Dried Plum is Making A Comeback

Global demand increased in 2020, but not for Californian producers

Pubblicato da Luigi Bidoia. .

International marketing Foreign markets Competitor analysis International MarketingHealthy dried plums

After four years of decline, there was a significant increase in world trade of prunes in 2020.

The health emergency forced us to spend long periods within domestic walls. Unable to travel and relate outside our family, our attention turned to improving our home environment and looking after our health, including working on our diet.

Among the goods that are included in the health category, prunes are among the world's top items. The health properties of prunes are officially recognised. Since 2013, prunes can be sold in the European Union using this health claim: "Prunes contribute to the normal functioning of the digestive system".

California prunes

When people talk about prunes, they immediately think of California. California has contributed enormously to the world's knowledge of prunes and their health-giving qualities. Plum trees were introduced in the mid 1800s by a French nurseryman, who brought cuttings from France to California's Santa Clara Valley. During the 20th century, prune orchards and packing plants spread throughout California, so that by the end of the century all American prune production was made in California, accounting for three-quarters of world production. Among other countries in the world, only France had significant production.

Sunsweet, the largest and only farmer-owned prune processing and marketing cooperative has historically played a dominant role in prune production. Nearly 50% of California's plum growers participate in Sunsweet. The other growers are organised in the Prune Bargaining Association, whose primary purpose is to ensure a stable and profitable price for sales to independent processors.

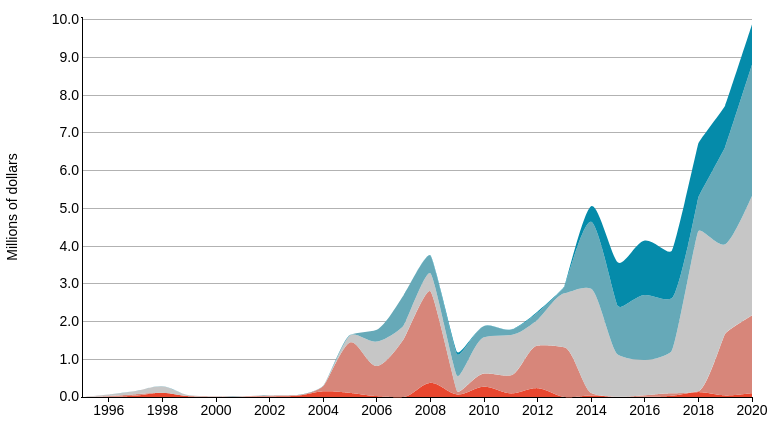

The success of the United States

California's manufacturing and organisational strength has generated the resources so that prunes became an "international product" as early as the last century. For almost 50 years, the California Dried Plum Board (formerly the California Prune Board) has operated with the aim of increasing world demand for prunes and promoting Californian ones. Until the end of the last century, the share of world trade in California prunes was close to 60%. The quality of California Plums was recognised as superior, due to the rigorous harvesting techniques employed, and quality control assessments. At the end of the last century, the only real competitor to the United States was France, which exploited the French origin of the plum variety for drying and the advantages of the European Single Market. The two graphs below compare the exports of prunes by price range over the past 25 years from the United States and France.

Exports by price/quality ranges

United States

|

France

|

|---|---|

| |

Both countries reached an export peak in 2005-2006. Subsequently, France and the United States (since 2015) experienced a sharp decline in exports. The reason was the emergence of two new competitors on the international market: Argentina and, above all, Chile.

The threat of Chile and Argentina

At the beginning of the century, Chilean and Argentinean prune exports were relatively marginal. In the first years of the century, however, both countries began a phase of strong expansion, which for Argentina stopped in 2007, while for Chile it continued until 2015, making Chile the world's leading exporter, surpassing the United States.

Exports by price/quality ranges

Chile

|

Argentina

|

|---|---|

| |

As can be seen by comparing colours of price bands in the four graphs, the advantage of Latin American countries is, above all for Argentina, based on low prices. The United States and France are trying to respond with marketing policies that shift their foreign sales to higher quality ranges. Both countries can do little to counter competition from Chile, which combines the advantages of the Chile-EU free trade agreements, a low price and good quality, thanks also to the transfer of knowledge from California to Chile, made possible by Sunsweet's Chilean plants.

Change in consumer preferences

In the last decade, before the pandemic, the prune has generally lost its appeal in consumer preferences. Between a high-fibre health product, a great source of antioxidants, vitamins and minerals, and a laxative product for the elderly, the second image continues to show a decline in consumer preference. The most obvious sign is in the reduction of exports of all major players in the years leading up to 2020.

The year 2020 seems to mark a possible turning point as French, Chilean and Argentinian exports grow at the same time, but not, as previously indicated, from the United States.

Healthy and organic dried plums

Beyond the growth in global demand for prunes in 2020 there is undoubtedly an increased demand for health foods, coupled with the effects of organic supply. German and, to a lesser extent, Polish supply plays a leading role in this respect.

Exports by price/quality ranges

Germany

|

Poland

|

|---|---|

| |

Germany also suffered from the crisis of the last decade, with exports falling after 2015. The response has been to move gradually towards biological agriculture, expanding the share of high-end prunes.

Poland's presence among the world's prune players is characterised by strong growth especially in the most recent years, with a significant share of high and medium-quality exports.

Conclusions

In the second half of the last century, the United States, and in particular California, led the world market for prunes, offering a quality product with healthy characteristics as part of global marketing campaigns. However, this world leadership position has been challenged over the course of this century, firstly by Chile, which offers an optimal quality/price combination, and more recently by German-speaking countries, which have added the values of organic farming to the health aspects.