Market Share Analysis: US Machinery Exports in Positive Countertrend

The pandemic crisis brought about a generalized yet contained loss in market share for US industries

Pubblicato da Gloria Zambelli. .

United States of America Slowdown Industries Export markets Global Economic TrendsThe latest trade statistics confirm what has now been known for several quarters: US exports are experiencing a phase of difficulty, due to the pandemic market crisis (for a focus on the topic, see the previous article: "The Recovery Path of US Exports: Sector Analysis and Performance in the Year of Covid-19”). The availability of data on imports and exports up to Q4-2020 (see ExportPlanning World Trade Datamart) allows to analyze the current phase of slowdown and evaluate the performance of US exports compared to other countries.

In the following graph, the different US export industries are placed according to the Market Share recorded in 2019 (X-axis) and the change that took place in 2020 (Y-axis). The size of each ball is proportional to the value of exports in 2019.

Source: ExportPlanning, World Trade Datamart

Overall, most American industries lost market share in 2020. However, given that the pandemic outbreak has concerned almost all countries, the fall of market share does not appear dramatic: the major losses in terms of market share, recorded in the automotive area, amounted to about -2%.

On the contrary, Machinery (F4) and Natural Raw Materials (A1) bucked the trend, showing a good performace during 2020 with an increase in market share respectively of +0.9% and +1.7%.

In the next section, we will therefore provide an overview of the performance of US Machinery exports.

Machinery exports: trade dynamics and market share

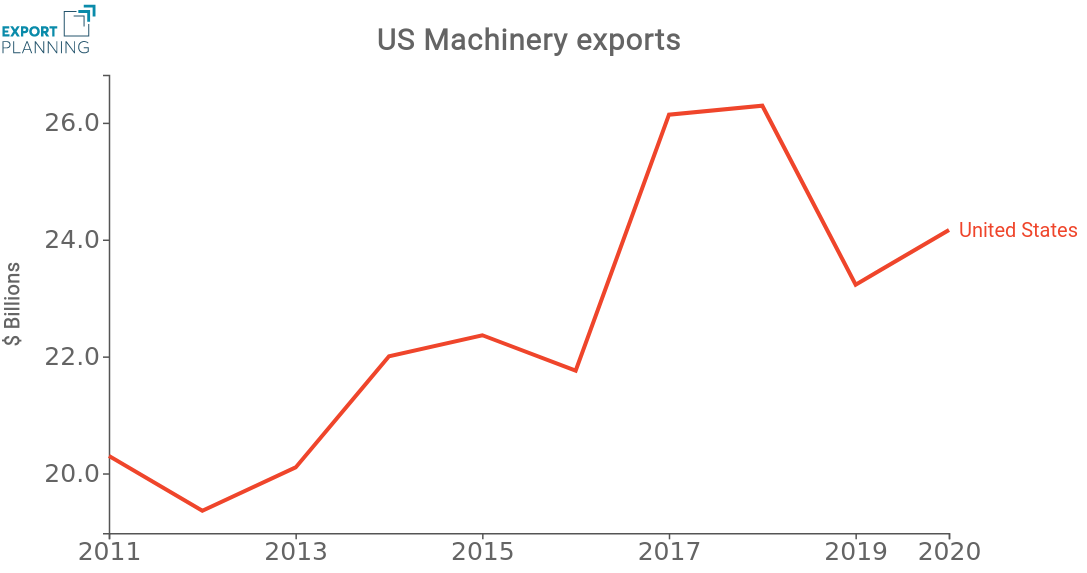

As shown in the graph below, US Machinery exports showed a significant increase starting from 2016, reaching the record value of almost $26 billion in 2018. As discussed in the previous article, this positive performance has stopped in the following year, when exports experienced a 11.6% fall year-over-year (-$3 billion). In spite of the global health crisis, US Machinery exports actually recovered ground in 2020 (+4% YoY), according to our preliminary estimates, but still remained below 2018 highs.

