD) were the top markets for increases of US exports in Q1-2020.

The sector's sales to the Chinese market confirmed record levels, after 2019, which had already seen particularly rapid increases (from 469 million USD in 2018 to 1420 million USD in 2019).

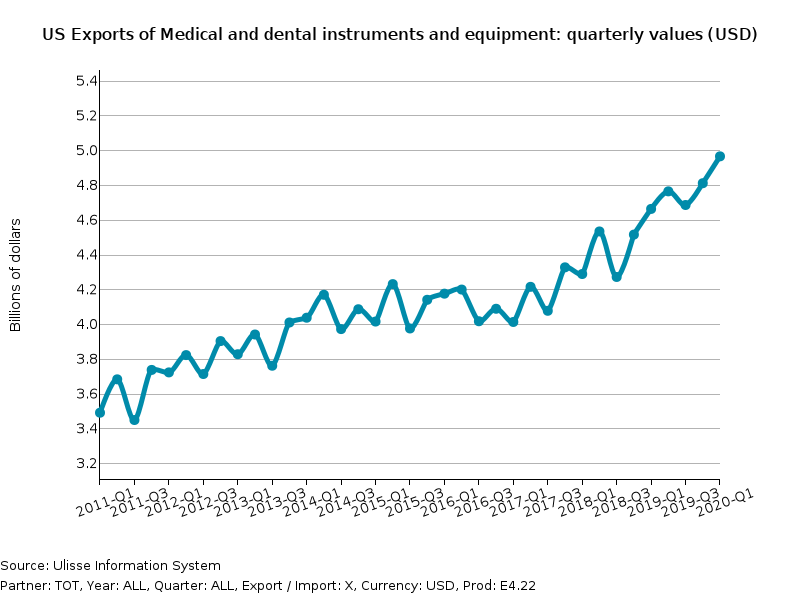

Medical and Dental Instruments and Equipment

Another sector that hit a new high point in US exports in the first quarter of the year, reaching a new high point in US exports, is Medical and Dental Instruments and Equipment, which reached the $5 billion threshold on a quarterly basis (+302 million USD compared to Q1-2019).

In this case, the major contributions to US exports came from Mexico, Belgium, Japan and Singapore.

Chemicals for industry

Last but not least, we must mention the positive performance of US exports of Chemicals for Industry, attaining a new record value in Q1-2020 (5.6 Bn USD), with an year-over-year increase of +269 millions USD.

China, Mexico and Taiwan made the largest growth contributions to the US Exports of this sector.

Conclusions

Without question, the sectors linked to commodities (energy, above all, but also feedstock and textiles) have certainly made significant contributions to the growth of US exports in Q1-2020; however, the first quarter of the year's trade data show significant growth (with maximum values) also for US exports from a few manufacturing processing sectors as well.

Although such positive performance is unlikely to be confirmed in the second quarter of a year full of unknowns given the current Covid-19 pandemic, they might be interpreted as a sign of relatively good health of the American industry, which can be put to good use once the current international health emergency has normalized.

1) The products here considered are listed in the following description table.

2) The products here considered are listed in the following

description table.

3) The products here considered are listed in the following

description table.

4) The products here considered are listed in the following

description table.

5) The products here considered are listed in the following

description table.

6) The products here considered are listed in the following

description table.

7) The products here considered are listed in the following

description table.

8) The products here considered are listed in the following

description table.

9) The products here considered are listed in the following

description table.

10) The products here considered are listed in the following

description table.