Source: ExportPlanning, US International Trade Datamart

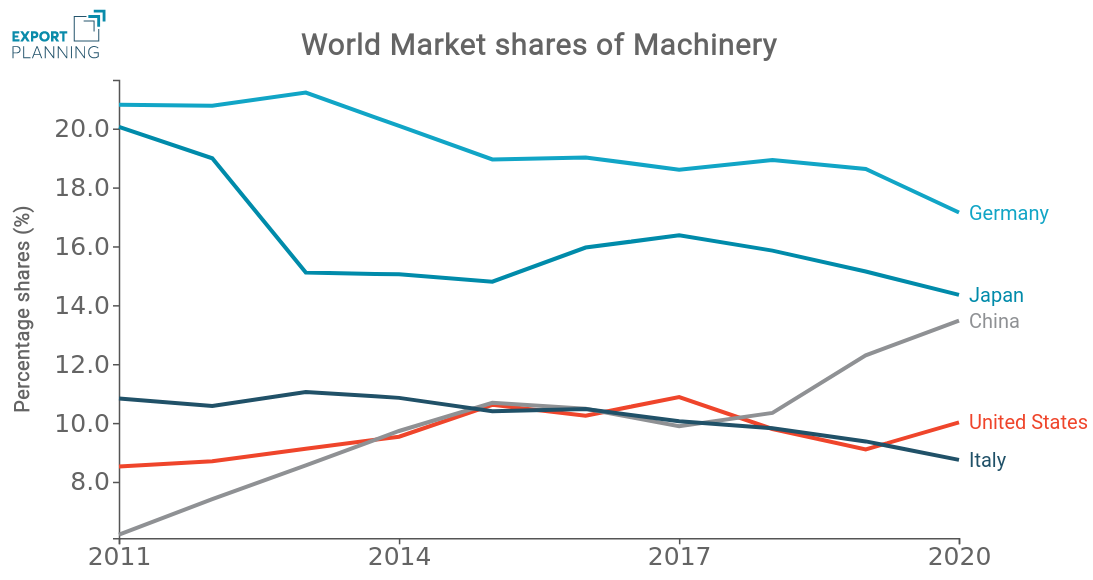

In this context, the effect on the international competitive positioning of US companies in the industry has improved, as can be seen from the chart below: in the last year, the US overtook Italy in the raking of world top five exporting countries of Machinery.

Source: ExportPlanning, World Trade Datamart

Surely, Germany is the most relevant exporter of Machinery, owning 18.6% of market share in 2019. However, China's influence in the industry has strongly increased in the last years, reaching 15% in 2019. As can be seen from the graph above, Italy and the United States have been competing for the fourth place in the ranking for several years, together with China for a certain amount of time; however, starting from 2018, China’s rapid growth led the country to overtake the US and Italy in terms of market share, rapidly rising to the third place, right after Japan.

During the pandemic crisis, the United States and China were the only major exporting countries that managed to increase their market share in the field of machinery, respectively reaching 10% and 13.5%.

Sector performance

Looking closer, Semiconductor Manufacturing Equipment (UL848620) emerges as the sector that has driven the recovery of US machinery exports in 2020, representing almost 90% of total exports of Metalworking machine tools (F4.32) and more than half of US Machinery exports in 2020. Over the last year, US exports of Semiconductor Manufacturing Equipment grew by almost $3 billion (+29.7% year-over-year), linked to the increasingly strategic role played by this technology and the consequent rush to invest in this area; US foreign sales were mainly directed to China, Korea, Taiwan and Japan.

In positive countertrend we can also find Packaging machinery (F4.38), which showed an year-over-year increase of 6% in USD during 2020. On the other hand, in line with the general paralysis seen in pandemic-affected countries, the remaining sectors of the Machinery industry have been penalized and recorded a year-over-year loss in exports between 10% and 24%. Among them, Textile machinery (F4.35) is one of the sectors that has suffered the most, showing a decrease in foreign sales of more than 23%.